Major Financial Groups Conclude Second-Half Strategy Meetings

"AI Strategy" Emerges as Central Theme

Corporate Finance and Non-Interest Income Identified as Key Profitability Strategies

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

As major financial holding companies have recently concluded their second-half management strategy meetings, the adoption of artificial intelligence (AI) technology, expansion of corporate finance, and growth of non-interest income have emerged as key strategies. Although the four major financial groups achieved record-high earnings in the first half of the year, they are accelerating management strategies to diversify profitability in anticipation of a slowdown in household loan growth in the second half.

According to the financial sector on July 31, major financial holding companies and banks have recently completed their second-half management strategy meetings. KB Financial Group presented four key keywords for the second half: customers, efficiency, AI, and inclusion. KB Financial Group plans to sequentially introduce over 250 AI agents across 39 business areas over the next three years, establishing a system that enables AI to serve as a practical business partner. At the management strategy meeting, KB Financial Group Chairman Yang Jonghee emphasized, "The era of AI transformation is both a crisis and a new opportunity for KB Financial Group to further enhance its added value," and added, "To maintain differentiated value as financial experts in the age of artificial intelligence, we need a customer-centric philosophy and deep insight into the essence of finance."

Shinhan Financial Group also addressed its AI utilization strategy under the theme "Igniting AX (AI Transformation), Shinhan's Future Leadership" at its second-half management forum. Prior to the forum, Shinhan Financial Group provided six weeks of AI-related pre-training to 237 executives, including affiliate CEOs and board members. Chairman Jin Okdong of Shinhan Financial Group urged, "Leadership in the age of artificial intelligence is meaningful only when demonstrated through direct action. Based on Shinhan's execution DNA, let us lead hyper-personalized finance by proactively proposing and realizing what customers want."

Woori Financial Group, which has officially launched as an integrated financial holding company, held its "2025 Second-Half Group Management Strategy Workshop" on July 18 and announced a company-wide push for AI transformation (AX). Chairman Lim Jongryong of Woori Financial Group emphasized, "Let us accelerate company-wide AX implementation and demonstrate our strength as a leading financial group," and added, "Those who can truly understand and utilize AI will be the core talent of the future, and the group will support AX talent development at the organizational level." In fact, Woori Bank has expanded and reorganized its existing "AI Platform Department" into the "AI Strategy Center" to innovate AI-based business processes and secure future growth engines.

Hana Financial Group, while not holding a separate second-half management strategy meeting due to its ongoing strategic meetings, is accelerating the internalization of AI technology, including the introduction of AI platforms. Recently, Hana Financial Group signed a business agreement with the Korea Artificial Intelligence and Software Industry Association (KOSA) to promote AI transformation and digital financial innovation.

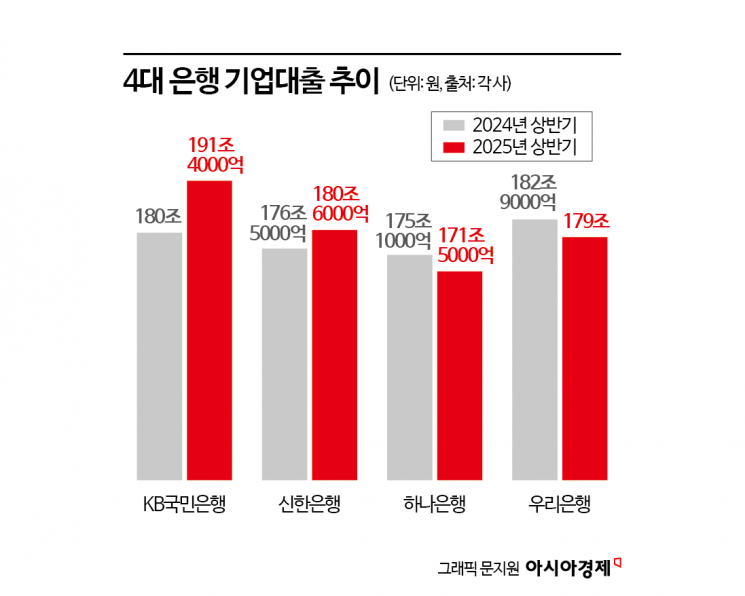

For the second half, the strategy to strengthen profitability focuses on expanding corporate finance and non-interest income. Although the four major financial holding companies posted record-high earnings of over 10 trillion won in the first half of the year, they expect that growth driven by lending will be difficult in the second half due to tightened household loans. KB Kookmin Bank President Lee Hwanju has emphasized the expansion of non-interest income since taking office earlier this year. To this end, the bank is working to strengthen competitiveness in the investment banking (IB) and wealth management (WM) sectors. KB Kookmin Bank has established a new "Golden Life Department" within the WM division and is also focusing on traditional methods of securing non-interest income, such as fund sales. According to the Korea Financial Investment Association, as of the first quarter of this year, KB Kookmin Bank's fund sales balance stood at 20.1826 trillion won, the largest among domestic banks.

Shinhan Bank reportedly aims to both supply funds to growth industries, including national infrastructure and small and venture businesses, and secure profitability at the same time. In addition, as one of the most stable global operators among major banks, Shinhan Bank plans to seek investment opportunities overseas as well.

Hana Bank plans to increase the limits for SOHO loans and corporate loans in the second half to support struggling businesses. In addition, the bank aims to strengthen growth drivers in non-interest income sectors such as trust business and asset management, where Hana Bank has traditionally held a competitive edge.

Woori Bank recently established a "SOHO Business Department" and a "Corporate Synergy Team" under its corporate group through a second-half organizational restructuring. Through this, the bank plans to support the growth of small business owners while also securing a leadership position in corporate banking, an area where Woori Bank has traditionally excelled. In addition, among major domestic banks, Woori Bank's sales of Hong Kong H Index products are significantly lower than those of other banks, making it the only bank to continue selling high-risk equity-linked securities (ELS) products. Recently, Woori Bank has resumed non-face-to-face sales in earnest and plans to take the lead in the non-face-to-face trust market. Through these efforts, the bank aims to strengthen non-interest income as a key strategy.

An industry insider said, "Since there are limits to the growth of household loans, financial groups are trying to expand corporate finance, but demand from companies is not high due to the difficult economic situation. Therefore, I expect that they will focus on strengthening non-interest sectors such as asset management, funds, and trusts, while also diversifying their portfolios globally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.