Both Major Indices Rise Over 1% in Response to Commercial Act Amendment

"Upward Momentum Secured, KOSPI Expected to Reach 3,700"

"Beneficiary Stocks May See Corrections... Opportunity for Bargain Buying"

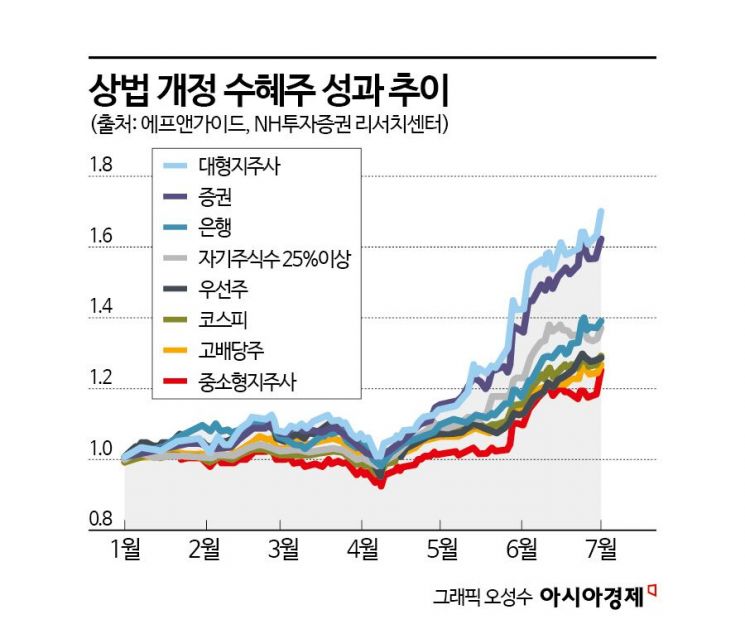

With the passage of the much-discussed Commercial Act amendment bill in the National Assembly, investor attention is now focused on how to respond strategically. Experts are advising that while stocks expected to benefit from the amendment may see short-term corrections, these should be viewed as opportunities for bargain buying.

According to the Korea Exchange on July 4, the KOSPI closed at 3,116.27 the previous day, up 41.21 points (1.34%). This rally was seen as a response to the passage of the Commercial Act amendment, the first major livelihood bill of the Lee Jaemyung administration. The KOSDAQ also joined the positive sentiment, rising by about 1.4%. Among the sectors expected to benefit from the amendment, the banking sector stood out the most, with 9 out of 10 stocks rising and the sector index up 1.56%. However, the holding company sector only managed a slight gain of 0.36% as profit-taking occurred, resulting in a modestly positive close.

The Commercial Act amendment passed the previous day mainly expands the fiduciary duty of corporate directors to include both the company and its shareholders, and limits the combined voting rights of the largest shareholder and related parties to 3% when appointing audit committee members. It also mandates electronic general shareholder meetings for listed companies and requires outside directors to be converted to independent directors. However, provisions for the introduction of cumulative voting and the expansion of separate elections for audit committee members were not included in this amendment.

The securities industry responded with mostly positive reviews. The news was welcomed as concerns about a market correction were growing due to fatigue from the KOSPI's rapid rise above the psychologically significant 3,000 level last month. Hana Securities Research Center commented, "Rather than dismissing the Commercial Act amendment as a one-off event, it should be seen as a major turning point that could mark the beginning of resolving the Korea discount (the undervaluation of the Korean stock market)," emphasizing the scenario of the KOSPI reaching 3,710.

Mirae Asset Securities Research Center also noted, "While the Commercial Act amendment may trigger short-term institutional changes in the market, in the long run it could lead to improvements in corporate governance and structural changes for Korean companies. If the high governance risk currently present in the Korean market is alleviated, the cost of equity (COE) could decrease, the intrinsic value per share could be reassessed, and this could result in higher share prices."

However, there remains a variable in that the passage of the Commercial Act amendment may have already been partially priced in, raising the possibility of a "sell-on-the-news" phenomenon (where stock prices fall despite positive news). The market had initially expected both the mandatory introduction of cumulative voting and the expansion of separate elections for audit committee members to be included in this amendment, but their exclusion may lead to mixed assessments regarding the amendment's effectiveness.

Kim Jongyoung, a researcher at NH Investment & Securities, commented, "There is a possibility that some of the initial expectations may be diluted." However, he added, "The mandatory introduction of cumulative voting still has legislative potential through future public hearings, and in addition to the Commercial Act, discussions are underway regarding improvements to tax laws and other regulations, such as dividend income tax, inheritance tax, and the mandatory cancellation of treasury shares. Therefore, any decline in the share prices of stocks related to the Commercial Act should be seen as a buying opportunity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.