Four Major Financial Groups Hit Record Highs

KB Financial Surpasses 120,000 Won

Stock Prices Rally on Earnings and Shareholder Return Expectations

ETF Returns Also Soaring

Bank stocks are showing strong performance, with many reaching new all-time highs, and bank exchange-traded funds (ETFs) are also surging. Expectations for solid second-quarter earnings, as well as increased shareholder returns and policy momentum, are projected to support the continued strength of bank stocks for the time being.

According to the Korea Exchange on July 9, KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group, iM Financial Group, JB Financial Group, and Industrial Bank of Korea all recorded new all-time highs the previous day.

KB Financial Group closed at 122,000 won, up 6.64%, surpassing the 120,000 won mark for the first time ever. This is its highest price on record. Shinhan Financial Group ended the session at 71,100 won, up 7.73%. During the session, it climbed to 72,100 won, also setting a new all-time high. Hana Financial Group closed at 94,500 won, up 10.27%, reaching an intraday high of 95,000 won and setting a new record. Woori Financial Group also rose 8.32%, reaching an intraday high of 25,500 won, marking another all-time high.

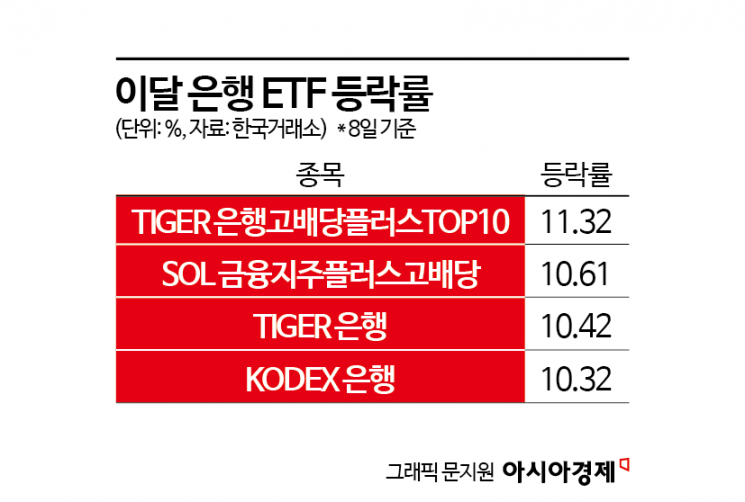

As bank stocks continue to rally, bank ETFs are also performing strongly. Since the beginning of this month, TIGER Bank High Dividend Plus TOP10 has risen 11.32%, SOL Financial Group Plus High Dividend is up 10.61%, TIGER Bank has gained 10.42%, and KODEX Bank has climbed 10.32%, ranking among the top ETF performers. In comparison, the KOSPI index rose only 1.41% during the same period.

Even as the overall stock market has shown sluggish movement recently, bank stocks have continued to stand out with strong gains. Solid second-quarter earnings, increased shareholder returns, and policy momentum are cited as key drivers. Choi Jungwook, a researcher at Hana Securities, said, "Last week, bank stocks rose 2.6%, outperforming the KOSPI, which fell 0.1%, and the strong trend in bank stock prices continued." He added, "Bank stocks remain attractive due to their relatively low price-to-book ratio (PBR), expectations for strong second-quarter earnings, and increased shareholder returns." He also noted, "The fact that U.S. financial stocks have reached new all-time highs, along with the global strength of financial stocks, is positively impacting investor sentiment."

With the second-quarter earnings season underway, expectations are rising for bank stocks to announce expanded shareholder return programs alongside their earnings reports. Choi commented, "The recent rally in U.S. bank stocks may be partly due to expectations for regulatory easing, such as the anticipated reduction of the supplementary leverage ratio (SLR), but in the medium to long term, the expansion of shareholder returns and the rise in PBR are moving in tandem." He continued, "For domestic bank stocks, further improvement in the common equity tier 1 (CET1) ratio is expected, and when second-quarter results are announced, the scale of share buybacks and cancellations is likely to exceed market expectations."

Kang Seunggeon, a researcher at KB Securities, also analyzed, "Although risk-weighted asset (RWA) growth is higher than in the first quarter, it is in line with the annual guideline, and considering the decline in the exchange rate, improvements in the CET1 ratio for financial holding companies are expected. This will have a positive impact on the share buyback and cancellation policies to be announced in the second half, alongside the second-quarter earnings reports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)