Banks to Cut Household Loans by 20 Trillion Won This Year, Raising Concerns Over Net Profit Decline

Banks Expected to Defend Profits by Raising Interest Rates and Expanding Corporate Loans

As the government has decided to significantly reduce the total amount of household loans available from all financial institutions in order to prevent overheating in the real estate market, concerns are emerging regarding banks' performance in the second half of the year. This is because a reduction in household loans, which account for half of banks' profits, will inevitably lead to a decrease in interest income in the latter half of the year. However, some market analysts believe that banks will defend their profits by raising lending rates or increasing corporate loans.

Banks to Cut Household Loans by 20 Trillion Won This Year, Raising Concerns Over Net Profit Decline

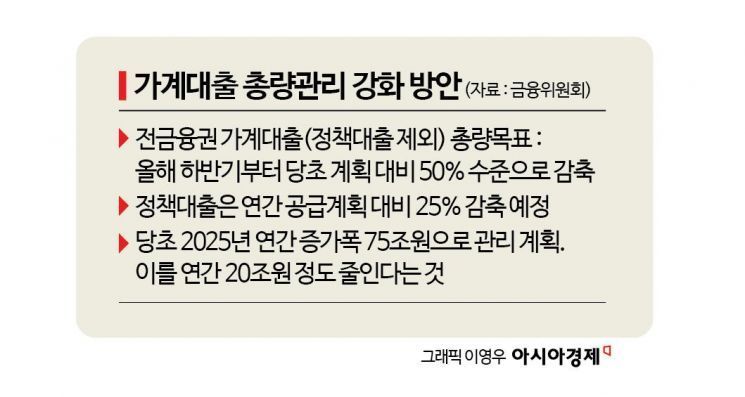

According to the financial sector on July 2, the government has decided to reduce the total household loan target for all financial institutions in the second half of this year to 50% of the original plan. Policy loans such as Didimdol and Bogeumjari Loans will also be reduced by 25% compared to the annual supply plan. If the government's plan proceeds as intended, the annual increase in household loans will decrease by up to 20 trillion won.

Shin Jinchang, Director General of Financial Policy at the Financial Services Commission, said at a meeting held on June 27, "Currently, the size of household loans in the financial sector is about 1,800 trillion won. The government initially planned to manage the annual increase at around 75 trillion won, considering the real growth rate of 3-4%. However, the nominal growth rate forecast has dropped by 1 percentage point, and with the total loan target reduced to 50%, the annual increase is expected to decrease by 20 trillion won."

This latest measure by the government is expected to lower the annual growth rate of household loans in the banking sector from the previous 4% range to the 3% range, a drop of about 0.5 to 1 percentage point. Household loans are a core business accounting for half of banks' profits, so a decline in growth rate increases the likelihood of a decrease in net profit in the second half of this year. In particular, internet banks such as KakaoBank, where more than 90% of loan assets are household loans, are expected to be heavily impacted by the government's measure.

Banks, now on high alert, are effectively in the process of establishing new management strategies for the second half of the year. An official at a major commercial bank explained, "Since we have to reduce household loans in accordance with government policy, revising our management strategy is inevitable," adding, "We are considering various measures to avoid a decline in performance."

Banks Expected to Defend Profits by Raising Interest Rates and Expanding Corporate Loans

The market expects banks to consider various alternatives, such as raising lending rates or increasing the proportion of corporate loans. In fact, after the government announced its policy to curb household loans, major commercial banks began raising interest rates on mortgage loans.

On the previous day, Woori Bank set the interest rate for periodic mortgages, which change every five years, at 3.57-4.77% per annum. This is 0.06 percentage points higher than the previous day, June 30 (3.51-4.71% per annum). Although the benchmark rate fell, the bank raised the spread, resulting in higher mortgage rates. Shinhan Bank also raised its floating-rate mortgage, which is linked to the new balance COFIX and changes every six months, from 3.54-4.95% per annum to 3.62-5.03% per annum over the same period. Hana Bank also increased the minimum rate on its mortgage refinancing product from 3.73% to 3.83% per annum, a rise of 0.1 percentage points, by raising the spread. These rate hikes are seen as a strategy both to curb the recent surge in mortgage applications and to defend profits.

Expansion of corporate loans is also expected. Banks previously defended their total loan growth and profits by increasing corporate loans in 2022 and 2023, when household loan growth was sluggish due to lending regulations. Jung Junseop, a researcher at NH Investment & Securities, analyzed, "The reduced capacity for household loan growth can be offset by an increase in corporate loans," adding, "Since major commercial banks have a roughly equal proportion of household and corporate loan assets, achieving annual loan growth targets should not be a significant challenge."

However, if household debt continues to be problematic and is not effectively curbed despite the government's latest measures, there is a possibility that the government may introduce additional regulations, such as adjusting the risk weight for mortgage loans, which would be a burden for banks. If the lower limit of the risk weight for mortgage loans is raised, banks will be forced to increase loans more conservatively in order to maintain their capital ratios. Expanding the scope of the debt service ratio (DSR) to include policy loans or Jeonse loans as a way to curb lending is also being discussed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)