Defense Stock ETFs Record Lowest Returns Among All ETFs This Month

KODEX K-Defense TOP10 Down 12.37%

Impacted by Overvaluation Concerns and Possibility of End to Ukraine War

Defense stocks, which have led this year's stock market rally, have struggled to maintain their momentum this month. This is attributed to accumulated fatigue from previous sharp gains, ongoing concerns about overvaluation, and speculation about a possible end to the Russia-Ukraine war. As a result, defense sector exchange-traded funds (ETFs) have posted the weakest returns among all ETFs.

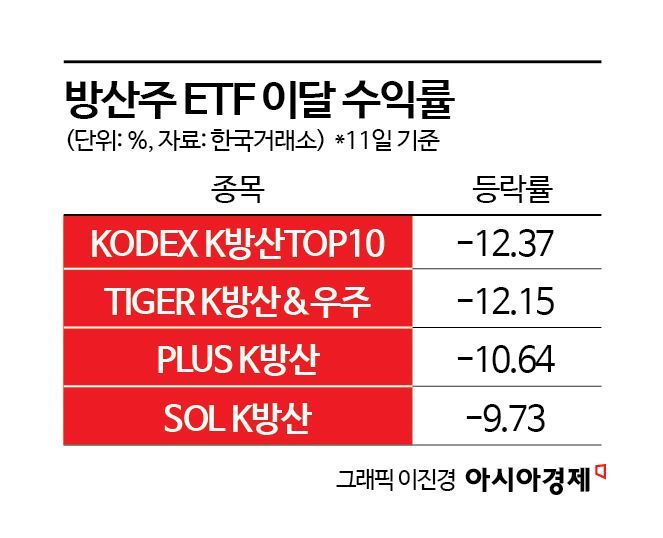

According to the Korea Exchange on August 12, KODEX K-Defense TOP10 has fallen by more than 12% so far this month, recording the lowest return among all ETFs. As of the previous day, it had declined by 12.37% this month. TIGER K-Defense & Space dropped 12.15%, PLUS K-Defense fell 10.64%, and SOL K-Defense lost 9.73%, with defense ETFs occupying the top four spots in terms of decline.

From the beginning of the year through last month, PLUS K-Defense soared 196.86%, making it the best-performing ETF overall. TIGER K-Defense & Space gained 180.50%, and SOL K-Defense rose 149.49%, ranking among the top in returns. KODEX K-Defense TOP10, which was listed on July 15, also rose 11.07% last month.

However, this month has seen a completely different trend. As the upward momentum has slowed in the second half of the year, concerns about overvaluation stemming from LIG Nex1's disappointing earnings and the possibility of an end to the Russia-Ukraine war have dragged down defense stock prices.

Earlier, on August 7, LIG Nex1 announced its second-quarter results, which fell short of market expectations. On a consolidated basis, operating profit increased by 57.9% year-on-year to 77.6 billion won, and revenue rose by 56.3% to 945.4 billion won. According to financial data provider FnGuide, the consensus for LIG Nex1's second-quarter results was 974.6 billion won in revenue and 79.9 billion won in operating profit.

Lee Jiho, a researcher at Meritz Securities, stated, "As in the previous quarter, we were able to reconfirm the expansion of domestic business sales and positive profitability, and export profitability is also estimated to have remained solid. However, due to expenditures on in-house R&D, provisions for losses related to domestic business orders, and the widening operating losses at Ghost Robotics, the results fell short of consensus. Even considering that the annual operating margin guidance was raised from 7% to 8%, a decline in operating margin in the second half is inevitable due to the high performance base in the first half."

Following the weak second-quarter results, securities firms have downgraded their investment ratings on LIG Nex1 from 'Buy' to 'Hold' or 'Neutral.' Jung Dongho, a researcher at Mirae Asset Securities, explained, "Given the recent sharp rise in the stock price, we believe there is limited short-term upside potential and have lowered our rating to Neutral. However, if the export margin for Cheongung in the Middle East exceeds 20-25% and the recognition of Cheongung sales in three Middle Eastern regions accelerates, there could be room for upward revisions to earnings estimates and additional upside potential."

There are expectations that valuation pressures will persist for the time being. Jang Namhyun, a researcher at Korea Investment & Securities, commented, "Even reflecting higher operating profit estimates compared to LIG Nex1's guidance, additional upside at current valuations is limited, with the 2026 price-to-earnings ratio (PER) at 32.3 times, higher than the European defense industry average of 30.5 times. Until there are further upward revisions to earnings estimates or clear progress in discussions on new export contracts, valuation pressures are expected to continue."

The possibility of an end to the Russia-Ukraine war has also negatively impacted defense stocks. U.S. President Donald Trump and Russian President Vladimir Putin are scheduled to meet in Alaska on August 15 (local time) to discuss ways to end the Russia-Ukraine war. Kim Jiwon, a researcher at KB Securities, analyzed, "There has been continued selling in sectors that led the first half, such as defense, finance, and shipbuilding, and expectations for an end to the war following news of the U.S.-Russia summit have also contributed to the weakness in the defense sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.