Government Sets Anode Material Subsidy Cap at 12 Billion Won

POSCO Future M Likely to Benefit

US Imposes 93.5% Tariff on Chinese Anode Materials

POSCO Future M has reportedly applied for government subsidies related to the production of natural graphite. Natural graphite is a key material for lithium battery anodes. As the anode materials market is overwhelmingly dependent on Chinese imports, domestic companies are now beginning to mount a serious counteroffensive.

According to industry sources on July 22, POSCO Future M applied for subsidies after the government included support for domestic production costs of high-risk economic security items?such as anhydrous hydrofluoric acid and graphite?in the supplementary budget bill last April. POSCO Future M is currently the only domestic producer of anode materials. While an official from the Ministry of Trade, Industry and Energy did not confirm POSCO Future M's application, the official indirectly stated, "The subsidy cap for natural graphite has been set at 12 billion won, and the actual subsidy will be paid according to each company's production volume." The industry expects that POSCO Future M will be the practical beneficiary of these subsidies.

Natural graphite is a core material for lithium-ion battery anodes, and China currently controls more than 94% of the global market. Leveraging its cost competitiveness, China has been supplying anode materials to Korean battery companies at $4?5 per kilogram (5,569?6,962 won) since the second half of 2023, putting pressure on the market. This price is 40?50% lower than the peak levels of 2022.

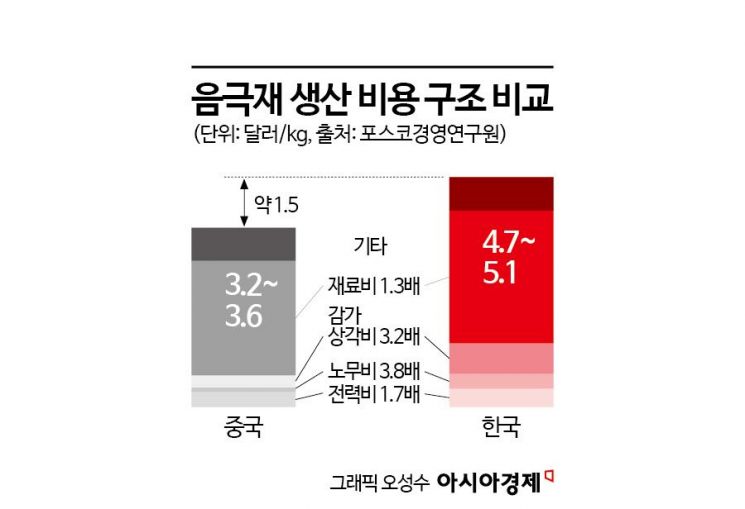

The cost of producing anode materials domestically is nearly 60% higher than in China. According to analysis by the POSCO Research Institute, domestic production costs are $4.7?5.1 per kilogram, while in China, the cost is $3.2?3.6 per kilogram. Breaking down the costs, electricity expenses are 1.7 times higher, labor costs are 3.8 times higher, and depreciation expenses are 3.2 times higher in Korea. The gap in depreciation expenses is the result of large-scale subsidies from the Chinese government being reflected in facility investment costs. Under this structure, it is difficult for Korean companies to compete with China on price alone, and there is a growing sense of crisis in the industry that Korea may ultimately have to cede sovereignty over key materials to China.

The entire supply chain for anode materials, from raw materials to finished products, is concentrated in China. China leads the world in graphite production, accounting for 67% of the global total, and processing costs?including labor and electricity?are extremely low. As a result, even when graphite ore is sourced from Africa or other regions, it is often processed in China. Unlike lithium or nickel, the processing cost of graphite is much higher relative to the raw material cost, making processing outside China economically unviable. For this reason, domestic battery material companies have consistently called for increased government support.

In addition to efforts by domestic industry to build an internal supply chain, recent global trade developments are also moving in favor of Korean companies. The recent preliminary decision by the U.S. Department of Commerce to impose a 93.5% anti-dumping tariff on Chinese anode materials is expected to benefit non-Chinese companies, including those from Korea and Japan. A final decision is expected by December 5.

Park Jaebum, Senior Research Fellow at the POSCO Research Institute, stated, "On average, the three major domestic battery companies rely on Chinese anode materials for more than 90% of their supply," and analyzed, "If this measure is finalized, it could become a favorable turning point for domestic companies, including POSCO Future M, in terms of diversifying supply chains and securing price competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.