"South Korea-US Negotiations May Lead to US Investment Fund Formation"

KDB and Eximbank Expected to Play Key Roles Through Special-Purpose Bond Issuance

Past Two Cases Showed Only Temporary Impact on Bond Market

Recent Surge in Bank Demand for Special-Purpose Bonds

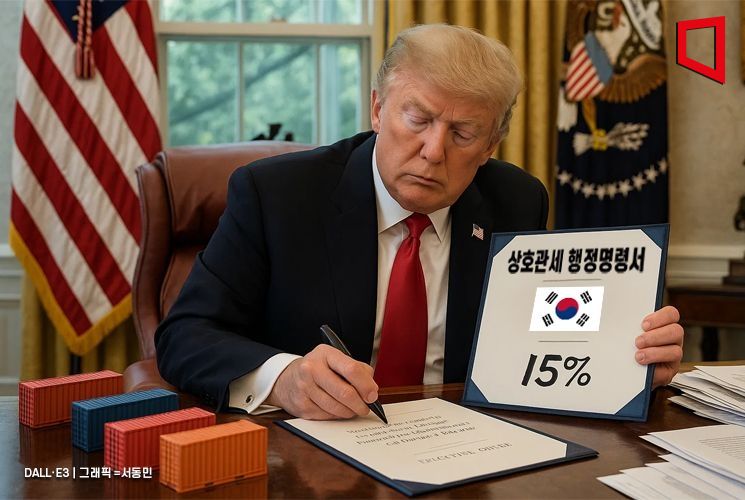

The South Korea-US tariff negotiations have been concluded. The key points are a 15% tariff rate and a $350 billion investment package. Of this, $150 billion will be allocated to shipbuilding projects. The remaining $200 billion will be invested in semiconductors, secondary batteries, and bio industries. The $200 billion figure is approximately 276 trillion won, which amounts to 40% of the government's total national expenditure of 677 trillion won as outlined in this year's budget proposal?a staggering sum. The government is now considering whether raising this money will impact the bond market.

Capital Call + Mostly Guarantees + Some KDB/Eximbank Fund Formation Expected

Kim Yongbeom, Chief Policy Officer at the Presidential Office, stated that the $350 billion investment in the US will primarily take the form of a "capital call" (where contributions are made as needed within the committed limit, rather than as a lump-sum payment). He also explained that direct government investment will be limited, and most of the investment will be executed in the form of loans and guarantees provided by the Export-Import Bank of Korea and the Korea Trade Insurance Corporation. The precise details of this structure will be clarified in an upcoming South Korea-US summit.

Lee Seungjae, an analyst at iM Securities, commented, "If the $350 billion investment proceeds in the manner President Donald Trump mentioned, where 'the United States owns and controls' the funds, there is a high possibility that intermittent investment funds will be created through equity contributions rather than simple guarantees." He added, "While private finance may participate, the basic structure will likely be based on policy banks such as the Korea Development Bank and the Export-Import Bank of Korea, which play a public financial role. Depending on funding needs, this could also serve as an incentive to increase the issuance of special-purpose bonds."

Limited Impact on Bond Market, as Seen in 2020 and 2024 Cases

iM Securities cited two recent cases of fund formation as examples. First, in 2020, the "Key Industry Stabilization Fund" was launched to enhance liquidity in key industries, which had a significant impact on jobs and exports. After the related bill was proposed, the 2-year KDB bond spread widened from 20.8bp to 25.8bp but recovered within a month. Although the fund bonds had a maximum issuance limit of 40 trillion won, actual issuance remained at 1.23 trillion won by December 2021. During the bond issuance period, the 2-year KDB bond spread widened from 14.1bp to 20.5bp. However, the impact of the Bank of Korea's monetary policy shift in August 2021 on the credit market was greater than the pressure from increased bond issuance.

In September last year, the "Supply Chain Stabilization Fund" was launched, led by the Export-Import Bank of Korea, to stabilize supply chains. On October 4 last year, the first supply chain stabilization fund bonds (hereafter, supply chain bonds) worth 190 billion won were issued. The issuance limit for supply chain bonds was expanded from 5 trillion won to 10 trillion won starting this year. Since its launch, a total of 2.44 trillion won has been issued. Because supply chain bond issuance has been limited relative to the ceiling, it has not exerted upward pressure on Eximbank bond spreads. In fact, after the fund's launch, the 2-year Eximbank bond spread narrowed by 1bp by year-end. As a result, in both cases of fund formation, while short-term supply concerns could have exerted upward pressure on spreads, the actual impact on the bond market was limited due to the relatively small scale of bond issuance compared to the size of the funds.

Corporate Loan Demand Surges... Bank Demand for Special-Purpose Bonds Is Key

The outcome of the South Korea-US tariff negotiations requires large Korean companies to increase their direct investment in the United States, which poses a challenge. This is because, in addition to government-led US investment funds, there will be increased demand from companies for loans from banks. Regarding this, analyst Lee Seungjae forecast, "An increase in special-purpose bond issuance will add to credit market supply pressure, but strong demand from banks and asset managers could partially offset this." In particular, banks recorded a cumulative net purchase of 22.4 trillion won in special-purpose bonds from January to July last year, and this figure increased to 35.8 trillion won during the same period this year, indicating stronger buying activity. On the asset management side, cumulative net purchases rose from 15.8 trillion won in January-July last year to 19.1 trillion won in the same period this year. Notably, banks have consistently recorded net purchases, except for April 2022, and asset managers have maintained an average monthly net purchase of 2.8 trillion won over the past three years.

However, the "details" of the South Korea-US tariff agreement have not yet been disclosed. These are expected to be finalized through upcoming summits between the two countries. Analyst Lee Seungjae stated, "It appears that the $350 billion US investment will initially proceed as a capital call, and the concept of a 'limit' may apply, so this needs to be monitored." He added, "There is a high likelihood that concrete information about the investment package will be announced at the upcoming South Korea-US summit, so attention should be paid to this event."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)