Intraday High of $164.42 Per Share

Surpasses $3 Trillion Market Cap Again in Just One Year

Now 13.8 Times the Size of Samsung, Korea's Top Company

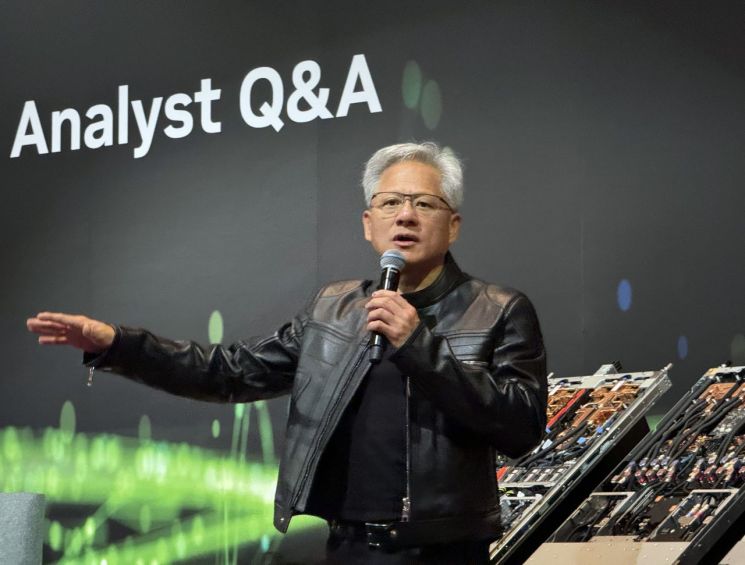

Jensen Huang, CEO of Nvidia, is answering questions from the press at the 'Global Media Q&A' event held on May 21 (local time) at the Mandarin Oriental Hotel in Taipei. Nvidia surpassed a market capitalization of 4 trillion dollars during trading on the 9th, becoming the first company worldwide to achieve this milestone. Photo by Yonhap News

Jensen Huang, CEO of Nvidia, is answering questions from the press at the 'Global Media Q&A' event held on May 21 (local time) at the Mandarin Oriental Hotel in Taipei. Nvidia surpassed a market capitalization of 4 trillion dollars during trading on the 9th, becoming the first company worldwide to achieve this milestone. Photo by Yonhap News

Nvidia, the most valuable company in the world, has crossed the "dream threshold" of a $4 trillion (approximately 5,500 trillion won) market capitalization. This milestone comes just one year after surpassing a $3 trillion market cap in June last year, when it overtook Apple to become the second most valuable company in the world. The $4 trillion figure is 13 times larger than Samsung Electronics, which is Korea's largest company by market capitalization ($290 billion).

On the 9th (local time), Nvidia closed at $162.88, up 1.8% from the previous trading day. Based on the closing price, its market capitalization was calculated at $3.972 trillion. During intraday trading, the stock price soared to $164.42, pushing the market cap past $4 trillion. This marks the first time in history that any company has surpassed a $4 trillion market cap, coming three and a half years after Apple crossed the $3 trillion mark during intraday trading in January 2022. Currently, this is 13.8 times the size of Samsung Electronics, Korea's largest company ($290 billion).

Under the leadership of CEO Jensen Huang, Nvidia has set a new milestone in the capital markets, reaching a $1 trillion market cap in June 2023 and then achieving $2 trillion in March last year, and $3 trillion in June of the same year. After overtaking Apple, which was in second place at the time, Nvidia began to rapidly close the gap with Microsoft (MS), the company with the highest market capitalization. As its size grew rapidly, Nvidia was added to the Dow 30 index, which tracks the performance of 30 leading blue-chip stocks, in November last year.

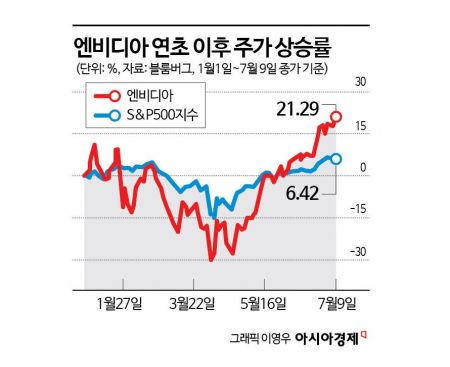

This year, the upward trend in Nvidia's stock price has been even steeper. Nvidia has emerged as the leading stock, spearheading the tech rally that followed the artificial intelligence (AI) boom. Since the beginning of the year, Nvidia's stock price has jumped by about 21%, outperforming the market return by more than 14 percentage points. Looking at a longer period, since early 2023, the stock has surged more than tenfold. According to Bloomberg, Nvidia's share of the market has also grown, now accounting for 7.5% of the S&P 500 index?an all-time high.

The recent surge in Nvidia's stock price is driven by strong demand for AI semiconductors from its clients. Major tech giants such as Microsoft, Meta, Amazon, and Google plan to invest $350 billion in capital expenditures in the coming fiscal year, which is $40 billion more than this year's $310 billion. With such strong potential demand, expectations for Nvidia continue to rise. In fact, these companies are reported to account for 40% of Nvidia's revenue. In particular, one of Nvidia's strategic product lines?AI graphics processing units (GPUs)?is considered essential for training large-scale AI models such as ChatGPT and Llama (LLAMA).

This is one of the reasons why Nvidia is regarded as one of Wall Street's "most beloved stocks." Brian Mulberry, portfolio manager at Zacks Investment Management, said, "The demand for Nvidia chips is clearly enormous," adding, "Nvidia chips are essential for AI to reach the next stage, and the sharp rebound in the stock price since April has brought renewed attention to this fact." This refers to Nvidia's V-shaped recovery after its stock hit a low in April due to the "DeepSeek shock" sparked by the emergence of Chinese AI startup DeepSeek and concerns over the US-China tech rivalry.

Despite already reaching all-time highs, some believe Nvidia still has further upside potential. Ken Mahoney, CEO of Mahoney Asset Management, told Bloomberg, "We will watch to see if Nvidia once again beats earnings expectations and raises its guidance," adding, "Given the rate of sales growth, it is hard to say the current stock price is expensive." According to Bloomberg, 90% of Wall Street analysts have given Nvidia a "buy" rating or equivalent, and the average price target has been raised by 6%.

Nvidia is not the only company benefiting from the tech rally. Microsoft, currently the second most valuable company ($3.74 trillion), and Apple, in third place ($3.15 trillion), are also expected to soon surpass the $4 trillion mark. As the market caps of the top companies have grown rapidly, the top seven stocks in the S&P 500, including Nvidia, now account for one-third of the index's total market capitalization. Reuters noted, "Currently, tech stocks make up about one-third of the S&P 500's market capitalization," adding, "This is similar to the level seen during the dot-com bubble in 2000."

Meanwhile, CEO Jensen Huang is reportedly preparing to launch AI chips specifically for the Chinese market. According to the UK Financial Times (FT), which cited sources on this day, the new China-specific chip will be a modified version of the existing Blackwell RTX Pro 6000 processor. In response to the strengthened US semiconductor sanctions against China under the Donald Trump administration, it is expected that this version will have advanced technologies such as high-bandwidth memory (HBM) and NVLink (an interconnection technology that increases data transfer speeds) removed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)