Multiple Homeowners Can Obtain Loans Without Selling Existing Properties

No Requirement for Actual Residence Within Six Months

Balloon Effect Also Seen During the September 13 Measures

Speculative Demand Concentrated on Trading Business Operator Loans

Although financial authorities have applied the same regulations to auction balance loans secured by auctioned properties as they do to household loans, this is expected to be insufficient to curb investment demand. If an individual registers as a real estate trading business operator, they can obtain loans without restrictions related to the number of homes owned or requirements for actual residence, leaving this as a regulatory blind spot. Experts pointed out that, in the past, failing to block auction balance loans through trading business operators led to a surge in speculative demand, highlighting the need for measures to prevent a "balloon effect" in the auction and public sale markets.

According to an Asia Economy report on July 4, financial authorities recently issued detailed guidelines to private financial institutions, instructing them to apply the same regulations to auction balance loans as to household loans. Under the June 27 loan regulations, financial institutions limit auction balance loans for homes in the Seoul metropolitan area and other regulated regions to a maximum of 600 million won. Borrowers are also required to move into the property within six months if they take out a loan. Those who already own one home must sell their existing property within six months. Individuals owning two or more homes are not eligible for loans.

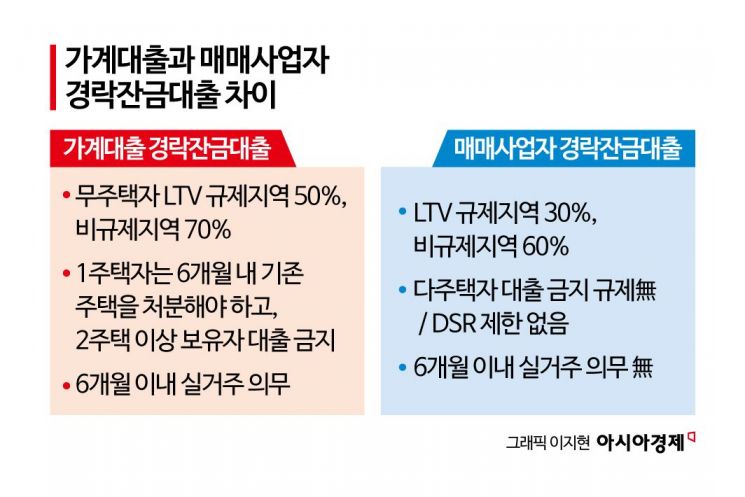

However, these rules apply only to household loans. Home purchase loans and auction balance loans for trading business operators, which are classified as business loans, can still be used under the previous conditions. Currently, when a trading business operator receives an auction balance loan, the loan-to-value (LTV) ratio is set at 30% in regulated areas and 60% in non-regulated areas. Since the borrower is a corporation, the debt service ratio (DSR) regulation does not apply. The 600 million won maximum loan cap for household loans is also not enforced. There are no requirements for actual residence or for disposing of existing properties.

A banking industry official explained, "Loans obtained by trading business operators are classified as business loans, so the new household loan regulations do not apply to them."

Multiple homeowners can obtain loans without selling existing properties... No requirement for actual residence within six months

For those who own multiple homes, registering as a trading business operator allows them to secure additional funds without having to sell their current properties. It is also possible to sell the auctioned property in a short period without residing in it.

For those without a home, it may be more advantageous in terms of securing funds to use household loans, which apply an LTV of 50% in regulated areas and 70% in non-regulated areas. However, if they wish to avoid the actual residence requirement, they can simply register as a trading business operator.

In fact, after the announcement of the new regulations, online communities have been sharing tips on how to circumvent the rules by utilizing trading business operator status. By obtaining a home purchase loan as a trading business operator, borrowers can avoid both the actual residence requirement and the ban on loans for owners of multiple homes. In the auction industry, trading business operator status has also been used as a tax-saving method for short-term profits. If a trading business operator acquires real estate at least once and sells it at least twice within a year, they are subject to the comprehensive income tax rate, which is generally lower than the capital gains tax rate.

Balloon effect also seen during the September 13 Measures... Speculative demand concentrated on trading business operator loans

Some critics argue that the current regulations are insufficient to block speculative funds from flowing into the auction and public sale markets. In particular, since corporate loans using trading business operator status remain a de facto "loophole," there are concerns that the balloon effect could continue in the auction market.

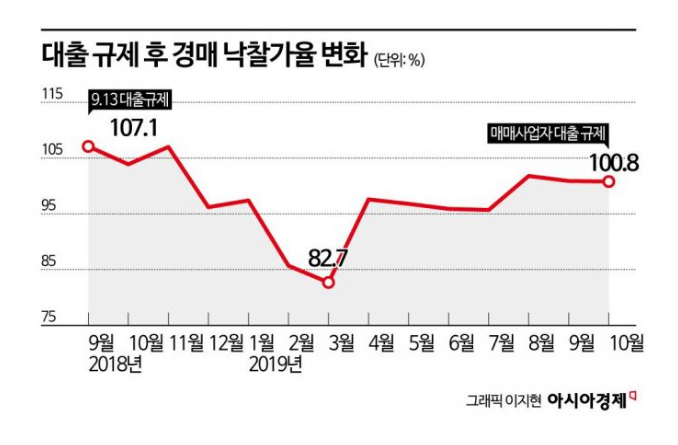

Indeed, when the government announced strong loan regulations in September 2018, investment demand shifted toward trading business operator loans. At that time, the auction success rate for Seoul apartments in September was 107.1%. After the regulations took effect, the rate temporarily dropped to 85.7% in February of the following year. However, it rebounded from March and surpassed 100% by August. An auction success rate above 100% means properties were auctioned off at prices higher than their appraised value.

Kang Eunhyun, head of the Myeongdo Auction Research Institute at Myeongdo Law Firm, explained, "Back in 2018, individual investors rushed to establish private corporations and used corporate loans as a workaround, creating an atmosphere where corporations dominated the Seoul metropolitan area apartment auction market."

As a result, the government regulated home mortgage loans for trading business operators in 2019 to prevent the spread of expedient loans. The LTV was limited to 40% in speculative and overheated speculation zones and 60% in adjustment target areas. The following year, all real estate transactions under the name of trading business operators were completely banned. Since 2023, some of these regulations have been eased, and the current standards remain in place.

Kang pointed out, "With the latest loan regulations, it has become virtually impossible to make normal auction investments using household loans. As a result, investors are likely to actively utilize trading business operator loans, which remain a regulatory blind spot."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.