JP Morgan Raises Its Growth Forecast from 0.5% to 0.7%

Goldman Sachs and Citi Also Increase Their Projections

Average Overseas IB Growth Outlook Rises to 1%

Attention on Whether Bank of Korea Will Revise Its August Forecast Upward

Overseas investment banks (IBs), which have traditionally offered more conservative forecasts for South Korea's economic growth rate compared to domestic institutions, are now collectively raising their outlooks for this year. Even JP Morgan, which had the lowest growth rate projection, increased its forecast by 0.2 percentage points compared to its outlook in May.

According to the financial sector on August 6, JP Morgan projected South Korea's real gross domestic product (GDP) growth rate for this year at 0.7% as of July 24. This marks the third consecutive upward revision, following an increase from 0.5% in May to 0.6% in June, and then another adjustment just a month later.

JP Morgan’s successive upward revisions reflect the anticipated effects of fiscal expansion, including the first and second supplementary budgets. In a report released after the Bank of Korea’s announcement of second-quarter GDP figures on July 24, JP Morgan stated, “The second-quarter growth rate slightly exceeded market expectations due to robust exports and manufacturing growth. Although there may be a rebound effect in the third quarter, the impact of fiscal stimulus is expected to provide a buffer.”

In May, JP Morgan had lowered its growth outlook for South Korea from 0.9% to 0.5%, making it the most pessimistic among the eight major overseas IBs tracked by the International Financial Center.

Following JP Morgan, Goldman Sachs also raised its growth forecast on August 1, from 1.1% to 1.2%. In its report, Goldman Sachs noted, “The announcement of the Korea-US trade agreement reduces uncertainty regarding tariffs on specific items such as semiconductors,” adding, “South Korea is not at a disadvantage compared to other countries.”

In June, Goldman Sachs had already raised its projection by 0.4 percentage points, from 0.7% to 1.1%, reflecting factors such as reduced US tariff risks, upward revisions to US and Chinese growth forecasts, and the potential for South Korean fiscal stimulus.

Citi also revised its growth forecast for South Korea on July 24, raising it from 0.6% to 0.9%.

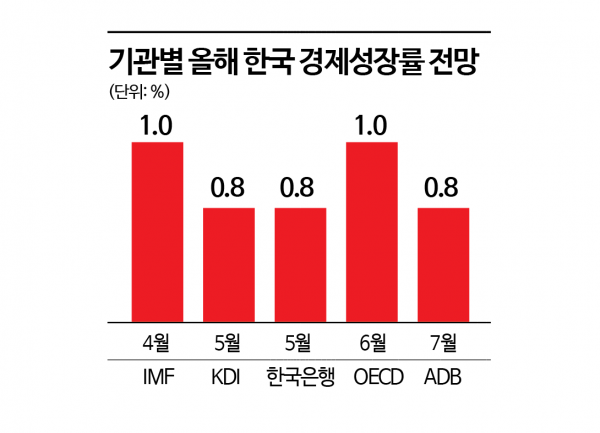

As of the end of July, the average 2025 growth forecast for South Korea among the eight major overseas IBs, including these institutions, stood at 1.0%. This is up from 0.8% at the end of June, marking a 0.1 percentage point increase and pushing the forecast into the 1% range.

With both domestic and international institutions raising their growth forecasts for South Korea this year, attention is now turning to the Bank of Korea’s revised economic outlook in August. Considering the effects of supplementary budgets, there is a possibility that the growth forecast will be slightly raised.

In May, the Bank of Korea had lowered its annual growth forecast for this year to 0.8%. At that time, the effects of the second supplementary budget had not yet been reflected, but the Bank now expects the supplementary budget to boost this year’s growth rate by 0.1 percentage points.

The outcome of tariff negotiations with the United States has been identified as a key variable for the second half of the year. The mutual tariff rate of 15% with the United States and the 15% tariff rate on automobiles are largely in line with the scenario assumed by the Bank of Korea in its May forecast.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)