LFP Market Grows Five Times Faster Than Ternary Materials,

Strengthening China's Dominance

Korean Companies Maintain Strong Presence in Ternary Segment,

While China Monopolizes LFP Market

US Tariffs on Chinese Products Prompt Supply Chain Rest

The global cathode material market for electric vehicle batteries grew by 42.6% in the first half of this year. Even excluding China, the market maintained strong growth at 26%. However, the LFP (lithium iron phosphate) cathode material market, in which China has a dominant position, grew about five times faster than the ternary cathode material market, intensifying the market concentration. Meanwhile, there are projections that the strategic importance of Korean cathode material companies will increase due to U.S. tariffs on Chinese products.

According to SNE Research, a secondary battery market research firm, the total amount of cathode materials loaded into electric vehicles (EVs, PHEVs, HEVs) registered worldwide from January to June 2025 was 1,105.6 kilotons (K ton), representing a 42.6% increase compared to the same period last year. Excluding China, the market recorded a loading volume of 399 kilotons, marking a 26.0% growth rate.

Cathode materials are key components that determine the capacity and output performance of lithium-ion batteries, directly impacting the driving range and performance of electric vehicles. The current lithium-ion battery market is divided between ternary cathode materials such as NCM (nickel, cobalt, manganese) and NCA (nickel, cobalt, aluminum), and LFP cathode materials.

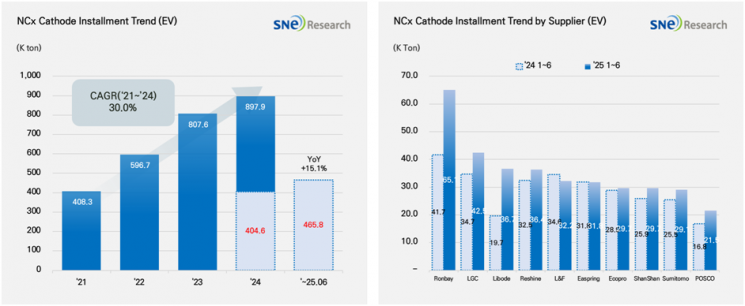

By cathode material type, the loading volume of ternary materials in the first half of this year was 465.8 kilotons, a 15.1% increase from the same period last year, continuing a moderate growth trend. By company, China’s Ronbay and LG Chem maintained the first and second positions, respectively, leading the market. Libode secured third place with 36.7 kilotons, driven by increased demand for mid-nickel cathode materials. South Korea’s L&F (32.2 kilotons), Ecopro (29.7 kilotons), and POSCO Future M (21.5 kilotons) ranked fifth, seventh, and tenth, respectively.

Chinese companies such as Reshine, Easpring, and ShanShan also ranked among the top players. SNE Research explained, "Overall, the growth of Chinese companies is particularly prominent," adding, "Chinese companies are gradually expanding their global market share by leveraging domestic demand, cost competitiveness, and large-scale capacity expansions."

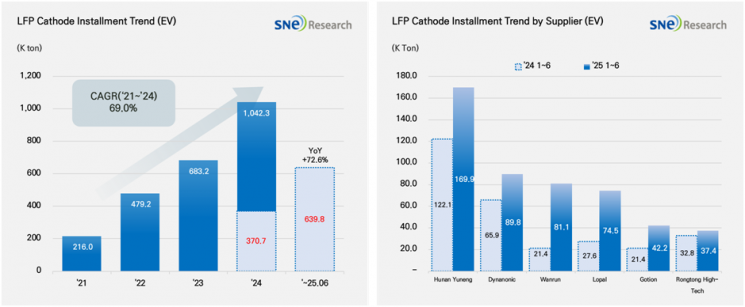

During the same period, the total loading volume of LFP cathode materials reached 639.8 kilotons, a sharp 72.6% increase compared to the same period last year. In terms of growth rate, this is five times faster than ternary cathode materials. LFP accounted for about 58% (by weight) of the total cathode material loading, surpassing half and further strengthening its influence in the market. This is the result of the expansion of the budget electric vehicle market in China, strong price competitiveness, and the increasing adoption by global automakers.

By supplier, Hunan Yuneng (169.9 kilotons) and Dynanonic (89.8 kilotons) secured the first and second positions, respectively, consolidating their market dominance. All of the top suppliers are Chinese companies, making the LFP cathode material market effectively a monopoly by China. SNE Research analyzed, "The rapid growth of the LFP market is directly strengthening the global dominance of Chinese material companies, which is leading to a further entrenchment of the China-centric structure in the global battery material supply chain."

Signs of change are also emerging. The United States is maintaining high tariffs on Chinese batteries and materials, pressuring a restructuring of the North American supply chain. As a result, non-Chinese material companies, including those from South Korea and Japan, are expanding their entry into the North American market under favorable conditions. Some are also working to secure local production bases.

SNE Research stated, "In the cathode material market, the strategic importance of Korean companies with stable production capacity and technological prowess is being highlighted, as China’s technology restrictions and the localization demands of the U.S. and Europe collide." The firm further predicted, "In the future, demand is expected to increase for high energy density, long life, and low-cobalt materials. Rather than oversupply, technological maturity and a globally diversified production strategy will become the key competitive factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.