Samil PwC Releases M&A Report

Global Market Sees Fewer Deals, But Higher Transaction Value

AI-Driven "Mega Deals" Lead the Way

Uncertainty to Continue in the Second Half... Gradual Recovery Expected

A recent study has found that global mergers and acquisitions (M&A) activity slowed somewhat in the first half of this year. While the number of deals declined overseas, the overall transaction value increased, indicating a growing polarization in the market. In contrast, both the number and value of deals in South Korea shrank by more than 10% year-on-year. Although the continued prevalence of mid-level interest rates is expected to keep funding burdens high, there are forecasts that the M&A market will gradually recover due to more realistic tariffs and reduced uncertainty.

On August 8, Samil PwC Management Research Institute published a report titled "2025 Global M&A Trends: Mid-Year Review," which covered these findings.

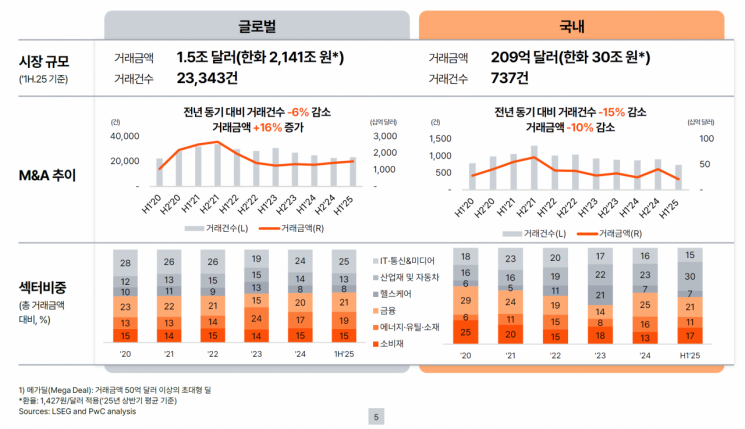

According to the report, the number of global M&A transactions in the first half of this year was 23,343, representing a 6% decrease compared to the same period last year. However, the total transaction value reached $1.503 trillion (approximately 2,141 trillion won), a 16% increase over the same period. This was largely driven by an increase in large-scale deals of $5 billion or more, particularly those centered on artificial intelligence (AI). By sector, transaction value increased in consumer goods (29%), energy·utilities·materials (23%), industrials·automotive (22%), IT·telecommunications & media (17%), and finance (11%), while healthcare saw a 15% decline.

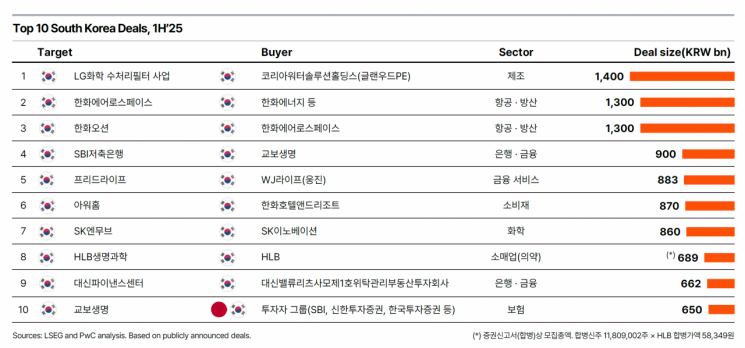

In contrast, both the number and value of deals in the domestic market declined. A total of 737 deals were completed, a 10% decrease compared to the first half of last year, and the total transaction value also fell by 15% to $20.9 billion (about 30 trillion won). Although there were initially high expectations for increased M&A activity, analysts attribute the decline to weakened investor sentiment caused by an economic environment marked by heightened domestic and international uncertainty and a strong won-dollar exchange rate.

Uncertainty is expected to persist in the second half of the year. The macroeconomic environment is likely to remain unfavorable for M&A, as policies from the Donald Trump administration in the United States have created greater-than-expected uncertainty.

First, government debt is increasing, and there is growing skepticism about the effectiveness of benchmark interest rate cuts. Weakness in the initial public offering (IPO) market has also made it more difficult for private equity fund (PEF) managers to exit investments. As a result, there is a trend toward seeking alternative strategies, such as continuation funds (where managers remain the same but high-quality assets or companies held by existing funds are transferred to new funds) and secondary deals (transactions between PEFs).

However, the ongoing technology revolution led by AI is seen as a positive factor. This is because investment in semiconductors and related infrastructure, beyond just AI technology, could accelerate across the board. In addition, in South Korea, improvements in corporate governance driven by amendments to the Commercial Act are expected to increase foreign investment. The completion of tariff negotiations is also prompting large corporations to resume overseas investments. As a result, the report anticipates a gradual recovery in the M&A market despite ongoing domestic and international uncertainties.

The report also provides a review of the first half and an outlook for the second half for six industries: consumer goods, energy·utilities and materials, finance, healthcare, industrials·automotive, and IT, telecommunications and media. The full report is available on the Samil PwC website.

Min Junseon, head of the Deals division at Samil PwC, commented, "Despite the uncertain environment in the first half of the year, investors remain focused on future growth opportunities. In Korea, the M&A market is expected to enter a gradual recovery phase due to factors such as AI-driven industrial restructuring, improvements in corporate governance through amendments to the Commercial Act, the rise of K-shipbuilding and defense industries, increased direct investment in the United States to avoid tariffs, and Samsung's return to the M&A market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)