Hyundai Motor Bears 3.41 Million Won Per Vehicle

Toyota Pays Only 2.55 Million Won

Local Content Rate Gap Is the Key Factor

The tariff burden on global automobile companies, including Hyundai Motor and Kia, has exceeded 2 million won per vehicle in the United States. As the U.S. has standardized the automobile tariff rate at 15% for South Korea, Japan, and the European Union (EU), future performance in the U.S. market is expected to be determined by the rate of local content.

On August 4, an estimate of second-quarter U.S. sales and tariff costs for the top six global automakers, including Hyundai Motor and Kia, revealed that Hyundai Motor and Kia paid approximately 3.41 million won in tariffs per vehicle sold in the United States. Toyota paid 2.55 million won per vehicle, which is 860,000 won less than Hyundai Motor and Kia.

U.S. automaker GM also paid 2.02 million won in tariffs for each vehicle sold. In the second quarter, GM sold 742,177 vehicles in the U.S. market, incurring $1.1 billion (1.5 trillion won) in tariff costs during this period. Notably, Volkswagen, which produces key vehicles in Europe and exports them to the U.S., paid 1.3 billion euros (2 trillion won) in tariffs during this period, resulting in a tariff cost of 15.14 million won per vehicle.

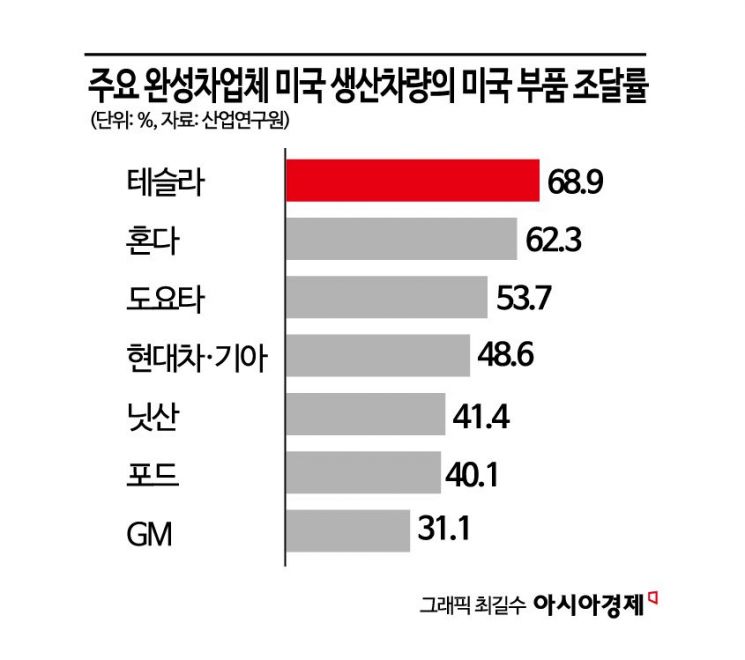

This is due to significant differences in the rate of local content for parts. According to the Korea Institute for Industrial Economics and Trade, GM's local procurement rate for parts in U.S. vehicle production was only 31.1%. Hyundai Motor and Kia's local procurement rate for parts in the U.S. was 48.6%, higher than GM but lower than Toyota (53.7%). Ford (40.1%) also has a low dependence on locally sourced parts in the U.S.

Lee Seungjo, head of Hyundai Motor's Corporate Planning and Finance Division, recently stated in a conference call regarding tariffs, "We expect to be more affected in the second half of the year," and added, "About 20% of the tariff costs are from parts tariffs." Accordingly, there are concerns that if the low local content rate for parts is not improved, the ongoing tariff burden will continue to undermine competitiveness.

If global automakers raise their low local parts procurement rates in the U.S., domestic parts suppliers may face not only declining profitability but also the risk of losing supply contracts. Hyundai Motor has formed a task force (TF) to expand local procurement of parts and is reportedly reviewing the best options for domestic export and local sourcing after receiving quotes from about 200 companies.

Lee Hangkoo, a research fellow at the Korea Automobile Research Institute, pointed out, "There are 374 first-tier long-term partner companies for Hyundai Motor and Kia, so 200 means most of them," and added, "Small and medium-sized parts suppliers have virtually no countermeasures during the restructuring of the automotive supply chain." He continued, "The government says it will foster artificial intelligence (AI), batteries, and semiconductors as core industries, but it should first prepare measures to support the automotive industry by integrating these technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.