EOD Occurs in 7.59% of Overseas Real Estate Projects

Less Than 1% of Total Assets, Unlikely to Trigger Systemic Crisis

The value of overseas distressed real estate assets held by domestic financial institutions has reached nearly 2.6 trillion won. However, since these assets account for only a small proportion of the institutions' total assets, the likelihood of this leading to an immediate systemic crisis is considered low.

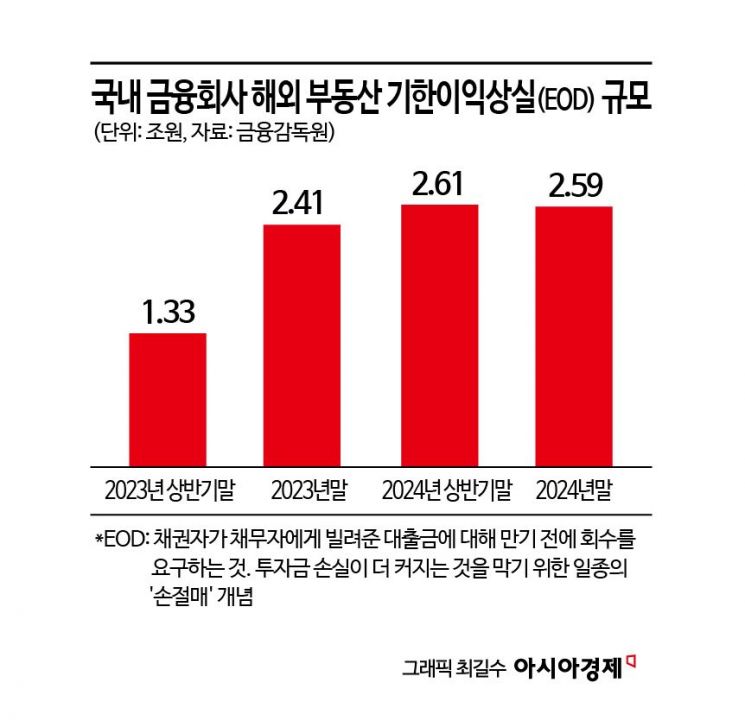

According to the "Status of Overseas Real Estate Alternative Investments by Financial Companies as of the End of December 2024," released by the Financial Supervisory Service on July 3, the total amount invested by domestic financial companies in individual overseas real estate projects as of the end of last year stood at approximately 34.1 trillion won. Of this, 2.59 trillion won, or 7.59%, had experienced an event of default (EOD).

An EOD refers to a situation in which a creditor demands repayment of a loan from a debtor before the maturity date. It is essentially a form of "stop-loss" to prevent further investment losses.

The scale of overseas real estate EODs for domestic financial companies increased from 1.33 trillion won at the end of the first half of 2023 to 2.59 trillion won at the end of last year, representing a rise of 1.26 trillion won in one and a half years. This increase is attributed to the significant contraction of the commercial real estate market, particularly in the United States, which has led to a rise in distressed overseas real estate investments by domestic financial firms.

A Financial Supervisory Service official stated, "While the overseas commercial real estate market has been showing signs of recovery since the COVID-19 pandemic, the pace of recovery remains slow due to concerns over economic slowdown and uncertainties in funding conditions. As overall profitability improvements in overseas real estate investments are being delayed, there is a possibility of further losses, especially for office buildings with high vacancy rates."

The total balance of overseas real estate alternative investments in the financial sector stood at 56 trillion won as of the end of last year, an increase of 200 billion won from the previous quarter. By sector, insurance accounted for 30.1 trillion won, or 53.8%; banks, 12.5 trillion won, or 22.3%; securities, 7.6 trillion won, or 13.6%; and mutual finance, 3.7 trillion won, or 6.5%.

By region, North America, including the United States, accounted for the largest share at 35 trillion won (62.5%). This was followed by Europe at 10.3 trillion won (18.4%) and Asia at 3.8 trillion won (6.9%). By maturity, assets maturing by 2030 totaled 39.7 trillion won, accounting for 70.9% of the total.

A Financial Supervisory Service official emphasized, "The scale of overseas real estate investments by domestic financial institutions is less than 1% of their total assets, so the impact of investment losses on the financial system is limited." The official added, "We will continue to guide thorough risk management and encourage appropriate loss recognition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.