Art Auction Market Experienced Booms Every Seven Years Over the Past Two Decades

This Year's Performance Hits Five-Year Low Despite the Seven-Year Cycle

"Early Boom in 2021 Due to COVID-19... Cycle Disrupted"

Industry Focused on Whether Past Cyclical Patterns Will Hold

The long-circulated theory of a "seven-year boom" in the domestic art auction market is losing credibility this year. Contrary to the conventional wisdom that the market experiences a surge every seven years, this year has instead entered a clear downturn, showing a pattern different from previous cycles.

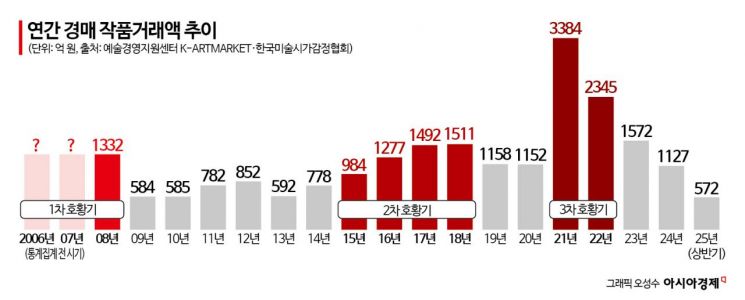

According to the Korea Art Authentication & Appraisal Research Center on July 22, the total transaction volume in the art auction market for the first half of this year was 57.2 billion won. This represents a 37.6% decrease compared to the same period last year (91.7 billion won), marking the lowest level in the past five years. The scale of transactions has also shrunk significantly compared to 2023 (81.1 billion won), 2022 (144.6 billion won), and 2021 (143.8 billion won).

The domestic art auction market has experienced two distinct boom periods in the past. The first was from 2006 to 2008, when K Auction's total hammer price reached 185.6 billion won. This was more than 20 times higher than the average of the previous three years (2003?2005). In 2008 alone, auction transactions amounted to approximately 130 billion won, which was 2.5 times higher than the 58.4 billion won recorded in 2009, when the global financial crisis erupted.

The second boom period lasted from 2015 to 2018, during which annual transaction volumes consistently stayed in the 150 billion won range. According to the Korea Arts Management Service, the value of art exports in 2015 was $439.23 million (about 510 billion won), far exceeding imports ($197.88 million, about 230 billion won). This is interpreted as a result of economic revitalization, including the expansion of large-scale exhibitions and increased demand for artworks.

A third boom was expected to begin around this year, but it is analyzed that the cycle was accelerated due to the COVID-19 pandemic. In 2021, after the pandemic, the art auction market saw explosive growth, with transaction volume soaring to 338.4 billion won. However, from 2022 (234.5 billion won), the market entered a decline, dropping to the 100 billion won range in 2023, and further decreasing to the 50 billion won range in the first half of this year, drawing a steep downward curve.

This growth was mainly driven by asset migration caused by strengthened real estate regulations, as well as the influx of MZ Generation (Millennials and Generation Z) and general consumers who viewed art as a new investment alternative. The influence of celebrity collectors such as T.O.P of Big Bang and RM of BTS, who exerted significant impact through social networking services (SNS), and the spread of non-face-to-face trading environments such as "online viewing rooms," also contributed greatly to expanding the market base.

An industry insider commented, "In 2021, there was a massive influx of novice collectors with trend-following investment tendencies, leading to active transactions focused more on trends than on artistic value. Currently, however, the buying momentum has plummeted, and the entire market is in a contracted state."

The seven-year boom theory is closer to an empirically accumulated analysis within the industry than a statistically proven theory. Nevertheless, it has been used in the industry as an indicator for market strategy. It is still difficult to predict whether this downturn will remain a temporary adjustment or mark the beginning of a prolonged recession. Another industry source stated, "This year, the prevailing sentiment across the industry is that the market feels worse than ever before. The industry's attention is focused on whether the cyclical patterns of the past will become relevant again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.