Hyundai Motor, Over the Mobility (26)

Hyundai Motor Designs Batteries for Both Hybrids and EVs

World's First Mass-Produced Vehicle with Lithium-Ion Battery

Securing Research Bases from Namyang, Uiwang, and Mabuk to Anseong

Strengthening In-House Semiconductor Design Led by Hyundai Mobis

Rising Importance of AI Semiconductors in the Autonomous Driving Era

An executive in charge of batteries at Hyundai Motor Group, whom I met earlier this year, emphasized this point. Hyundai Motor Group believes that, through its strategy of internalizing key components, it is crucial for automakers to secure technological leadership in core parts such as batteries and semiconductors. This conviction has grown stronger after experiencing several supply chain crises in the past. Even if the company does not manufacture key components itself, it must possess development and design capabilities. When the global semiconductor shortage struck in 2021, one can imagine how things might have been different if automakers had their own semiconductor design capabilities. They could have quickly identified alternative foundries for production, increased their negotiating power with semiconductor companies, and secured purchasing priority, enabling a much faster response.

The same logic applies to batteries. Battery manufacturers have prioritized orders for electric vehicle (EV) batteries, which are larger in capacity and more profitable, while supply for hybrid electric vehicle (HEV) batteries has been relegated to a lower priority. However, with the recent stagnation (chasm) in EV demand and a rapid shift in the market, automakers now see securing hybrid batteries as more urgent. In response, Hyundai Motor Group has chosen a strategy of directly designing hybrid batteries tailored to the characteristics of Hyundai and Kia vehicles. Of course, technical support from battery partners is still needed at the design and mass production stages. However, the responsibility and role of automakers are gradually increasing, particularly in specifying target vehicle performance and evaluating and optimizing quality after battery installation. The first hybrid battery in which Hyundai Motor Group participated in the core design was installed in the fifth-generation Santa Fe Hybrid launched in 2023, and is now being sequentially applied to various models such as the K8 Hybrid and Palisade Hybrid.

5th generation Santa Fe Hybrid. This car is equipped with a hybrid battery in which Hyundai Motor Company participated in the core design for the first time. Provided by Hyundai Motor Company

5th generation Santa Fe Hybrid. This car is equipped with a hybrid battery in which Hyundai Motor Company participated in the core design for the first time. Provided by Hyundai Motor Company

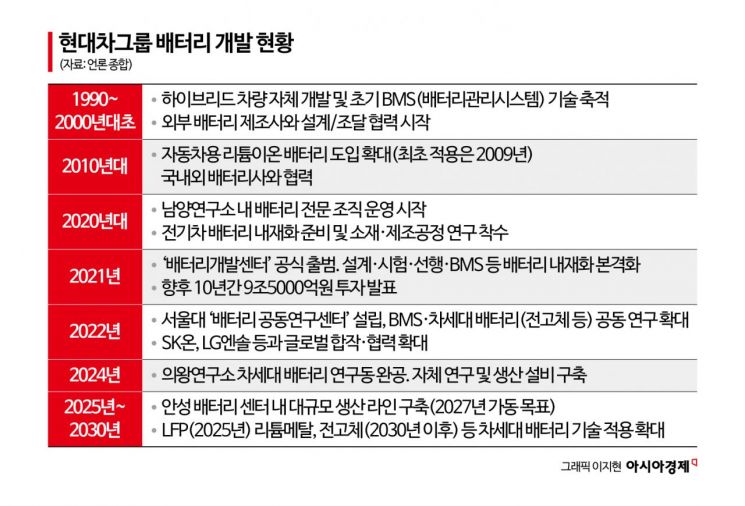

The History of Hyundai Motor's Battery Development Began in Pyongyang

Hyundai Motor Group's battery internalization strategy was not achieved overnight. Its origins date back to Pyongyang in 2007. At that time, Hyundai Motor was in the midst of developing its first hybrid vehicle. The urgent need was to develop a new lithium-ion battery for vehicles. However, the response from battery manufacturers, including LG Chem's management, was negative. Back then, lithium-ion batteries were widely used in small IT devices such as laptops and smartphones, but had never been used in automobiles. It would have been easier to import Japanese nickel-metal hydride batteries, but Hyundai Motor chose the more challenging path of localization. To do so, LG Chem's support as a battery manufacturer was essential.

