Min Byungdeok Proposes Capital Markets Act Amendment

Disclosure Requirements for Private Equity Funds to Be Raised to Public Fund Level

Industry Points Out "Lack of Understanding of Fund Systems"

Most Private Equity Fund Incidents Stem from 'Internal Controls'

Concerns Over Disadvantaging Domestic Funds Against Foreign Private Equity

LPs Question Effectiveness... "Proper Monitoring of Private Equity Funds Needed"

The industry is on edge as a bill to amend the Capital Markets Act, directly targeting private equity fund (PEF) managers, has been introduced, mainly by the ruling party. Critics argue that the bill will not only affect private equity funds for general investors but also tighten regulations on institutional-only private equity funds, which are already restricted by limited partners (LPs) such as pension funds and mutual aid associations. There are concerns that this will create an "uneven playing field" against larger foreign private equity funds, thereby undermining the competitiveness of domestic funds.

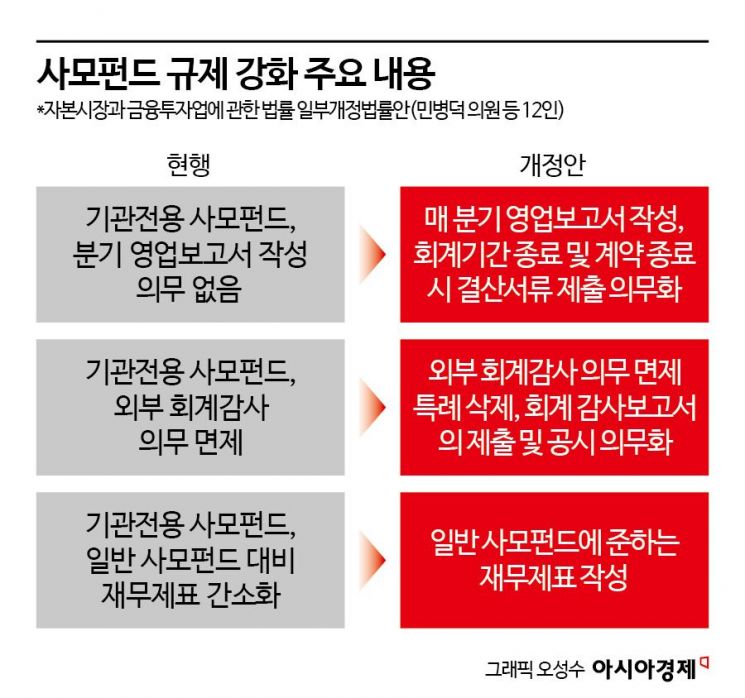

According to industry sources on July 28, Min Byungdeok, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, recently proposed a bill to amend the Capital Markets Act, which aims to strengthen disclosure obligations for private equity funds to the level required of public offering funds. The bill includes provisions to apply requirements currently imposed only on public offering funds?such as the preparation and delivery of quarterly asset management reports, submission of quarterly business reports, ad hoc disclosures, and accounting audits?to private equity funds as well.

Lack of Fundamental Understanding of Fund Systems Pointed Out

Industry insiders criticize the bill as lacking a fundamental understanding of funds. They point out that it fails to consider the rationale behind distinguishing between public and private funds, and further, the purpose of dividing private equity funds into institutional-only and general categories.

Institutional-only private equity funds, introduced after 2015, are based on transactions between institutions where information asymmetry is minimal. The intent is for private equity funds with expertise and responsibility to exercise flexible investment strategies, thereby increasing public funds such as the National Pension Fund to support citizens' retirement. Therefore, institutional-only private equity funds differ from general investor funds in terms of information accessibility and protection levels.

In contrast, general private equity funds are designed to allow a small number of investors to implement strategies that maximize returns while considering various risks. The absence of separate disclosure obligations is based on the principle that investment losses are entirely the investor's responsibility. The cap of 49 investors was also intended to prevent the spread of fund failures across the market, thereby limiting the number of victims. The minimum investment requirement of 300 million won was meant to ensure that retail investors would not become victims.

Most Private Equity Fund Incidents Are Due to 'Internal Controls'

There is ongoing criticism that, although the bill claims to address "information asymmetry," it is overly focused on disclosure as a solution. In reality, major incidents involving private equity funds such as Lime and Optimus were not caused by failures in disclosure, but rather by failures in internal controls and fraud.

Both funds engaged in false reporting by claiming to invest in assets they did not actually invest in, or by investing in unrelated assets. Distributors such as securities firms emphasized only stable returns and inadequately explained investment risks. These incidents occurred because the monitoring functions among fund managers, distributors, and custodians did not operate properly.

An industry insider from the private equity sector commented, "It seems there is a lack of basic understanding and consideration regarding the concept and ecosystem of private equity funds," adding, "It is bewildering to see such a crackdown on private equity funds, seemingly riding on the Homeplus incident."

Already Struggling... Government Creating an 'Uneven Playing Field' for Foreign Firms

There are concerns that excessive disclosure obligations will ultimately weaken the competitiveness of domestic institutional-only private equity funds. These funds compete for investment opportunities ranging from several tens of billions of won to deals worth trillions of won. They generate returns and exit after managing investments for eight to ten years. Confidential investments and long-term strategy formulation are key elements.

If excessive disclosure obligations expose their strategies, they may miss opportunities to invest at more favorable prices and lose bargaining power. If profitability declines, LPs such as pension funds and mutual aid associations will naturally prefer foreign general partners (GPs). In this case, new annual commitments may flow to foreign private equity funds, increasing the risk of attacks on domestic companies.

The domestic market is already seeing an intensified onslaught from global private equity funds, narrowing the space for local players. While global private equity funds previously focused on large-scale deals worth trillions of won, they are now lowering the threshold to actively pursue deals under one trillion won. A private equity industry source lamented, "There is already a significant difference in fundraising capabilities, and if excessive disclosure obligations are imposed, the government will essentially be creating an uneven playing field."

A mid-sized private equity fund CEO noted, "There is a reason for distinguishing between public offering funds and private equity funds, and applying public fund regulations to private equity funds, as in the proposed amendment, is not realistic." He further pointed out, "Although the amendment claims to protect investors, it is questionable whether LPs such as pension funds, which invest in institutional-only private equity funds, will feel protected by this bill."

LPs expressed similar views. A mutual aid association official said, "A concrete discussion with relevant authorities such as the Financial Services Commission is necessary to assess the effectiveness of the bill," but added, "Rather than such regulations, it seems more appropriate to ensure that LPs can properly monitor private equity funds and that market evaluations are possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.