The 1st Industry Forum Hosted by the National Assembly Futures Institute

BCG: "Excess Capacity for General-Purpose Products... Supply Must Be Reduced"

Calls for Accelerated Restructuring Ahead of Ulsan Shaheen Operation

Discussions on restructuring the petrochemical industry, centered on the consolidation of naphtha cracking center (NCC) facilities, are expected to gain momentum. There is growing concern that, once the S-Oil Shaheen Project begins full-scale operation in 2027, a surge of basic feedstocks such as ethylene and propylene will flood the market, drastically worsening the survival environment for the entire industry.

At the '1st National Assembly Future Industry Forum' held on the 2nd at the National Assembly Members' Office Building and hosted by the National Assembly Future Institute, discussions focused on the inevitability of consolidating facilities such as NCCs. The forum was attended by a large number of stakeholders, including lawmakers Kim Wonyi and Park Sungmin, the ruling and opposition secretaries of the National Assembly's Trade, Industry, Energy, SMEs and Startups Committee, as well as representatives from the Ministry of Trade, Industry and Energy, the Korea Institute for Industrial Economics and Trade, and the petrochemical industry.

Jihoon Kim, representative partner of Boston Consulting Group (BCG), who presented at the forum, stated, "The profitability of Korea's petrochemical industry has already fallen below the global average," emphasizing that "active collaboration among companies and government support for such collaboration are necessary." Kim pointed out, "Korea's export dependence exceeds 50%, and more than 70% of its production consists of general-purpose products such as ethylene, propylene, and polyethylene." He added, "Optimization should first be pursued through collaboration among NCC-based companies, and then, in the long term, collaboration with refiners should be promoted."

He cited Japan as a representative case of ongoing structural restructuring. Japan plans to reduce 2.4 million tons, equivalent to 36% of its total domestic ethylene facility capacity, by 2026-2028. To achieve this, it is integrating or shutting down aging crackers within major industrial complexes. Kim stated, "Japan has continuously carried out petrochemical structural restructuring for over 20 years and has achieved significant changes," adding, "Korean companies should also view this as the first phase of restructuring and lead the change."

Jihoon Kim, representative partner of Boston Consulting Group (BCG), is speaking at the '1st National Assembly Future Industry Forum' held on the 2nd at the National Assembly Members' Office Building, hosted by the National Assembly Future Institute. Photo by National Assembly Broadcasting System

Jihoon Kim, representative partner of Boston Consulting Group (BCG), is speaking at the '1st National Assembly Future Industry Forum' held on the 2nd at the National Assembly Members' Office Building, hosted by the National Assembly Future Institute. Photo by National Assembly Broadcasting System

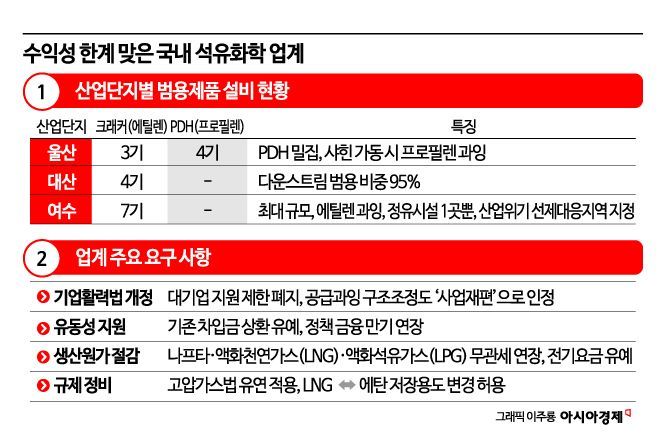

The sense of crisis in the industry is intensifying as the completion of the Ulsan Shaheen Project approaches. Once operational, this facility is expected to produce 1.8 million tons of ethylene, 770,000 tons of propylene, and 1.3 million tons of polyethylene annually starting in 2027. This is the largest single facility in Korea. Industry stakeholders unanimously agree that "once Shaheen begins operation, the supply-demand balance in existing industrial complexes such as Ulsan, Yeosu, and Daesan will collapse." In Ulsan, where propane dehydrogenation (PDH) facilities are concentrated, there will be an annual oversupply of more than 700,000 tons of propylene, making it difficult to avoid a deterioration in business profitability.

Policy recommendations from the industry have continued. Companies have called for revisions to the Corporate Revitalization Act so that restructuring aimed at resolving oversupply can also be recognized as 'business restructuring.' They have also insisted that practical financial and fiscal support must be provided in parallel, such as refinancing and maturity extensions from policy financial institutions, as well as subsidies, to cover the costs of facility relocation, dismantling, transportation, and investment required for restructuring. The Ministry of Trade, Industry and Energy plans to use this forum as an opportunity to resume discussions on follow-up measures to support restructuring in the petrochemical industry, which had been postponed due to the presidential election schedule and other factors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.