Mong-Koo Chung, Honorary Chairman of Hyundai Motor Group, met the late Bon-Moo Koo, then Chairman of LG Group, in Pyongyang in 2007, when both attended the inter-Korean summit as special delegates. There, Chung strongly argued for and persuaded Koo of the need to develop lithium-ion batteries for automobiles. Both chairmen agreed on the spot and instructed their teams to proceed with joint development. Two years later, in 2009, Hyundai Motor unveiled its first hybrid vehicle, the Avante LPi Hybrid. This car was equipped with a lithium-ion battery jointly developed by Hyundai Motor and LG Chem.

This was the world's first application of a lithium-ion battery in a mass-produced vehicle. In 1996, Nissan introduced the first lithium-ion electric vehicle, but it was not a mass-production model. Other hybrid competitors such as Toyota were using nickel-metal hydride batteries. Nissan's mass-produced lithium-ion EV, the Leaf, was released in 2010, a year after Hyundai's Avante Hybrid.

Hyundai Motor Company's first hybrid vehicle, the 'Avante LPi Hybrid.' Hyundai Motor Company and LG Chem applied lithium-ion batteries to a mass-produced car for the first time in the world with this vehicle. Photo by Hyundai Motor Company

Hyundai Motor Company's first hybrid vehicle, the 'Avante LPi Hybrid.' Hyundai Motor Company and LG Chem applied lithium-ion batteries to a mass-produced car for the first time in the world with this vehicle. Photo by Hyundai Motor Company

'Global Top 3 Automaker' Hyundai Motor's Battery Development: How Far Has It Come?

Hyundai Motor has leveraged the battery development expertise gained from hybrids to make significant advances in electric vehicles. Batteries account for more than 30% of the cost of an electric vehicle and are a core component. It is no exaggeration to say that battery performance development, supply chain management, and cost competitiveness determine success or failure in the EV market. Hyundai Motor Group has decided to invest 950 billion KRW by 2032 to secure capabilities in battery manufacturing, design, and development. The company has established a dedicated 'Battery Development Center' within its R&D organization and operates three battery development bases in Namyang, Uiwang, and Mabuk. The Namyang Research Center is responsible for basic battery research and internalization preparation. The Uiwang Research Center focuses on pilot production and commercialization testing. The Mabuk Research Center, led by Hyundai Mobis, specializes in developing BMS (Battery Management Systems) and electrification modules, as well as other electronic components.

Hyundai Motor Group is building a battery research complex and a gigawatt-hour (GWh)-scale production line in Anseong, Gyeonggi Province, with the goal of starting operations in 2027. Both research and commercialization testing will be conducted there. Even a single 1GWh line can supply batteries for about 15,000 electric vehicles per year. This is not a small scale for pilot production and internalization research, which has attracted attention and competitive responses from both battery manufacturers and rival automakers. Hyundai Motor Group clarified that although it is building production lines for prototype and mass production technology development, this does not mean full-scale mass production for finished vehicles. The battery industry also sees the likelihood of Hyundai Motor directly mass-producing batteries as low for now. However, considering the trends of competitors such as Toyota, which has its own production lines, and Volkswagen Group, which is pursuing internalization through its subsidiaries, Hyundai Motor is expected to be able to shift its strategy at any time if the market situation changes or technology matures.

Top Priority: Supply Chain Stability

Another pillar of battery internalization is building a stable procurement system to reduce supply chain risk. Hyundai Motor Group is pursuing a strategy of establishing joint ventures with battery manufacturers such as SK On and LG Energy Solution to secure partial production rights and equity shares. With LG Energy Solution, Hyundai has built a joint battery plant in Indonesia with an annual capacity of 10GWh, which has been operational since 2024. In the United States, joint battery plants with both LG Energy Solution and SK On, each capable of supplying batteries for 300,000 electric vehicles, have been established near the Hyundai Motor Group Metaplant America (HMGMA) in Georgia and began operations this year.

The strategy for emerging markets is thorough localization. In India, Hyundai signed a battery cell supply contract with local company Exide Energy Solutions and equipped local strategic models with batteries based on Indian-made LFP (lithium iron phosphate) and NCM (nickel cobalt manganese) cells. In the Chinese market, batteries from local Chinese manufacturers were also applied. The Elecseo, an electric vehicle to be launched by Beijing Hyundai in China in September, will be equipped with BYD's LFP battery, and the Kia EV5, launched in China in 2023, also uses BYD's LFP battery.

