If Current Tariffs of 15% for Japan and 25% for Korea Are Applied,

Hyundai Cars Become More Expensive in the US

Domestic Industry: "Even a 1 Percentage Point Tariff Gap Is a Competitive Disadvantage"

Growing Concerns Over Competitiveness of Korean Cars in the US Market

As the United States and Japan have agreed to lower automobile tariffs to 15%, a sense of crisis is growing within the South Korean automotive industry. This is because there are concerns that if Japan, South Korea's biggest competitor, faces lower tariffs than South Korea, Korean cars could lose their price competitiveness in the US market.

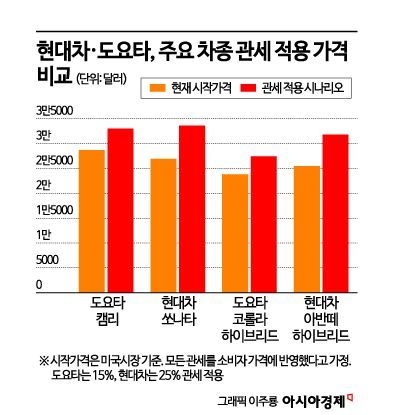

According to industry sources on July 24, the starting price of the Hyundai Sonata currently sold in the United States is $26,900, which is about 6% cheaper than the Toyota Camry, priced at $28,700. Until now, Hyundai has maintained a relatively lower selling price compared to Toyota, thanks to the tariff-free benefits provided by the Korea-US Free Trade Agreement (FTA).

However, the situation changes if, according to the US-Japan agreement, a 15% tariff is imposed on Japanese cars and a 25% tariff on Korean cars. In this case, the price of the Toyota Camry would rise to $33,005, while the Hyundai Sonata would cost $33,625, making the Hyundai model more expensive. This scenario assumes that both models are produced in their respective home countries and that all tariffs are fully reflected in the consumer price.

Until now, Hyundai has maintained its price competitiveness in the US market by utilizing the tariff-free benefits of the Korea-US FTA. GM has also exported about 500,000 small SUVs annually from its Changwon and Bupyeong plants in Korea to the US, employing a production adjustment strategy that takes advantage of the tariff-free benefits as well.

Therefore, the domestic automotive industry argues that the product-specific tariffs imposed by the US on Korean vehicles should at least be matched to the same level as those for Japan. Japan, which does not have an FTA with the US, has negotiated a total tariff of 15%?combining the existing basic tariff (2.5%) and an additional product-specific tariff (12.5%). Since Korea previously enjoyed zero tariffs, the industry calculates that Korea must secure at least the same reduction in product-specific tariffs as Japan in order to maintain a 2.5 percentage point advantage over Japanese cars.

During the era of internal combustion engines, Hyundai competed in the US market by leveraging lower prices compared to Toyota. However, as the US has recently shifted toward eco-friendly vehicles, the price gap between the two brands has been narrowing. For some hybrid models, Toyota, which is increasing local production in the US, is now even cheaper. The industry is concerned that if the tariff difference also becomes unfavorable, Korean-made eco-friendly cars will lose their competitiveness in the US market.

An industry insider commented, "Given that the Hyundai Motor Group is staking its future on the US market, even a one percentage point difference in tariffs could lead to a significant gap in market share going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.