June Imports of Chinese Steel Rise by 1.8%

Share of Imports Expands to 62.5%

South Korea Remains the Outlet... Export Push Continues

Industry: "Mainly a Short-Term Adjustment"

Calls for Government Trade Remedies and Measures

Despite China's policy of reducing steel production, the proportion of Chinese steel in the domestic market has actually increased. This is because, even with production cuts, oversupply within China persists, preventing a decrease in export volumes pushed into South Korea.

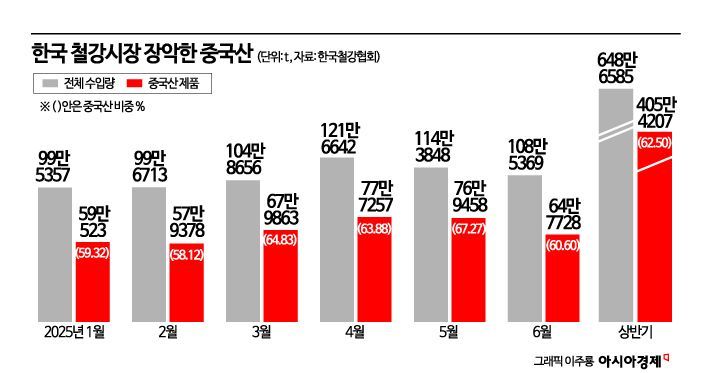

According to the Korea Iron & Steel Association on July 11, imports of Chinese steel products last month reached 657,728 tons, up 1.8% from the same period last year (646,293 tons). While the total steel imports for the first half of this year (January to June) fell by 17.7% year-on-year to 6,486,585 tons, the share of Chinese steel imports increased from 59.9% to 62.5% over the same period. Notably, in May, Chinese steel accounted for 67.3% of total imports, marking the highest level in the past year.

China has recently drawn attention for reducing steel production. After officially announcing production cuts for the first time at the National People's Congress in March, some state-owned enterprises, such as Baowu Steel, began to scale back output. In May, crude steel production was about 86.55 million tons, a 7% decrease from the same month last year, and cumulative production from January to May also fell by 2.1% to 431.63 million tons. This raised expectations that the structural oversupply could be resolved. As a result, the stock prices of major domestic steelmakers such as POSCO and Hyundai Steel also rose.

Industry consensus is that the increase in the share of Chinese steel in the domestic market is because China's production cuts are more of a short-term adjustment than a structural shift. The existence of numerous blast furnaces makes it difficult to halt or reduce operations easily. Furthermore, in a system dominated by state-owned enterprises, issues related to regional economies and employment are intertwined, making it hard for central government policies to translate into actual production cuts. An industry official stated, "China produces about 1 billion tons of steel annually, and considering the slowdown in domestic demand, a meaningful reduction would need to be at least 400 million tons," adding, "In the end, there are still no viable alternatives to exports."

From the perspective of Chinese companies, South Korea remains an attractive market due to its geographic proximity and continued demand from industries such as shipbuilding and automotive. As imports of Chinese hot-rolled steel sheets and rebar have increased, domestic steel prices have remained weak. Hot-rolled steel sheets are maintaining a price of 820,000 won per ton, and rebar is at 700,000 won per ton.

While domestic steelmakers such as POSCO and Hyundai Steel are pursuing strategies focused on high value-added products, they are gradually losing ground in the domestic market. Some companies have already reduced production or halted factory operations. The industry is calling for stronger government-level trade remedies and more active import regulations to prevent such structural damage. An industry official said, "This is not a temporary price competitiveness issue but one directly linked to the sustainability of the industry," emphasizing, "Institutional measures to maintain market order are urgently needed at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)