Recently, Hyundai has been increasing the use of cost-competitive Chinese batteries in electric vehicles released in Korea. This is part of a battery sourcing diversification policy to create a diverse lineup of electric vehicles at various price points. Kia has decided to apply CATL's ternary (NCM) battery to the EV5, which is scheduled for domestic release in August this year. This is the first time Hyundai and Kia have applied Chinese batteries to mid-sized models.

High-voltage battery assembly process line at Hyundai Motor's Asan plant. Provided by Hyundai Motor Company

High-voltage battery assembly process line at Hyundai Motor's Asan plant. Provided by Hyundai Motor Company

Semiconductor Strategy: Another Core Component for Future Vehicles

What about semiconductors, another core component for future vehicles? In 2009, Hyundai Motor began full-scale semiconductor internalization by jointly developing the 'Arisu-LT' automotive semiconductor with German company Infineon. Arisu was Hyundai Motor's first semiconductor, integrating multiple lamp control functions into a single chip. Chip production took place in Germany, while assembly was done in Korea. As the trend toward vehicle electrification, including driving assistance and infotainment, gained momentum in the 2000s, Hyundai Motor Group recognized the importance of semiconductors early on and paid close attention to the field.

Since the 2020s, the emphasis has been on in-house semiconductor design capabilities. Hyundai Mobis, a key affiliate, leads the group's semiconductor internalization efforts. Currently, about 16 types of semiconductors designed by Hyundai Mobis are installed in finished vehicles. Hyundai Mobis specifies desired specs and customized requirements, requests designs from fabless companies, and places orders with foundries. In this process, Hyundai Mobis shares know-how and data with partners during production to ensure quality and focus on technological internalization. Hyundai Mobis entered the semiconductor business in earnest by acquiring the semiconductor division of Hyundai Autron in 2020. From this year, it will begin mass production of semiconductors in which it participated in the core design process. Additionally, to secure outstanding overseas talent, it has established a semiconductor research base in Silicon Valley, USA.

The main semiconductors entering mass production this year include a power integration chip that combines electric vehicle power control functions and a lamp drive semiconductor. The battery management integrated circuit (IC), which is already being supplied, is accelerating the development of next-generation products. To promote external collaboration, Hyundai Motor Group is also increasing equity investments in competitive fabless companies. It has invested over 2 billion KRW in automotive semiconductor fabless startup BOS Semiconductors and more than 60 billion KRW in Canadian AI semiconductor startup Tenstorrent. Hyundai Mobis has also invested over $15 million (about 2.1 billion KRW) in US system semiconductor startup Elevation Microsystems.

Why Are Semiconductors So Important in the Era of Future Vehicles?

Automotive parts, which were once mechanical or analog (such as physical wires), are gradually becoming 'electrified' (integrated with electrical and electronic devices). When driving, every part?from the steering wheel, accelerator pedal, air conditioner, side mirrors, instrument panel, display, to lamps?is now controlled and operated by electrical signals. Even moving a single wiper requires an electrical signal. When you press an ON/OFF button or move a lever, this signal is detected by a sensor, sent to a control electronic device, and then converted into an electrical action (such as a motor movement) for each part. In this process, semiconductors are essential for processing and converting signals electronically. Therefore, it is now concluded that semiconductors are needed in every component of modern automobiles.

In the upcoming era of autonomous driving, the importance of AI semiconductors cannot be overstated. Autonomous vehicles must process real-time information from dozens to hundreds of sensors, often in terabytes (TB). They analyze this information to recognize road conditions, control driving situations, and respond to unexpected hazards. This process must be carried out in real time without delay to avoid traffic congestion or accidents. To collect, compute, control, communicate, secure, and store massive amounts of information smoothly, high-performance AI semiconductors at the core of all processing are absolutely necessary. According to market research firm Global Market Insights, the automotive AI semiconductor market was worth over $2.3 billion (about 3.18 trillion KRW) in 2022 and is expected to grow at an average annual rate of over 20%, reaching $15 billion (about 20.76 trillion KRW) by 2032. Within the overall AI semiconductor market, the automotive sector is cited as the fastest-growing area due to the spread of autonomous and intelligent vehicles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.