15% Tariff on Exports to the U.S. Confirmed

Ramyeon Exports Reach 2 Trillion Won... Price Hike Pressure

Cosmetics Industry Faces Limited Short-Term Impact

"K-Beauty's Opportunity" to Compete Head-to-Head with Europe

As the United States has confirmed the imposition of a 15% tariff on Korean cosmetics, food products, and other items, domestic industries are busy preparing countermeasures. The application of high tariffs to major export items is expected to inevitably weaken their price competitiveness. The industry is seeking alternatives such as reflecting the increased tariffs in product prices, expanding local production, and diversifying export destinations.

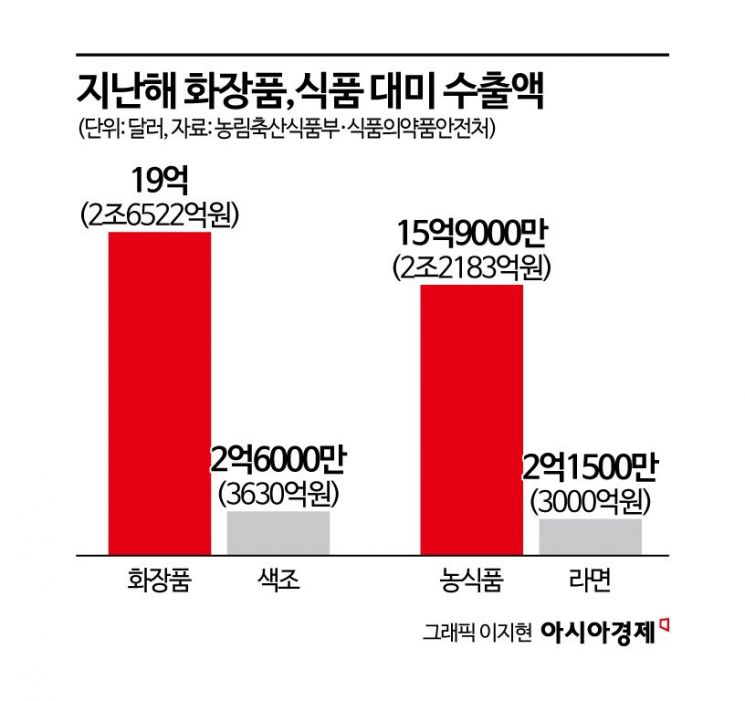

According to the Ministry of Agriculture, Food and Rural Affairs on August 1, last year Korea's agricultural and food exports to the United States reached $1.59 billion (approximately 2.2183 trillion won), a 21% increase from the previous year and the highest figure ever recorded. Exports of instant noodles (ramyeon) surged by 70% to $215 million (approximately 300 billion won), while processed rice products ($173 million) and kimchi ($48 million) also increased by 51% and 20%, respectively.

However, with this measure, a flat 15% tariff will be applied to major items such as ramyeon, increasing pressure to raise export prices. Previously, a provisional 10% tariff had been imposed since April, but this time it has been confirmed as an official measure.

Samyang Foods, the leading exporter of ramyeon, is actively considering raising the local retail price of its flagship "Buldak" series in the U.S. market. A representative from Samyang Foods stated, "We are preparing profit and loss scenarios based on different tariff rates and monitoring the trends of overseas competitors," adding, "We are seeking ways to minimize the burden on American consumers while maintaining profitability."

Of Samyang Foods' total sales of 1.728 trillion won last year, overseas sales accounted for 77.3%, with U.S. sales alone reaching $280 million (approximately 386.8 billion won), representing 28% of the total. All export products are produced at the Miryang plant in Gyeongnam, and since the beginning of the year, Samyang has formed a task force (TF) to work with its U.S. subsidiary to devise countermeasures.

Kimchi exports are also inevitably affected. Daesang, a major kimchi exporter, established a local plant near Los Angeles, U.S., in 2022 and acquired the American food company Lucky Foods last year to accelerate localization. However, half of the total kimchi export volume is still produced in Korea. Last year, Daesang's kimchi exports amounted to $94 million (approximately 131.2 billion won), with U.S. exports reaching $35.7 million (approximately 4.98 billion won, 38%). A representative from Daesang explained, "We are working to expand the proportion of local production in the U.S. as well as diversify our export markets," adding, "We are also negotiating with local distributors in the U.S."

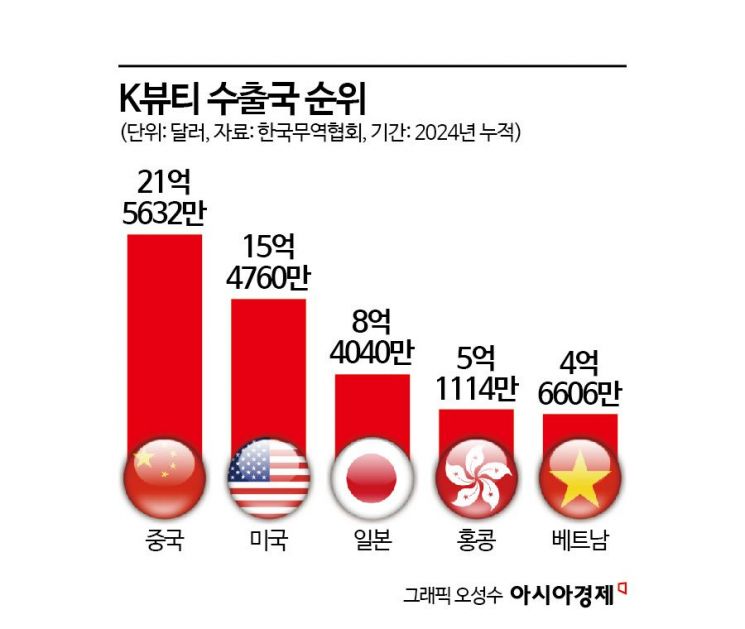

The cosmetics industry expects that the impact of the tariffs will be limited in the short term. Demand for Korean cosmetics in the U.S. is based on their "cost-effectiveness" image and quality competitiveness, so rather than immediately raising prices, companies are likely to adjust their promotional strategies as a buffer. An industry representative said, "A 15% tariff is not enough to immediately damage business, but responses may differ by brand depending on their margin structure," adding, "It is more likely that companies will adjust the frequency or terms of promotions rather than prices." Last year, Korea's cosmetics exports to the U.S. totaled $1.9 billion (2.6522 trillion won). The U.S. is the second-largest export market for Korean cosmetics after China.

Korean ODM (original development manufacturing) companies such as Kolmar Korea and Cosmax plan to respond to the demand from brands seeking to shift their production base from Korea to the U.S. by operating manufacturing plants in the U.S. Amorepacific, which is increasing its sales share in North America, stated, "To maintain competitiveness in the U.S. market, we are preparing various response strategies through close communication with local distribution partners," adding, "We are currently closely examining the overall increase in cost burden for our U.S. operations."

Some in the industry analyze that this measure may actually help K-beauty maintain its relative price competitiveness, as Korean cosmetics will now compete under the same conditions as competitors from Europe and Japan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.