On the Day the Korea-U.S. Tariff Agreement Was Reached, Trump Abolishes the "De Minimis" System

Korea's Reverse Direct Purchase Market Comes Under Direct Influence... Concerns Over Export Disruptions for Small Business Owners

President Lee Jaemyung Calls for Special Attention... Ministry of SMEs and Startups Says "Careful Review Underway"

As the United States abolishes tariff exemptions for low-value parcels, a new variable has emerged in Korea's reverse direct purchase (reverse direct import) market, which has grown mainly around K-beauty and fashion. Reverse direct purchase refers to overseas consumers buying Korean products directly from domestic online shopping malls or platforms. There are growing concerns that this could particularly impact small and medium-sized enterprises (SMEs) and small business owners who have been selling cosmetics and clothing to American consumers.

On July 30 (local time), U.S. President Donald Trump signed an executive order abolishing the "De Minimis" provision for all countries worldwide, including Korea. This measure is separate from the tariff negotiation agreement with Korea reached on the same day. The low-value exemption system, introduced in 1938, is based on Section 321 of the U.S. Tariff Act and allows for simplified customs procedures without tariffs if the total daily import value per importer is $800 (approximately 1.12 million KRW) or less.

This order will take effect starting August 29. For six months after implementation, goods entering through the international postal network will be subject to both ad valorem duties (proportional to value) according to the tariff rate applied to the country of origin, and a specific duty of $80 to $200 (approximately 110,000 to 280,000 KRW) per item. After this period, only ad valorem duties will be applied. However, the exemption for personal goods worth $200 or less brought in by U.S. travelers and for "genuine gifts" worth $100 or less will remain in place.

This measure follows the Trump administration's withdrawal of duty-free benefits for low-value parcels from China and Hong Kong in May, and now extends it globally. While the low-value exemption system has contributed to expanding choices for U.S. consumers and reducing the workload of the Customs and Border Protection (CBP), there have been strong demands for reform, as it has been cited as a reason for the rapid growth of C-commerce platforms such as Temu and AliExpress and the worsening U.S. trade deficit with China. Korea has now also come under the direct influence of this measure.

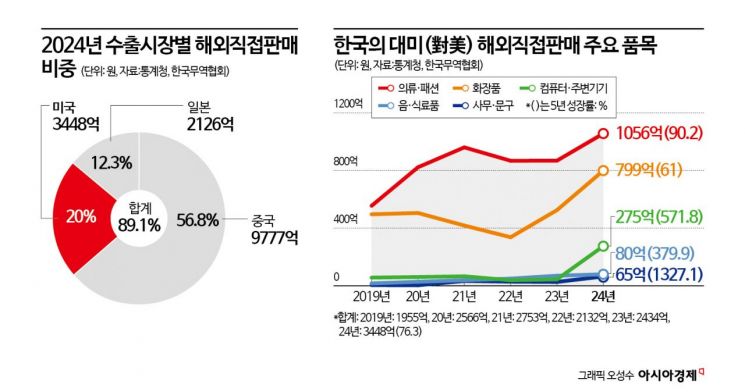

The U.S. reverse direct purchase market has shown steady growth, along with the expansion of the consumer base due to the spread of the Korean Wave (Hallyu). According to Statistics Korea, last year’s online overseas direct sales (reverse direct purchase) amounted to 1.7225 trillion KRW. Of this, the United States accounted for 344.8 billion KRW, or 20% of the total, ranking second after China (977.7 billion KRW, 56.8%). Notably, the U.S. market recorded an average annual growth rate of 76.3% over the past five years since 2019. This contrasts with China, where the figure plummeted from 5 trillion KRW to below 1 trillion KRW during the same period.

By product category, the top item in overseas direct sales to the U.S. last year was clothing and fashion (105.6 billion KRW), followed by cosmetics (79.9 billion KRW). Over the past five years, these two categories have recorded average annual growth rates of 90.2% and 61%, respectively. They were followed by computers and peripherals (38.6 billion KRW), food and beverages (8 billion KRW), and office supplies and stationery (6.5 billion KRW). These categories also showed explosive growth of 380% to 1,330% during the same period.

The Korea International Trade Association (KITA) has pointed out in a related report that, since the majority of sellers engaged in overseas direct sales are small business owners, the revision of the low-value exemption system could negatively impact small domestic exporters. The report also recommended continuously monitoring changes in U.S. tariff policies and CBP regulations to prevent customs delays and additional costs, and to establish a rapid response system. Kim Nayul, a KITA researcher, said, "Small businesses are less able to cope with such changes compared to large corporations, so ongoing information sharing by the government and related organizations will be of practical help."

On the day the tariff negotiation agreement and executive order were announced, the Korean government began reviewing the reverse direct purchase market. President Lee Jaemyung, at a chief secretary meeting held at the presidential office in Yongsan, called for "special attention" to the reverse direct purchase market. President Lee stated, "Expanding the reverse direct purchase market allows us to increase exports without having to go abroad," and instructed relevant ministries to review measures to expand the reverse direct purchase market.

The Ministry of SMEs and Startups is also closely monitoring industry trends. An official from the ministry said, "We are gathering feedback from across the beauty and fashion industries and closely monitoring the situation." The official added, "With about a month remaining before the executive order takes effect, we plan to examine and closely analyze the potential impact of these regulatory changes through various channels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.