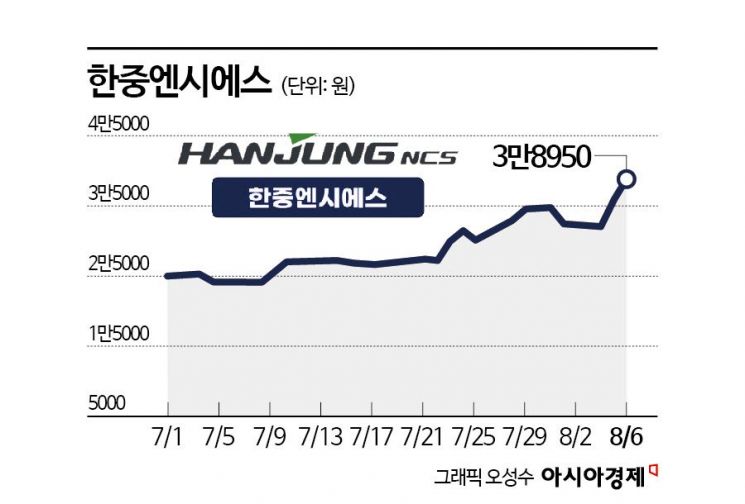

Stock Price Up 52% Since Late June

ESS Market Projected to Grow at 34% Annually Through 2030

Hanjung NCS Established U.S. Subsidiary in April This Year

Hanjung NCS, a component manufacturer for energy storage systems (ESS), has reached its highest stock price of the year. Expectations are rising that Hanjung NCS’s performance will improve alongside the growth of the ESS market in North America. With the Donald Trump administration in the United States intensifying restrictions on Chinese-made ESS products, Hanjung NCS is expected to benefit as a result.

According to the financial investment industry on August 7, Hanjung NCS’s stock price rose by 51.9% compared to the end of June. The previous day, it closed at 38,950 won, setting a new annual high based on closing prices. In contrast, the KOSDAQ index increased by only 2.8% over the same period. The return relative to the market reached 49.1 percentage points. Institutional investors led the stock price increase by recording a cumulative net purchase of 16.4 billion won over the past month. During the same period, individual investors sold 15.8 billion won worth of shares.

Founded in 1995, Hanjung NCS produces components for energy storage systems (ESS) and electric vehicles (EVs). The company has developed a water-cooled cooling system that controls the heat generated during the charging and discharging processes of electrical energy. It possesses core technology that enables a water-cooled cooling system superior to air-cooled systems. Through independent research and development, Hanjung NCS has secured numerous proprietary technologies for water-cooled systems required for large-scale ESS, including chillers based on heating, ventilation, and air conditioning (HVAC), as well as flow and temperature control systems. The company manufactures water-cooled components for ESS and supplies them to its main client, Samsung SDI.

As of the first quarter of this year, ESS accounted for approximately 70% of the company’s total sales. With the ESS market, including North America, expected to grow, the company is targeting an 80% share of sales from ESS-related products.

In April this year, Hanjung NCS established a subsidiary in the United States. The company is preparing to set up a production base on a 53,000-square-meter site in Indiana. It aims to complete mass production facilities for ESS components and begin full-scale production in the second half of next year. Lee Hyunwook, a researcher at IBK Investment & Securities, stated, “As the only domestic company mass-producing water-cooled ESS, Hanjung NCS holds a monopolistic position,” adding, “The company’s significant external growth is expected to begin in the second half of next year, once the North American production base is completed.”

Power demand is surging due to the development of data centers and artificial intelligence (AI). The ESS market, which can resolve imbalances in power supply and demand, is also expected to grow rapidly. ESS can store excess electricity produced and supply it when needed. IBK Investment & Securities forecasts that the ESS market will grow at an average annual rate of 34% through 2030. The U.S. government is increasingly tightening restrictions on Chinese-made products. Considering tariffs on ESS, whether a company owns a local factory in the U.S. is becoming more important.

Yoo Minki, a researcher at SangSangin Investment & Securities, explained, “In the U.S. ESS market, the share of ESS equipped with Chinese batteries exceeds 80%,” and added, “With additional tariffs on Chinese ESS batteries set to rise from next year, domestic companies are likely to benefit.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)