Sales of Top 10 Food Companies Up 3.5% in Q2,

Profits Remain Flat

Samyang and Orion Drive Overseas Growth...

Strong Performance in Russia and US Markets

Lotte, Ottogi, Binggrae See Profitability Falter

Due to Weak Domestic Demand

In the shadow of sluggish domestic consumption in the second quarter of this year, the food industry is expected to see mixed results. Companies that actively targeted overseas markets, such as Samyang Foods and Orion, posted strong performances, while those with a higher reliance on the domestic market are expected to report weaker results.

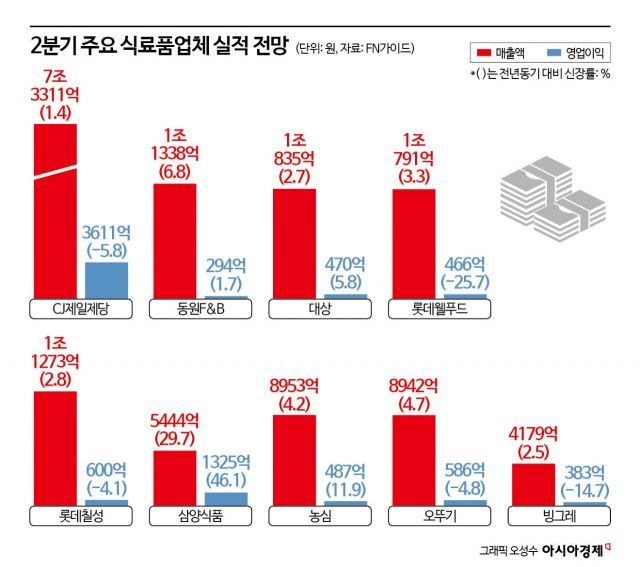

According to financial information provider FnGuide and the food industry on July 11, the combined estimated sales of the top 10 domestic food and beverage companies for the second quarter of this year amounted to 15.2888 trillion won. This represents a 3.5% increase compared to the same period last year (14.769 trillion won). Operating profit for the same period is estimated at 951.4 billion won, a 1.0% increase from the previous year (941.8 billion won). The 10 companies are CJ CheilJedang, Daesang, Dongwon F&B, Lotte Wellfood, Lotte Chilsung, Orion, Samyang Foods, Nongshim, Ottogi, and Binggrae.

An industry insider commented, "While domestic consumption remains sluggish, expanding into overseas markets and exporting premium product lines helped companies defend their performance," adding, "In particular, demand for K-food remains robust in Southeast Asia and the United States."

Samyang and Orion Drive Performance Overseas

Samyang Foods is expected to post second-quarter sales of 544.4 billion won, up 29.7% year-on-year, and operating profit of 132.5 billion won, up 46.1%. The operating margin stands at 24.3%, significantly higher than the industry average.

Samyang Foods' average monthly ramen exports for April and May reached $87.5 million (about 120.2 billion won), up 29.6% from the same period last year. After surpassing 1 trillion won in annual sales in 2023, the company is estimated to have already exceeded 1 trillion won in sales in the first half of this year alone. This marks the highest half-year performance in the company's history. In the first quarter, Samyang Foods also posted strong results, with sales of 529 billion won and operating profit of 134 billion won.

More than 80% of total sales were generated overseas. The share of overseas sales for Samyang Foods expanded from 44% in 2017, to 57% in 2020, 77% last year, and 80% in the first quarter of this year. With the continued popularity of Buldak Bokkeum Myeon in the United States, China, and Europe, the company is expected to maintain its upward performance trend in the second half of the year. Kang Eunji, a researcher at Korea Investment & Securities, analyzed, "Exports of Buldak Bokkeum Myeon produced at the Miryang Plant 2 will begin in earnest to the US and Europe from the third quarter, driving further growth. Since some channels in Europe and the US were unable to fully meet demand in the first quarter, a rapid recovery is expected."

Orion also benefited significantly from expanding its overseas business. Second-quarter sales are estimated at 782.2 billion won, up 8.6% year-on-year, and operating profit at 129.2 billion won, up 5.9%. Growth in the Russian subsidiary was particularly notable. Sales in Russia for April and May surged 74.7% year-on-year. The operating rate of the Choco Pie production line exceeded 140%. Expanding supply through major local distributors such as X5 and Tander contributed to the results.

Nongshim is also expected to post second-quarter sales of 895.3 billion won (up 4.2%) and operating profit of 48.7 billion won (up 11.9%), reflecting the entry of Shin Ramyeon Tumba into distribution networks in the US, Japan, and China, as well as the impact of a price increase implemented in March.

Profitability Pressured by Weak Domestic Demand

However, most domestic food companies saw their first-quarter results deteriorate this year. Stagnant domestic demand, rising costs, and increased promotional expenses combined to erode profitability.

Ottogi's second-quarter operating profit is estimated at 58.6 billion won, down 4.8% year-on-year. Lotte Wellfood is expected to see a decrease of 25.7% to 46.6 billion won, while Binggrae's operating profit is projected to fall 14.7% to 38.3 billion won. Lee Kyungshin, a researcher at IM Investment & Securities, explained, "With the prolonged slowdown in domestic consumption and rising marketing costs, profitability has worsened. However, price adjustments for key products have helped defend performance to some extent."

CJ CheilJedang's consolidated second-quarter sales are projected to increase by 1.4% to 7.3311 trillion won, but operating profit is expected to decrease by 5.8% to 361.1 billion won. The food division, in particular, struggled. In the domestic market, weakened consumer sentiment, rising raw material prices, and expanded promotions led to deteriorating profitability. Overseas, intensified competition in the Americas slowed growth. Jung Hansol, a researcher at Daishin Securities, forecast, "In the second half of the year, gradual performance recovery is possible as domestic consumer sentiment improves and the normalization of the US dessert line takes full effect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.