Financial Companies Expected to Provide 400 Billion Won for Bad Bank Establishment

Potential Conflict Between Bad Bank and Amended Commercial Act

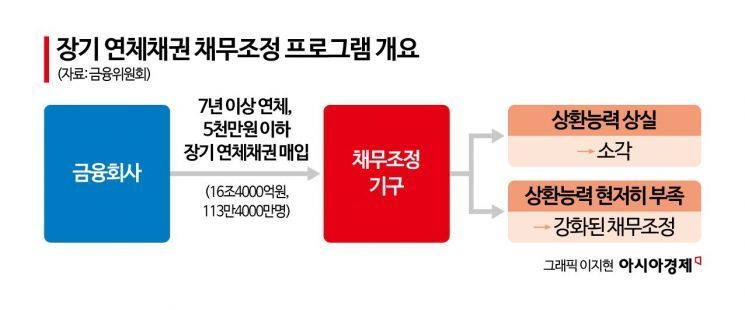

The government is currently discussing a plan to secure 400 billion won in financial sector support for its "Long-term Delinquent Debt Adjustment Program (Bad Bank)," which involves purchasing and writing off old debts held by vulnerable groups. The government is expected to announce specific details as early as the third quarter. However, there are concerns that if financial institutions provide large-scale funding to the bad bank, the recently amended Commercial Act, which expands the fiduciary duty of directors, could expose them to charges of breach of trust.

Financial companies expected to provide 400 billion won for bad bank establishment

According to the financial industry on July 8, the Financial Services Commission plans to raise about 400 billion won of the 800 billion won needed for the bad bank from the financial sector. Major commercial banks are expected to contribute a significant portion, with additional capital also anticipated from securities, insurance, savings banks, and specialized credit finance companies. This reflects calls for these institutions to contribute, as a large share of the delinquent loans to be purchased and written off by the bad bank are non-performing loans currently held by secondary financial institutions.

Industry sources expect the Financial Services Commission to finalize the program details and announce them during the third quarter, after which it will discuss concrete plans and implementation measures with financial companies. As several procedural steps are required, it is expected to take about one year for vulnerable borrowers to actually receive debt adjustment. An official from the Financial Services Commission explained, "We are currently discussing specific measures, but nothing has been finalized regarding the funding method or timeline."

However, as discussions on financial institutions' funding for the bad bank gain momentum, concerns have arisen about potential conflicts with the recently amended Commercial Act. On July 3, the National Assembly passed an amendment to the Commercial Act that expands the scope of directors' fiduciary duty. Previously, directors' fiduciary duty was limited to the company, but the amendment broadens this duty to include all shareholders. As a result, when making important management decisions, boards of directors must now consider not only the interests of the company or majority shareholders but also those of minority shareholders.

On July 3, the partial amendment to the Commercial Act was passed at the plenary session of the National Assembly. 2025.7.3 Photo by Kim Hyunmin

On July 3, the partial amendment to the Commercial Act was passed at the plenary session of the National Assembly. 2025.7.3 Photo by Kim Hyunmin

Potential conflict between bad bank and amended Commercial Act

Within the financial industry, there are concerns that the amended Commercial Act could conflict with financial support for the bad bank. While contributions to the bad bank are clearly meaningful from a social perspective, they could potentially harm the interests of the company, leading to controversy over directors' breach of trust. A financial industry official stated, "While it is understandable for banks to contribute for the public good, there are concerns about whether this truly benefits the overall interests of the company," adding, "Since the Commercial Act was amended, such concerns have been gradually emerging internally."

Conflicts between the public role of banks and current law have also arisen recently during the Fair Trade Commission's investigation into alleged collusion on loan-to-value (LTV) ratios among the four major banks (KB Kookmin, Shinhan, Hana, and Woori). LTV refers to the ratio of the loan amount to the value of the property. The Fair Trade Commission suspects that the banks shared information to set lower LTVs, thereby enabling higher loan amounts relative to collateral value. However, the banks countered that this was a routine risk management practice and that lowering the LTV actually reduces the maximum loan amount, leaving little incentive for collusion.

The financial authorities, who introduced LTV to ensure stable household debt management, are also uncomfortable with the Fair Trade Commission's investigation. They are concerned that the Commission's sanctions could undermine efforts to stabilize the financial market through LTV regulation. In May, former Financial Supervisory Service Governor Lee Bokhyun remarked, "Due to the nature of the financial industry, necessary financial stability measures can trigger concerns over competition restrictions, while measures to promote competition may in turn threaten financial stability and consumer rights."

In light of the recent Fair Trade Commission case, it is expected that financial authorities will exercise greater caution regarding how financial companies provide funding to the bad bank. A financial industry official commented, "Given the various controversies surrounding the government's establishment of the bad bank, I believe the government will engage in sufficient discussions with financial companies to come up with a reasonable solution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.