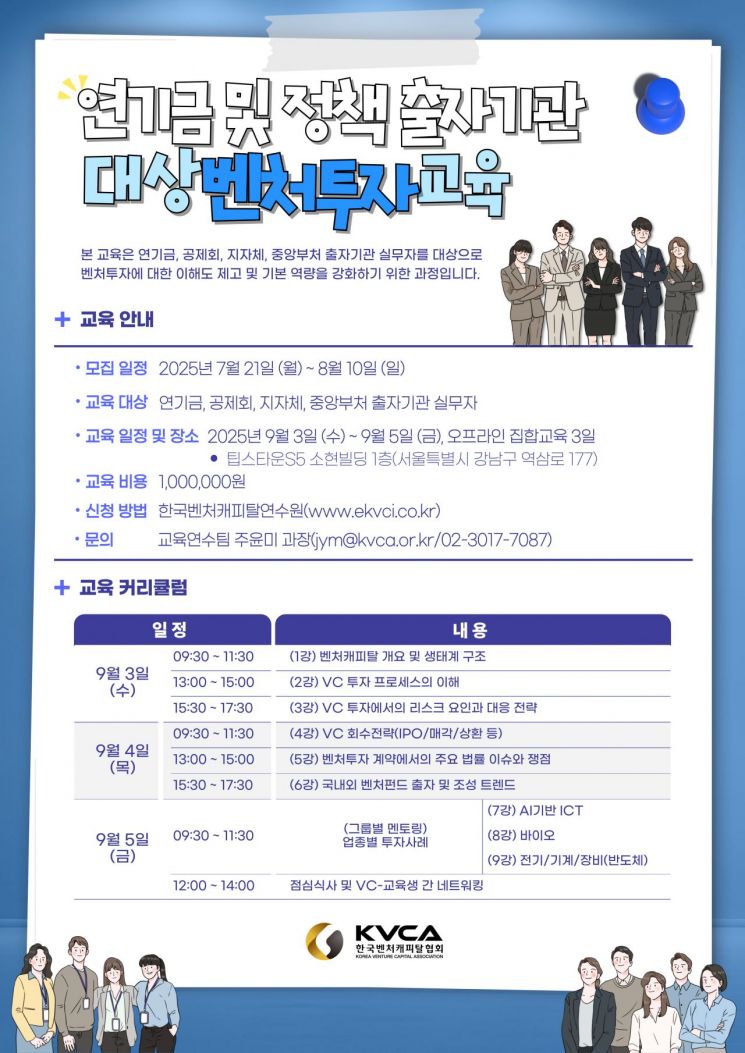

The Korea Venture Capital Training Institute, affiliated with the Korea Venture Capital Association, announced on July 21 that it will hold an offline "Venture Investment Training for Pension Funds and Policy-based LPs" at Gangnam Tipstown for three days from September 3 to September 5.

This training program is designed to enhance the understanding of the venture investment market and strengthen investment capabilities among practitioners from venture investment LPs, including pension funds, mutual aid associations, local governments, and central government agencies. As a group training session, it also offers opportunities for networking among participants.

The curriculum covers topics such as the structure of the venture capital industry, the venture investment process, risk management, legal and regulatory frameworks, and sector-specific investment cases. The program combines theory with case studies to ensure that participants can immediately apply what they learn to their work. Instructors, who are current venture capital professionals, will share real investment cases and insights, and will further support participants' understanding through Q&A sessions and group mentoring.

A representative from the Korea Venture Capital Training Institute stated, "As the venture investment market expands, the understanding and strategic planning capabilities of public LPs are becoming increasingly important. We expect this training to provide a platform for networking among practitioners from different LPs and to further strengthen connections with the venture ecosystem."

Applications for the training will be accepted through the institute's website until August 10. The fee is KRW 1,000,000 per person. For more details on the curriculum and application process, please visit the Korea Venture Capital Training Institute website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.