Signs of a Rebound in Gangnam Buying Sentiment

Jeonse and Monthly Rent Instability, Interest Rates, and Supply Policies: Numerous Variables

The volume of apartment transactions in Seoul has dropped by about 70% before and after the implementation of loan regulations. Although a wait-and-see attitude has become more prevalent, record-high transactions at prices above previous deals are still being reported in some complexes in the Gangnam area of Seoul. In Gangnam, buying sentiment has also risen for the second consecutive week, leading to speculation that the effect of the loan regulations may have already worn off.

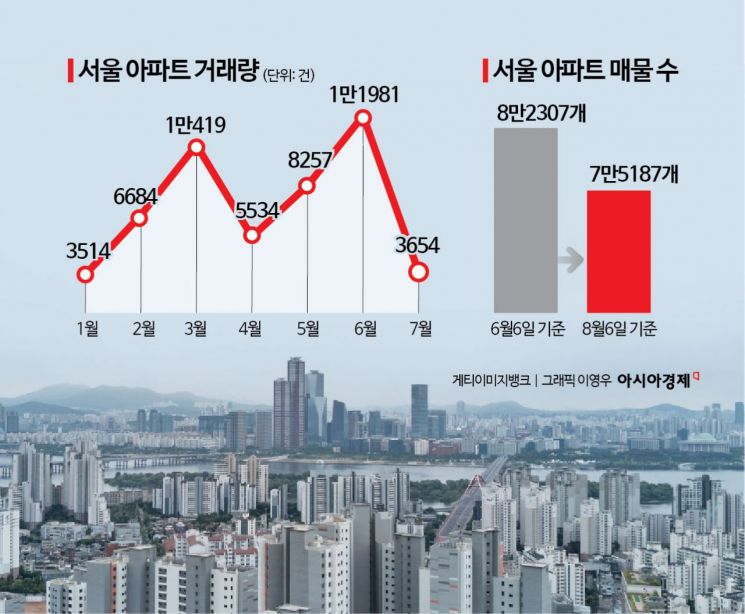

According to data from the Seoul Real Estate Information Plaza on August 12, apartment transactions in Seoul reached 11,981 in June. This is the highest monthly figure so far this year. In contrast, the number of transactions in July dropped to 3,654, a 70% decrease. Although transaction reports for July can still be filed until the end of this month, the number is unlikely to increase significantly due to the intensified wait-and-see sentiment caused by the loan regulations.

Signs of a Rebound in Gangnam Buying Sentiment

Compared to early June, when buying demand surged around the launch of the Lee Jaemyung administration, the number of apartments for sale in Seoul has decreased by nearly 10%. According to the real estate big data platform Asil, the number of apartments for sale in Seoul fell from 82,307 on June 6 to 75,187 as of August 6.

About six weeks after the 6·27 loan regulations were implemented, apartment prices in Seoul have started to rebound in some areas. According to KB Real Estate, the transaction price change rate for the first week of August rose by 0.11% compared to the previous week, marking the 28th consecutive week of increases. Songpa-gu (0.31%), Dongjak-gu (0.24%), Gangnam-gu (0.23%), Seocho-gu (0.19%), and Yongsan-gu (0.17%) recorded the highest increases. In the Korea Real Estate Board's "Weekly Apartment Price Trends Nationwide," Seoul apartment prices rose by 0.14% in the first week of August (as of the 4th), up from 0.12% the previous week.

Buying sentiment in the Gangnam area appears to be gradually recovering. The Seoul Buyer Sentiment Index, an indicator of real estate sentiment, stood at 56.8 for the 11 districts of Gangnam in the first week of August, up 0.9 points from the previous week. This marks a slight increase for the second consecutive week. In contrast, the 14 districts of Gangbuk recorded 42.7, a decrease of 2.8 points from the previous week.

Despite unprecedented loan regulations, record-high transactions continue to be reported in the three main Gangnam districts. In the Jamsil Jugong 5 Complex, a redevelopment project, a 76㎡ unit was sold for 4.177 billion won on July 11, setting a new record. An 82㎡ unit also changed hands at a record-high price of 4.525 billion won. At Raemian Daechi Palace, a 151㎡ unit was sold for 6.3 billion won on July 14, 150 million won higher than the previous transaction.

A 74㎡ pre-sale right at Jamsil Raemian I-Park was sold for 3.1 billion won, 218 million won higher than the previous record price. Ham Youngjin, head of the Real Estate Research Lab at Woori Bank, analyzed, "Rather than interpreting this as adaptation to loan regulations, this phenomenon is occurring in certain areas where sensitivity to loan regulations is lower due to the requirement for actual residency in land transaction permit zones and a shortage of listings, resulting in a seller's market."

Jeonse and Monthly Rent Instability, Interest Rates, Supply Measures... Numerous Variables

There are also forecasts that soaring jeonse and monthly rent prices could reignite buying demand. Ham Youngjin stated, "Depending on changes in jeonse and monthly rent prices during the autumn moving season, demand could shift back to purchases," adding, "Loan regulations, delays in interest rate cuts, the effectiveness of government supply measures, and U.S. interest rate cuts are all variables."

The cumulative decrease in leading supply indicators?such as permits, construction starts, and completions?over the past four years is another factor causing anxiety among buyers. According to the Housing Industry Research Institute, the accumulated supply shortage over the past four years compared to the annual average is estimated at 298,000 units for the Seoul metropolitan area and 68,000 units for Seoul. For private housing in Seoul, the number of permits this year stands at 27,000 units, down by 6,000 from the previous year, while construction starts are tallied at 34,000 units, an increase of 11,000 units year-on-year.

Experts believe that, given the high preference for the three main Gangnam districts and the continued seller's market, the "one smart home" phenomenon is likely to persist, driving further price increases. Yoon Sumin, real estate expert at NH Nonghyup Bank, said, "Core complexes are still dominated by sellers, and for buyers with ample cash reserves, this could even be an opportunity to purchase. The continued record-high transactions indicate that the current market sentiment cannot be subdued by loan regulations alone."

Yang Jiyeong, head of Asset Management Consulting at Shinhan Investment Corp., explained, "When similar measures to the 6·27 loan regulations were implemented in the past, the effects lasted about six months before rebounding, but this time the recovery appears to be happening more quickly. Compared to the past, supply is more limited and there are more cash-rich buyers, so price increases are emerging in key areas, with listing shortages causing asking prices to become the market price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.