SK On and SK Enmove to Merge in November

Integration Aims to Boost Profitability and Battery System Competitiveness

No Immediate Plans for SK On IPO, Focus Remains on Financial Stability

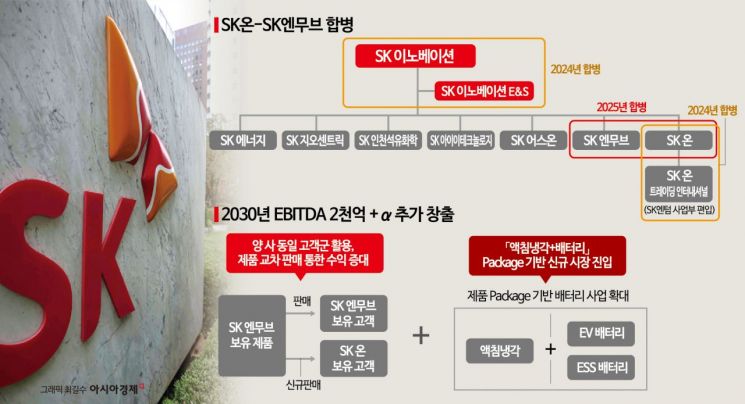

SK Innovation will merge its battery subsidiary SK On with SK Enmove, a company specializing in lubricants and immersion cooling, in November. By integrating the consistently profitable SK Enmove, SK On aims to improve its profitability and financial structure. The company also plans to incorporate thermal management technologies such as immersion cooling into its battery packs to strengthen its competitiveness at the system level. The integrated corporation intends to accelerate its expansion into new markets, including electric vehicle (EV) batteries and energy storage systems (ESS).

According to industry sources on July 31, SK Innovation announced at the 'SK Innovation Corporate Value Enhancement Strategy Briefing' held at the SK Seorin Building in Jongno-gu, Seoul, the previous day, that it will merge its battery subsidiary SK On and SK Enmove on November 1. This decision is part of a strategy to secure financial stability by integrating the two companies and to enhance battery system technology competitiveness in line with the era of electrification.

On this day, Jang Yongho, President of SK Innovation, stated, "The portfolio rebalancing we have been pursuing since last year consists of two main aspects: restructuring our business structure and stabilizing our financial structure." He added, "SK Innovation has established a stable and growing structure as an integrated energy company, covering the entire energy sector from oil to liquefied natural gas (LNG)." He continued, "In the era of electrification, the energy value chain will expand its global profit generation capabilities, and our core subsidiary SK On will achieve solid growth by strengthening its production sites, manufacturing and technological capabilities, and leveraging its trading expertise."

SK Enmove is a subsidiary that has consistently posted profits in the lubricant business and has recently sought technological synergy with SK On's battery product lineup by leveraging EV-specialized technologies such as immersion cooling. SK On will not only enhance its competitiveness in battery cells but also expand its 'integrated battery package' business, which improves system-level safety and battery cooling performance through better power and thermal management.

At the briefing, Lee Seokhee, CEO of SK On, explained, "By combining SK On's pack-level technology with SK Enmove's thermal diffusion control technology, this will be an important milestone as we evolve from a simple cell supplier to a provider of customer-tailored system solutions for next-generation EV and ESS product lines." Lee added, "We plan to secure the ESS market with differentiated products such as integrated modules and early fire suppression solutions. We are currently in discussions with several customers and expect to achieve order results within this year."

Jang stated, "If the merged entity is combined with customer businesses, it could generate over KRW 200 billion in additional EBITDA by 2030. We will grow into the most competitive total energy company in the coming era of electrification."

Meanwhile, regarding the much-anticipated SK On initial public offering (IPO), Jang drew a clear line, saying, "There are no plans at this time." He added, "Profitability and financial stability are the priorities. An IPO may be considered in the mid-to-long term, depending on market conditions."

This merger is a strategy to simultaneously enhance profit generation and technological competitiveness, while also reducing SK On's financial burden. SK Innovation will raise a total of KRW 8 trillion in capital this year. The company is pursuing capital expansion of KRW 5 trillion, including KRW 2 trillion from a third-party paid-in capital increase and KRW 700 billion from perpetual bond issuance by SK Innovation, KRW 2 trillion from a third-party paid-in capital increase by SK On, and KRW 300 billion from a paid-in capital increase by SK IE Technology (SKIET). Additionally, SK Innovation announced that it will secure an additional KRW 3 trillion in capital by the end of this year.

This capital expansion and asset efficiency improvement are expected to reduce SK Innovation's net debt by more than KRW 9.5 trillion this year.

The company is focusing its capabilities on strengthening profit generation and securing stable financial soundness, with the goal of achieving KRW 20 trillion in EBITDA and maintaining net debt below KRW 20 trillion by 2030. Jang stated, "Based on a stable financial structure, SK Innovation will be reborn as a company with both profitability and growth potential. Through this, we will enhance corporate value and actively expand shareholder returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.