K-Defense Boom Spurs Component Supplier Contracts

Government Sets $20 Billion Export Target for This Year

Core Component Localization Rate Reaches 65%

Expert: "Practical Support Needed for Materials, Parts, and Equipment Sector"

On October 2 last year, Hyundai Rotem's K2 tank was exhibited at the 'Korea International Defense Industry Exhibition' held at Gyeryongdae, Chungnam. Photo by Kang Jinhyung.

On October 2 last year, Hyundai Rotem's K2 tank was exhibited at the 'Korea International Defense Industry Exhibition' held at Gyeryongdae, Chungnam. Photo by Kang Jinhyung.

Amid growing instability in international security following the Russia-Ukraine war and the U.S. presidential election, 'K-Defense' is drawing increased attention. In line with this trend, domestic component manufacturers are moving swiftly to localize parts used in tanks, self-propelled howitzers, and other defense equipment.

An official from SBB Tech, a domestic reducer manufacturer, stated on July 29, "This year, we are working on a total of four new projects, including reducers for Remote Controlled Weapon Systems (RCWS) and High Capacity Tactical Radio (HCTR), with mass production scheduled for 2026." SBB Tech succeeded in localizing reducers in 2019 through a Defense Acquisition Program Administration initiative to support the domestic development of weapon system components. The company has independently developed high-strength special bearings for self-propelled howitzers and tanks, and is the only domestic supplier of harmonic reducers. Sixty percent of the company’s reducer sales come from the defense sector. Bearing products for defense applications, which were developed last year, are also contributing to sales from this year.

M&C Solution, a specialized manufacturer of motion control components for defense, produces and supplies key parts such as gun and turret drive units, suspension systems for K9 self-propelled howitzers and K2 tanks, hydraulic systems for Cheonmu and Cheongung missile launchers, and servo valves. Thanks to strong exports of self-propelled howitzers and tanks, the company’s first-quarter sales this year reached 75.1 billion KRW, a 51.7% increase compared to the same period last year. The company is also working to expand localization by conducting joint research and development projects in collaboration with government initiatives, focusing on equipment and hydraulic pumps for land, air, and naval weapon systems.

SNT Dynamics, a company specializing in transmissions, also supplies automatic transmissions for the K9 self-propelled howitzer and K2 tank. The transmission for the K2 tank was approved for the fourth round of mass production by the Defense Acquisition Program Promotion Committee in October last year, and a contract worth 133.7 billion KRW was signed in February this year.

The favorable conditions experienced by domestic component manufacturers are closely linked to the rise of K-Defense. According to a report by the Stockholm International Peace Research Institute (SIPRI), South Korea’s share of the global defense market over the past five years was 2.1%, ranking 10th worldwide. This represents more than a fourfold increase from 0.5% (19th place) in 2008. Industry analysts believe that, following Russia’s invasion of Ukraine in 2022, European countries have increased their defense budgets and demand for alternatives to Russian-made weapons, creating a turning point for South Korean defense exports.

This year, in particular, is seen as a momentum builder for export growth. On July 2 (local time), Hyundai Rotem and the Polish Ministry of Defense officially confirmed the second export contract for K2 tanks. The contract, covering 180 units and worth approximately 9 trillion KRW (about 6.5 billion USD), is the largest single-item defense export in history. As of the first half of this year, the combined operating profit of the five major domestic defense companies?Korea Aerospace Industries (KAI), Hanwha Aerospace, Hyundai Rotem, LIG Nex1, and Poongsan?totaled 911.2 billion KRW, a 57.6% increase compared to the same period last year.

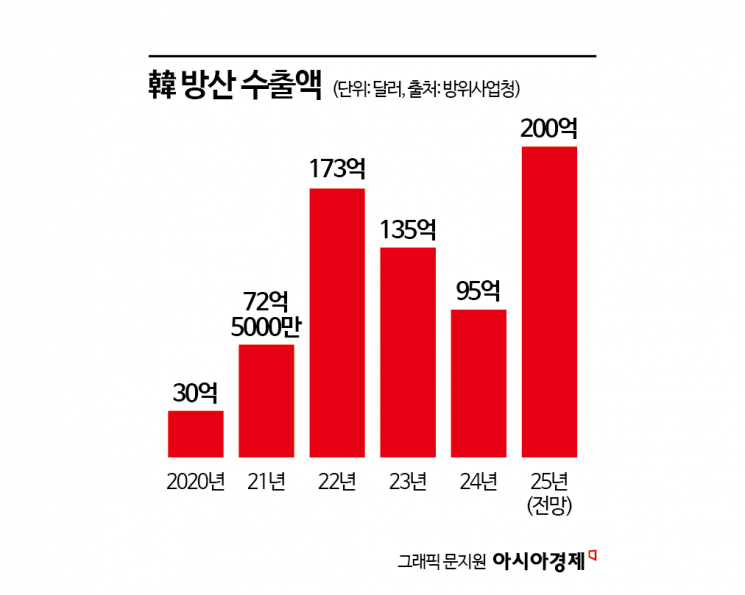

The government has set a defense export target of 20 billion USD for this year. In addition to the second K2 tank export contract in the first half, negotiations for exports of Cheongung-II, FA-50 light attack aircraft, submarines, and ammunition in the second half are expected to further accelerate the total export volume.

Along with market expansion, domestic component manufacturers are expected to further intensify their efforts toward localization. According to the Defense Acquisition Program Administration, the average localization rate for South Korean defense products currently stands at about 65%, with many export items still relying on foreign-made core components. Ryu Jaewan, CEO of SBB Tech, commented, "While K-Defense is receiving global attention, what matters more is maintaining stable market competitiveness in the coming future. We plan to accelerate the development of core defense components that surpass imported products, while continuing to collaborate with the government and the industry."

The government is also pursuing various policies to support small and medium-sized manufacturers of core defense components through localization. Since 2023, the Defense Acquisition Program Administration has been providing up to 75% of research and development costs for the localization of key defense components under the '2023-2027 Comprehensive Plan for Component Localization.' This year, together with the Defense Technology Promotion Research Institute, the government launched the 'GVC30 Project,' offering up to 5 billion KRW in support to small and medium-sized enterprises in the defense materials and components sector.

However, some argue that more practical support is needed for the growth of component manufacturers, most of which are small and medium-sized enterprises. Yang Wook, adjunct professor at the Graduate School of National Defense Strategy, Hannam University, stated, "To sustain localization, performance must ultimately be improved, but most SMEs lack the capacity. The government should not only provide support but also ensure that companies receive proper contract payments so they can conduct research and development effectively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.