Demand Deposits at Five Major Banks Drop by 17 Trillion Won in One Month

Time Deposits Increase by About 13 Trillion Won

Tension Rises Over Potential "Money Move" from Banks if Deposit Insurance Limit Is Raised

The demand deposit balances (including MMDA) at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) decreased by more than 17 trillion won in just one month. In contrast, despite low interest rates, time deposits increased by about 13 trillion won during the same period. It is considered unusual that the outflow from demand deposits was driven by corporate funds rather than individual funds. As for the increase in time deposits, some analysts suggest that the recent tax reform proposal has reduced the attractiveness of the stock market, causing funds to flow back into banks. There is also growing tension over a potential "money move" from banks to secondary financial institutions in anticipation of the upcoming increase in the deposit insurance coverage limit.

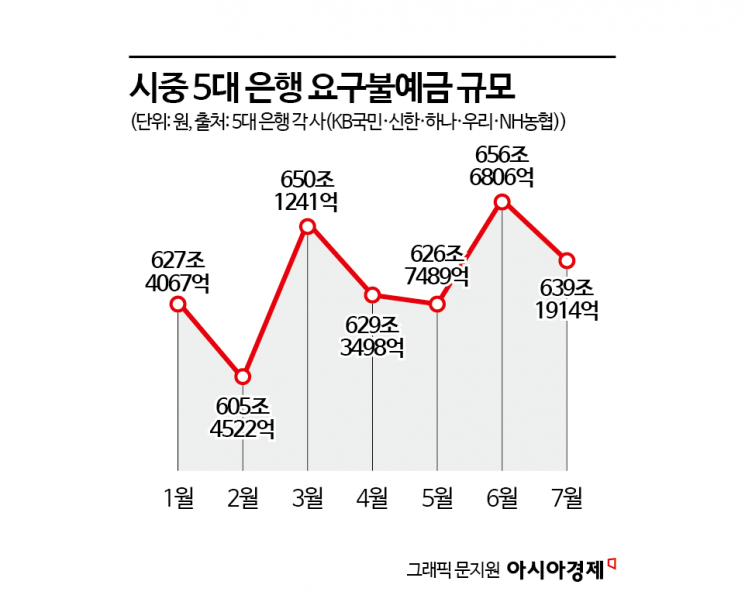

According to the banking sector on August 6, the balance of demand deposits (including MMDA) at the five major commercial banks stood at 639.1914 trillion won at the end of last month, down by 17.4892 trillion won from the previous month. This is in stark contrast to the previous month (June), when demand deposits increased by 29.9317 trillion won in a single month. Demand deposits, which offer an annual interest rate of only around 0.1%, are freely accessible accounts typically classified as funds waiting for investment opportunities.

Until the first half of this year, changes in demand deposits were mainly driven by individual investors' sentiment, with funds moving in and out accordingly. However, last month's decrease in demand deposits is attributed to an outflow of corporate funds.

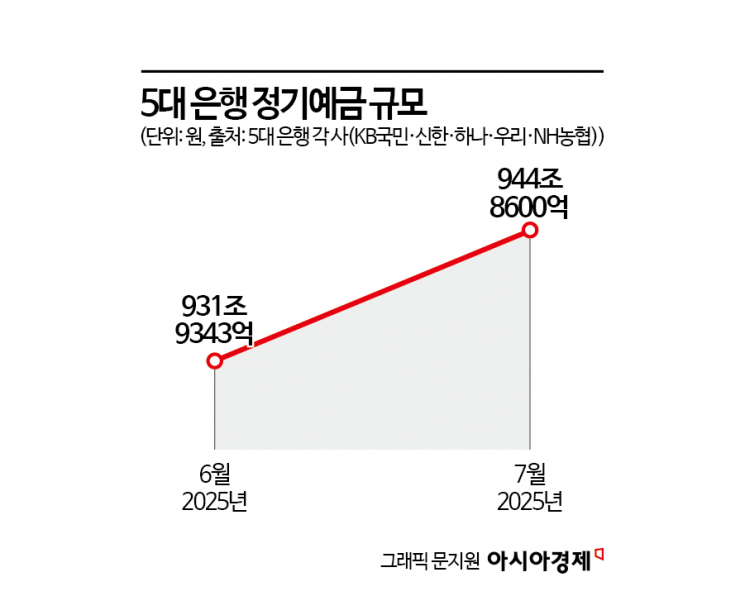

On the other hand, the increase in time deposits compared to the previous month is also unusual. Typically, when interest rates are low, deposit balances decrease as customers seek higher returns elsewhere, while demand deposits increase. Last month, time deposits at the five major banks rose by 12.9257 trillion won from the previous month. Installment savings also increased by more than 600 billion won, indicating a trend of growing deposit-type funds. In the previous month (June), time deposits had decreased by nearly 9 trillion won.

An official from a major commercial bank said, "While the number of individual customers with demand deposits actually increased, the decrease among corporate customers was particularly significant. Some corporate clients were observed to be moving funds from demand deposits into time deposits."

Another bank official explained, "There are also seasonal factors influencing corporate fund movements. Typically, companies temporarily deposit funds in banks during settlement periods."

Despite the downward trend in interest rates, several factors are believed to be behind this money move, including the US-led tariff war, stock market volatility, and the tax reform proposal, which includes stricter criteria for major shareholder capital gains tax and an increase in the securities transaction tax rate.

One commercial bank official noted, "When the stock market is booming, it is common for individual customers to withdraw funds from banks and invest in stocks. Recently, however, expectations for a bullish stock market have diminished due to the tax reform proposal, and we are increasingly seeing cases where customers park their funds in banks while searching for alternative investment opportunities."

However, there is growing concern about a potential money move from banks to secondary financial institutions if the deposit insurance coverage limit is raised from 50 million won to 100 million won next month. While commercial banks have been lowering their deposit rates following the base rate cut, savings banks are instead raising their rates to attract funds. According to the Korea Federation of Banks, the average interest rate for one-year time deposit products at 17 commercial banks nationwide is 2.25%. In contrast, according to the Korea Federation of Savings Banks, the average rate for one-year time deposits at 79 domestic savings banks is 3%.

NICE Credit Rating stated, "The increase in the deposit insurance coverage limit may have only a limited short-term impact on the banking sector, but in the medium to long term, there is a risk of fund outflows and rising funding costs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.