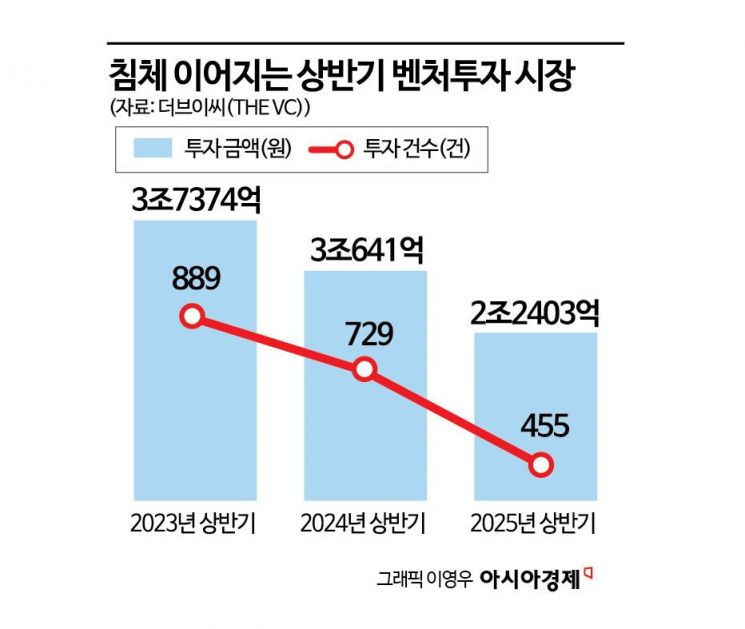

2.24 Trillion Won Invested in First Half, Down 26.9% Year-on-Year

AI, Bio, and Foreign Capital All Show Downward Trends

Industry Eyes on Government's Extra Budget and Policy Initiatives

The scale of domestic venture and startup investment in the first half of this year has seen a significant decline compared to the previous year. Even investment in artificial intelligence (AI) and biotechnology, which performed relatively well during last year's so-called "venture investment winter," has shown sluggish trends, heightening concerns over a tightening of funding for ventures and startups.

According to venture investment platform THE VC on July 3, investment in domestic startups and small and medium-sized enterprises in the first half of this year totaled 2.2403 trillion won, a decrease of 26.9% compared to the same period last year. The number of investment deals also dropped by 37.6%, recording 455 cases. Despite the Bank of Korea maintaining a policy of lowering the base interest rate and the government deciding to expand the budget for the Korea Fund of Funds, the resulting monetary and policy relief has not been clearly reflected in the market.

Even the bio-healthcare sector, which has recently been highly favored by investors, and the AI sector, considered a megatrend, have not escaped this trend. In the first half of the year, the number of investments in domestic AI venture startups was 77, a decrease of 36.9%, while the total investment amount fell by 44.1% to 309.9 billion won. Investment in the bio-healthcare sector, which accounts for the largest share among all invested companies, also declined by 21.9%.

THE VC analyzed, "The decrease in the number of investments in AI companies can be seen as an optical illusion, as the number had remained at a similar level to the boom years of 2021-2022 despite last year's venture investment downturn." However, the platform added, "The fact that the total investment amount has also decreased indicates that it has become more difficult for AI startups to attract investment."

The withdrawal of foreign investors has also become more pronounced. In the first quarter, foreign investors' investment amount showed a brief recovery, increasing by more than 20%, but for the first half of the year, it totaled 275.1 billion won, a decrease of 17.6% compared to the same period last year. The number of deals involving foreign investors also dropped by 18.3% to 76. In the short term, the rate of decline in foreign investment is relatively smaller compared to overall investment, but in the long term, the proportion of foreign capital in total investment continues to decrease. The share of investment by foreign investors dropped from 28.4% in 2021 to 12.4% in 2023, rebounded slightly to 14.1% last year, and then fell again to 12.3% in the first half of this year.

As the venture investment cold spell continues, the outlook for corporate funding conditions is also darkening. According to the 'Q2 Venture Business Survey Index (BSI)' recently released by the Korea Venture Business Association, the outlook for funding conditions in the third quarter was 96.3, down 0.7 points from the previous quarter. Notably, among the factors expected to improve business conditions in the third quarter, the proportion of respondents who said "funding conditions are smooth" dropped sharply from 40.8% in the previous quarter to 19.9%, suggesting that uncertainty in investment inflows is affecting sentiment even before it is reflected in actual business conditions.

In response to this situation, the government plans to revitalize the venture investment market through an extra budget. Last month, the Ministry of SMEs and Startups announced the second supplementary budget, which includes an additional 400 billion won investment in the Korea Fund of Funds. In addition, with the Lee Jaemyung administration pledging to expand the venture investment market to an annual scale of 40 trillion won, there is growing anticipation for strong policy support.

However, industry insiders point out that simply supplying more funds through the Korea Fund of Funds will not be enough to bring about an immediate recovery that is felt by the market. One venture industry official said, "Stabilizing the capital recovery market and restoring the trust of global investors must also take place in parallel for the venture investment ecosystem to regain its vitality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)