Overseas Cigarette Sales Surge... K-Tobacco Gains Global Popularity

3.7 Trillion Won Shareholder Return Plan... Additional 1 Trillion Won Expected from Real Estate Cash Securing

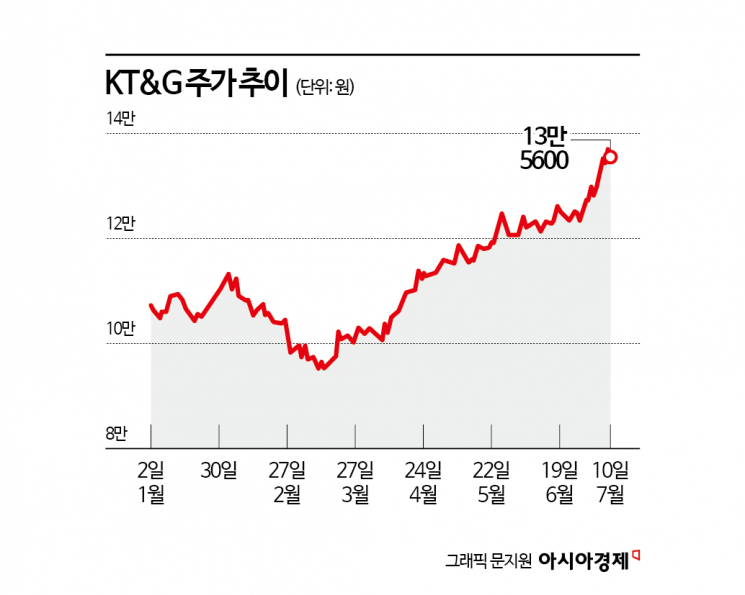

KT&G is receiving positive evaluations from the securities industry, driven by robust overseas tobacco exports and an active shareholder return policy. Securities firms have unanimously raised their target prices, expressing optimism about the company's global business expansion and expectations for enhanced long-term shareholder value.

According to financial information provider FnGuide on July 11, KT&G's consensus estimates for the second quarter of this year are 1.518 trillion won in revenue and 339.3 billion won in operating profit, representing increases of 6.6% and 5.4%, respectively, compared to the same period last year. Although domestic tobacco demand remains sluggish, strong overseas performance is expected to offset this, resulting in overall solid earnings.

Recently, K-tobacco has been gaining popularity worldwide. Since KT&G first began exporting tobacco in 1988, the company has expanded into 135 countries. The growth of the cigarette business, in particular, stands out. KT&G's overseas cigarette sales rose from 1.0101 trillion won in 2022 to 1.1328 trillion won in 2023, and to 1.4501 trillion won last year. The securities industry expects overseas cigarette sales to reach 1.83 trillion won this year, surpassing domestic sales for the first time.

Shim Eunju, a researcher at Hana Securities, stated, "Domestic cigarette demand is expected to decrease by about 5% year-on-year, but overseas tobacco exports and corporate performance are estimated to grow by nearly 30%." She added, "The achievements in developing new markets such as the Middle East and Africa are particularly noteworthy."

Jung Hansol, a researcher at Daishin Securities, commented, "Overseas cigarettes are showing growth in both price and volume, and the stable expansion of local subsidiaries is a positive factor." He further analyzed, "In particular, with the new plant in Kazakhstan starting operations in April, KT&G's global supply capabilities are expected to be significantly strengthened over the mid to long term."

Despite temporary production disruptions and delayed launches, the next-generation product (NGP) segment is expected to show a gradual recovery. In the second quarter of this year, total domestic demand for electronic cigarettes is estimated to increase by about 5% year-on-year. KT&G's domestic market share in electronic cigarettes is also believed to be rising.

Researcher Jung explained, "Despite intensifying domestic competition, strong stick sales continue, and the device supply disruptions that occurred in the first quarter have been resolved, leading to a recovery trend." He added, "However, overseas, the launch of new devices has been delayed more than expected, so the short-term contribution to earnings is likely to be limited."

In addition to strong earnings, KT&G's proactive shareholder return policy is also seen as a positive for its stock price. KT&G has announced a shareholder return plan worth a total of 3.7 trillion won over the next three years, including share buybacks, cancellations, and dividends. In addition, through the restructuring of 57 real estate assets and 60 financial assets, the company is expected to secure approximately 1 trillion won in additional cash, making further shareholder returns possible.

Jo Sanghoon, a research fellow at Shinhan Investment & Securities, said, "KT&G has been undervalued due to its conservative management strategy and cash utilization, resulting in a lower return on equity (ROE) compared to global competitors." He continued, "If a virtuous cycle is established where an aggressive management strategy and capital expenditures focused on the three core growth areas?electronic cigarettes, global business, and health functional foods?lead to a strong shareholder return policy, the stock price is expected to show a favorable trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)