Regulation to Be Enacted in August and Enforced in January Next Year

SGI Seoul Guarantee Holds Monopoly Over Payment Guarantee Insurance

Industry: "Internal Control Burden and Confusion Are Growing"

Authorities: "Difficult to Delay Regulation Due to Issues with External Institutions"

The electronic payment gateway (PG) industry, which is required to entrust 60% of settlement funds to external institutions, has been thrown into confusion due to a system failure at SGI Seoul Guarantee. Financial regulators decided to implement a rule starting next year that mandates the outsourcing of settlement funds to external institutions in order to prevent a repeat of the so-called 'TMon-Wemakeprice incident,' which involved large-scale settlement payment defaults by TMon and Wemakeprice. However, a problem has arisen at Seoul Guarantee, the designated external institution. The industry is requesting a slight extension of the grace period, but the regulatory authorities maintain that it is difficult to adjust the content or schedule of the regulation due to issues with the external institution.

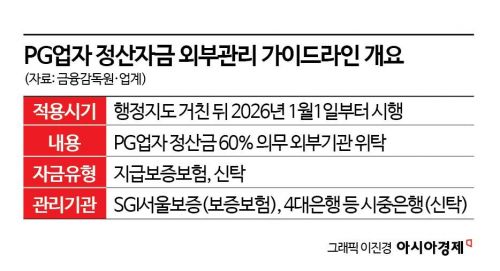

According to the Financial Supervisory Service and the PG industry on July 17, regulators will implement the so-called "Second TF Prevention Regulation" as scheduled in January next year. On August 13, the "Guidelines for External Management of Settlement Funds by PG Operators" will be submitted to the Administrative Guidance Review Committee, and the regulation will be established immediately upon approval. This means a grace period of just over four months will be granted from August 13 until the end of the year. The regulators initially considered a three-month grace period, but partially accepted the industry's appeal that at least six months was needed.

The core of the guidelines, which the Financial Supervisory Service plans to finalize on July 27 after discussions with the industry and administrative procedures, is that all PG operators must entrust 60% of their settlement funds to external institutions through trust or payment guarantee insurance. The offline meetings reportedly concluded the previous day. Settlement funds refer to the money held by PG companies as intermediaries in transactions between card companies and merchants. If PG companies misuse these funds, incidents like last year's TMon-Wemakeprice case can occur, prompting regulators to introduce this regulation. In order to properly manage the entrusted funds, both the PG company and the external institution must establish a system to check the daily settlement balance and calculate the required ratio for the next business day.

The problem is that SGI Seoul Guarantee is the only external institution managing payment guarantee insurance. While trust funds are mainly entrusted to major commercial banks such as KB Kookmin, Shinhan, Hana, and Woori, payment guarantee insurance is effectively monopolized by Seoul Guarantee. If an issue arises at Seoul Guarantee, PG companies will have no choice but to increase the proportion of funds entrusted to banks, which could pose difficulties for companies with insufficient trust funds. Furthermore, even if a PG company has a robust daily settlement transaction system, problems with external institutions could still lead to issues in managing settlement funds. The incident at Seoul Guarantee has revealed the financial sector's vulnerability to ransomware attacks and similar threats.

An industry representative stated, "PG operators cannot process daily settlements manually and are required to entrust them to external institutions, but now we are facing difficulties due to system problems at the external institution itself." The representative added, "It would be ideal to extend the grace period to six months from the current five, but if adjustment is not possible, the regulatory authorities should at least consult with the industry to provide guidelines regarding internal controls at external institutions."

Regulatory authorities currently have no plans to change the implementation date or details of the guidelines. There are also no plans to introduce additional regulations related to internal controls at external institutions. If the amendment to the Electronic Financial Transactions Act, proposed by Kang Minguk, the opposition secretary of the National Policy Committee from the People Power Party, which would raise the mandatory outsourcing ratio for settlement funds to 100%, is enacted, exceptions could be discussed to address issues like the Seoul Guarantee incident. However, under the Financial Supervisory Service's 60% rule, they believe there will be no major problems, as PG operators are still allowed to autonomously manage the remaining 40% of settlement funds.

A Financial Supervisory Service official said, "We are aware of the confusion and difficulties faced by PG companies due to the Seoul Guarantee incident, but we cannot delay the regulatory schedule." The official added, "Overseas, in countries such as the UK and the European Union (EU), external management of settlement funds is already in place, and considering that Korea is already significantly behind, we will proceed with the regulation as planned." The official further stated, "At this time, there are no plans for additional discussions regarding internal controls at external institutions such as Seoul Guarantee."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)