Overseas Economic Research Institute's "Second Half Economic and Industrial Outlook"

Domestic Demand to Improve, While Exports and Investment Slow

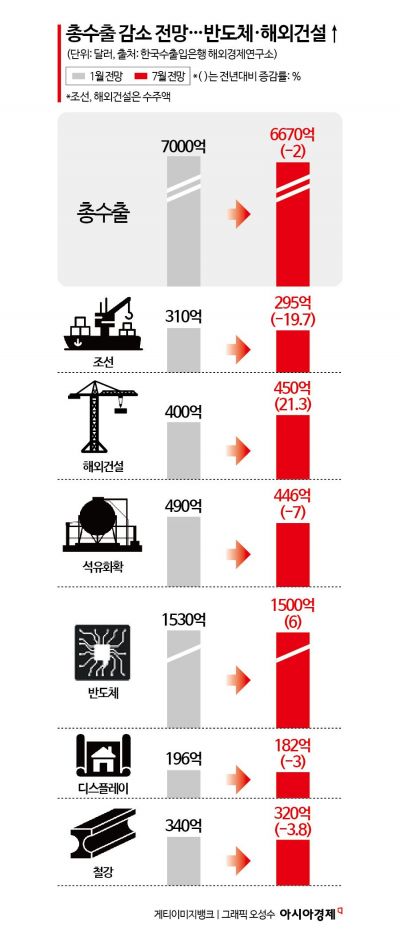

Among Korea's Seven Major Export Industries,

Export Value Expected to Decline Except for Semiconductors and Construction Plants

Due to the downturn in the construction sector and deteriorating trade conditions, there are forecasts that South Korea's economic growth rate this year will struggle to surpass 1%.

According to the "2025 Second Half Economic and Industrial Outlook" recently published by the Korea Eximbank Overseas Economic Research Institute on August 5, South Korea's economy is projected to grow by less than 1% compared to the previous year. This is because domestic demand remains sluggish due to the construction market slump, and downward pressure on exports is increasing due to worsening trade conditions. Specifically, although economic sentiment, which had weakened due to increased domestic and international uncertainties such as U.S. tariff policies in the first quarter, has somewhat eased, the growth outlook has been revised downward compared to the beginning of the year due to the continued slump in the construction sector and delayed recovery in consumption.

The institute predicted that while domestic demand is expected to improve going forward, exports will slow and investment, excluding semiconductors, will shrink in other sectors. The institute added, "After the second half of the year, domestic demand will see some improvement, mainly driven by private consumption, due to the supplementary budget and interest rate cuts. However, exports will slow as the impact of U.S. tariffs becomes more pronounced." In the area of facility investment, semiconductor investment is expected to continue, but overall investment will fall short of early-year expectations due to delays in non-IT sector investments. The institute also forecast that investment in machinery, which is mainly export-oriented, will decrease due to worsening trade conditions, and investment in transportation equipment will slow due to sluggish exports and increased overseas production.

As for export value, it is expected to reach around $667 billion (approximately KRW 924.2619 trillion), about 2% lower than last year. While exports remain strong in the semiconductor and shipbuilding sectors, export uncertainties have increased in the second half of the year as the impact of tariffs on major export items such as automobiles and steel has become more pronounced.

From a macroeconomic perspective, regarding factors such as oil prices, interest rates, and exchange rates that affect the Korean economy, the institute projected, "Oil prices will remain in the low $70 per barrel range, interest rates will show a downward trend due to Federal Reserve rate cuts, but the extent of the decline will be limited, and the exchange rate will also see limited declines as the U.S. dollar remains weak in the second half of the year."

There was also analysis that, among Korea's seven major export industries, five sectors?excluding semiconductors and construction plants?are expected to underperform. Semiconductor export value is expected to reach a record high of $150 billion, a 6% increase from last year. The institute stated, "In the first half, exports increased by 11.4% year-on-year to $73.3 billion, driven by price hikes from memory semiconductor production cuts, increased sales of high-value-added products such as high-bandwidth memory (HBM) for robust artificial intelligence (AI) servers, and stockpiling of semiconductors in anticipation of U.S. tariffs." It added, "Although U.S. tariffs in the second half will negatively impact demand, AI infrastructure investment demand, including for Sovereign AI, is expected to remain relatively robust." In the construction plant sector, annual orders are expected to reach $45 billion, boosted by large-scale plant contracts such as nuclear power plants. Despite sluggish orders from the Middle East, overseas construction orders in the first half surged significantly due to nuclear power plant orders from the Czech Republic. However, the institute explained that there are concerns that orders from the Middle East may decrease in the second half due to weaker oil prices.

In the shipbuilding industry, due to the downturn in the shipping market, orders this year are expected to reach only $29.5 billion. In the petrochemical sector, the institute anticipated that intensified competition in the commodity sector, due to large-scale capacity expansions in China, will inevitably shrink the business. For the steel industry, although a slight improvement is expected in the second half, both crude steel production and steel exports are projected to decline, resulting in continued difficulties. Display exports are also expected to decrease by 3% year-on-year (to $18.2 billion), due to increased uncertainty in demand from downstream industries in the first half.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)