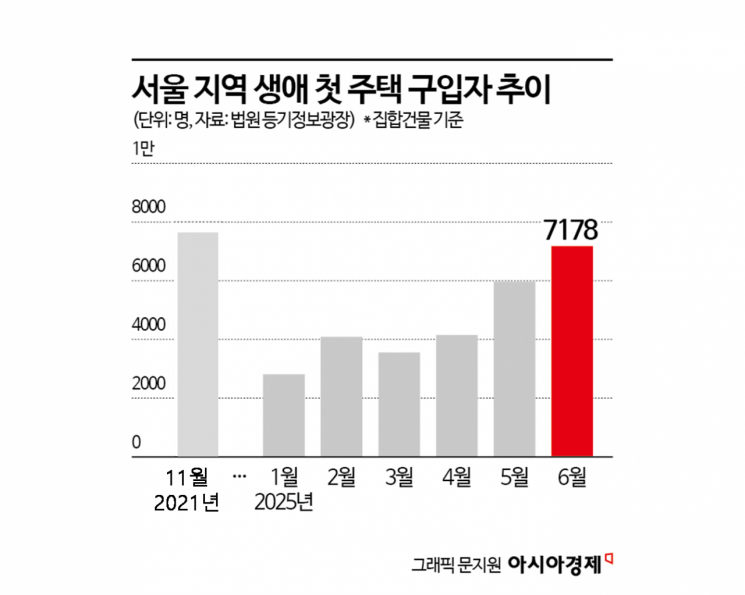

7,178 People Bought Their First Home Last Month

First-Time Home Purchases Hit 43-Month High

Highest Level Since November 2021

"Panic Buying Driven by Anxiety"... Expected to Decrease After Loan Regulations

The number of people purchasing their first home reached its highest level in three years and seven months. As real estate prices in Seoul, including apartments, soared, demand from those trying to buy before prices rose further became concentrated. However, it is expected that this surge in first-time home buying will subside starting this month. Analysts say that as even genuine homebuyers without property are now facing tighter loan regulations, the path to homeownership for ordinary citizens has become even more challenging.

According to an analysis of court registry data on July 11, the number of first-time real estate buyers who purchased collective buildings (such as officetels, apartments, row houses, and multi-family housing) in Seoul last month was 7,178. This is the highest figure in about 43 months. For the first time since November 2021, when the figure was 7,886, the number surpassed 7,000. Compared to the previous month’s 5,962, this represents a sharp increase of 20.3%. Compared to the beginning of the year, when the figure was 2,812, it is a 155.3% increase.

The impact of "panic buying" is reflected in these numbers. As apartment prices in Seoul soared, demand surged from those who wanted to buy before it was "too late." Before the loan regulations, the rise in housing prices began in premium areas such as the three Gangnam districts and Yongsan-gu, then spread to the Han River Belt, and was expected to expand across all of Seoul. Since early February this year, when Seoul apartment prices began to rise, they have increased for 23 consecutive weeks. Until the financial authorities implemented strict loan regulations on June 28, apartment prices in the three Gangnam districts alone had risen by 7?8% just this year.

Yoon Sumin, a real estate specialist at NH NongHyup Bank, explained, "The anxiety that housing prices could rise significantly, which can be summed up as panic buying and FOMO (fear of missing out), has led to an increase in the number of first-time buyers." She added, "A similar phenomenon occurred during the Moon Jae-in administration in 2021, when real estate prices also soared."

By age group, those in their 30s accounted for the largest share of first-time homebuyers at 46.3%, followed by those in their 40s (26.4%), 50s (12.4%), and 20s (8.6%). By gender, women accounted for 55%, which is 10 percentage points higher than men.

However, after last month's loan regulations, the increase in first-time real estate buyers is expected to slow down. The mortgage loan limit has been capped at 600 million won, and the policy loan limit has been reduced by 25%, making it impossible to buy a home without sufficient cash. The limit for Didimdol (purchase) loans has been reduced from 250 million won to 200 million won for general purchases, and from 300 million won to 240 million won for first-time buyers. For newlywed couples, the limit has been reduced from 400 million won to 320 million won, and for newborn special cases, from 500 million won to 400 million won.

Some experts argue that measures are needed to support first-time real estate buyers, such as providing partial financial assistance for home purchases. Yoon stated, "For those without a home who need to buy in the future, it is inevitable to be sensitive to real estate policy," and added, "We need to consider policy support for genuine buyers, such as shared equity housing finance (where financial institutions provide part of the funds as an equity investment when purchasing a home), by appropriately combining supply through new housing and financial measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)