Raising 65.6 Billion KRW Through Rights Offering to Existing Shareholders...

37 Billion KRW to Be Invested in Facility Expansion

Largest Shareholder to Subscribe to 40% of Allocated Shares

SW Steeltech, a construction materials company, is raising funds through a rights offering allocated to existing shareholders in order to finance a large-scale expansion investment. The largest shareholder, SW, plans to participate in the subscription for approximately 40% of the allocated shares. The board of directors of SW Steeltech has signed a final contract with KB Securities, the lead manager for the rights offering, for the acquisition of unsubscribed shares. As uncertainty in the real estate market is increasing, the movement of the stock price after the new share issue price is set is expected to affect the subscription competition rate.

According to the Financial Supervisory Service's electronic disclosure system on July 15, SW Steeltech will raise funds by allocating 0.49 new shares per one existing share, expanding its production capacity for deck plates and soundproofing materials. The planned issue price for the new shares is 4,375 KRW, with 15 million new shares to be issued, aiming to raise 6.56 billion KRW. The final issue price will be determined on August 29. The total amount raised may change depending on the final issue price.

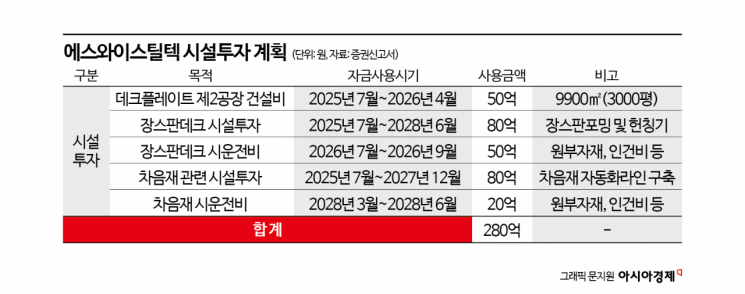

Of the funds raised, 3.7 billion KRW will be used for facility investment, while the remaining funds will be used for operating capital and debt repayment. Of the facility investment, 2.8 billion KRW will be allocated to expansion investments in construction materials such as deck plates and soundproofing materials. 900 million KRW will be allocated to facility investments in power generation equipment for the solar power business.

The company explained that maintaining long-term business competitiveness and improving profitability in the deck plate manufacturing business requires ongoing capital investment for the maintenance and expansion of production facilities and equipment. The company also expects that as the scale of facilities increases, it will be able to reduce repair costs, labor costs, and other variable costs per unit, thereby improving profitability.

However, if the domestic construction market downturn continues, there are concerns that large-scale expansion investments could worsen profitability. If the volume of design and construction at construction sites decreases, demand for deck plates could decline. Since 2022, uncertainty in the domestic construction industry has increased due to the global trend of high interest rates and concerns about household debt. The amount of domestic construction investment has been steadily declining since 2022. In the first quarter of this year, the value of completed construction was approximately 27 trillion KRW, a 20.7% decrease compared to the same period last year. During the same period, the value of construction orders also fell by 7.7%.

In the first quarter of this year, SW Steeltech recorded sales of 26.5 billion KRW and operating profit of 280 million KRW. While sales increased by 7.6%, operating profit dropped sharply. This was due to intensified competition for deck plate orders as downstream industries stagnated. Profit margins for each project declined due to low-price orders. Profitability also deteriorated as the proportion of sales from distribution and new business segments, which have relatively lower profit margins, increased.

The board of directors made a final resolution to conduct a rights offering for existing shareholders followed by a public offering of unsubscribed shares, with the lead manager underwriting the remaining shares, after comprehensively considering the potential for shareholder dilution, measures to protect shareholder value, and the feasibility of raising funds.

An official from the financial investment industry explained, "The greater the number of unsubscribed shares, the higher the fee burden may become," adding, "The company still faces the challenge of convincing shareholders of the necessity of the large-scale facility investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)