Complete Victory in 1 Trillion Won Government Bid Round 1

Eight Preferred Negotiation Partners Selected for ESS

Six Choose Samsung SDI Batteries

LFP Has Cheaper Raw Material Costs

But Lower Price Offer Secures Advantage

Samsung SDI has secured the upper hand in the first round of the government-led energy storage system (ESS) central contract bidding, which is valued at over 1 trillion won. Despite the relatively lower price competitiveness of its NCM (nickel-cobalt-manganese) batteries, Samsung SDI outperformed competitors who promoted LFP (lithium iron phosphate) batteries. Industry insiders are calling this a "major turnaround," with renewed attention on the pricing strategy and domestic procurement ratio of NCM batteries.

According to industry sources on July 25, the Ministry of Trade, Industry and Energy has selected eight preferred negotiation partners in the 2025 first-round ESS central contract market competitive bidding. BS Hanyang, Top Solar, and Korea Southern Power were among those selected, and it is reported that more than 80% of them chose Samsung SDI batteries.

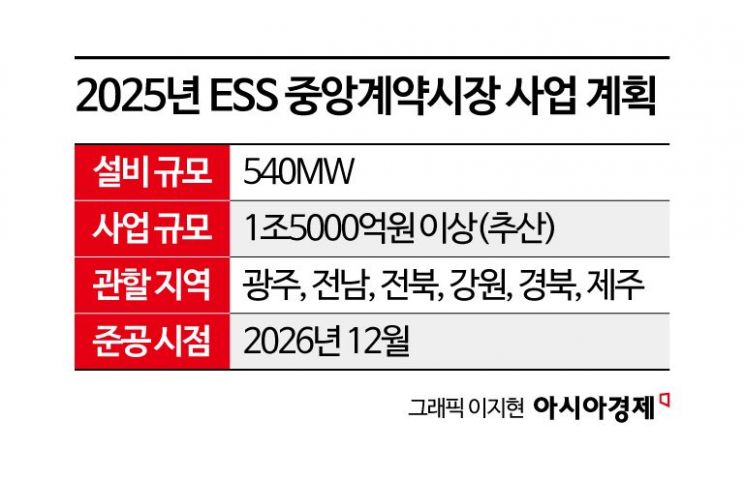

This project covers a total capacity of 540 megawatts (MW), including 500 MW on the mainland and 40 MW in Jeju. The ministry selected eight companies for the first round, and Samsung SDI will supply batteries to six of them, accounting for 465 MW. LG Energy Solution, which promoted LFP products, will supply two companies, while SK On did not secure any contracts.

The evaluation criteria for selecting battery ESS operators, as announced by Korea Power Exchange, consisted of 60 points for "price evaluation" and 40 points for "non-price evaluation," for a total of 100 points.

A Korea Power Exchange official stated, "Samsung SDI stood out by offering a more aggressive low price than before. In the previous Jeju ESS project, the same product was offered at 50 won per kilowatt-hour (kWh), but this time, the price was offered at less than 35 won per kWh." The official added, "Although LFP batteries were also competitive in terms of price and technology, Samsung SDI's pricing strategy played a greater role."

ESS consists of three components: battery cells, power conversion systems (PCS), and energy management systems (EMS). Among these, the battery accounts for more than 50% of the total system cost. In this bid, Samsung SDI gained an advantage by unexpectedly offering a low price in the battery cell segment, which was the key factor in price competitiveness.

Until now, the industry consensus was that LFP materials, being cheaper in raw material cost than NCM, would give LG Energy Solution and SK On an advantage. Samsung SDI had previously lost out to LG Energy Solution in domestic projects, such as the Jeju long-term ESS project and the Korea Electric Power Corporation grid stabilization ESS project.

However, in this competitive bidding, evaluation scores for companies with low prices and a high proportion of domestic production and parts procurement proved to be crucial, leading to an unexpected result. An industry source commented, "Samsung SDI likely received high marks for industrial contribution, as it procures most of the key materials and parts for ESS batteries domestically." Another industry insider remarked, "Samsung SDI has typically avoided low-priced bids, but based on these results, it appears they are now actively pursuing low-margin, low-priced contracts."

It is also noteworthy that Samsung SDI entered the ESS market relatively early and has accumulated significant experience. Samsung SDI launched its ESS business team in 2009, marking the start of its ESS battery business. In the early days, when the ESS business was not very active, the company participated in government-led pilot projects to lay the foundation for its business. Currently, Samsung SDI is actively targeting both domestic and international ESS markets with the launch of its container-type battery product, Samsung Battery Box (SBB), tailored to market demand.

However, these results are not yet finalized. After the objection period, which ends as early as the end of July, the central contract market committee will review the process, and the final successful bidders will be confirmed. Korea Power Exchange aims to conduct a second round of competitive bidding in the second half of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)