"Policy Loans Excluded from Lending Limit Regulations, but Not Driving Household Debt"

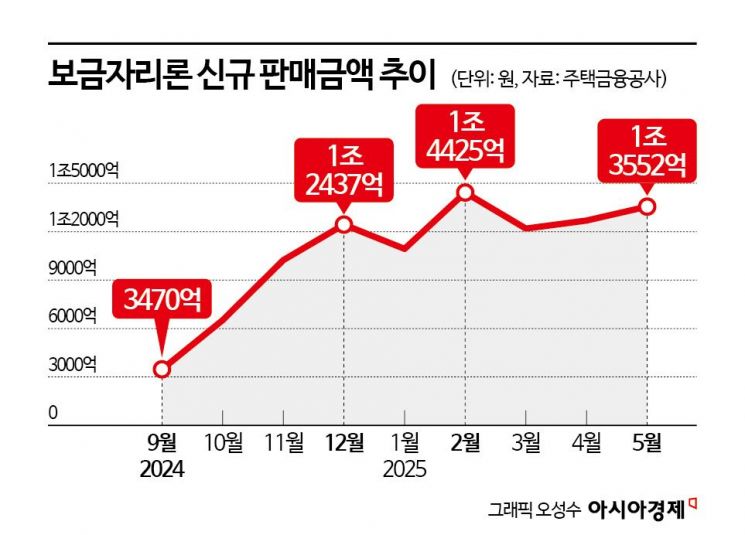

Over 1 Trillion Won for 7 Consecutive Months... 3 Months of Continuous Growth

Potential for Even Greater Demand Concentration

The new sales volume of the policy mortgage loan “Bogeumjari Loan” has exceeded 1 trillion won for seven consecutive months. As the housing market in the Seoul metropolitan area has overheated again, sales have also increased for three consecutive months. While the government is implementing strict lending regulations to curb housing prices in the metropolitan area, there are projections that demand for Bogeumjari Loan could increase further, as it has been excluded from the latest round of loan limit reductions.

According to the Korea Housing Finance Corporation on July 1, the cumulative sales volume of Bogeumjari Loan from January to May this year reached 6.379 trillion won. This is close to last year’s annual total of 6.5887 trillion won. Considering that the monthly increase has exceeded 1 trillion won every month this year, it is estimated that the first-half results have already surpassed last year’s annual performance.

Bogeumjari Loan is a long-term, fixed-rate, amortized mortgage product supplied by the Korea Housing Finance Corporation. After the highly popular Special Bogeumjari Loan, which was launched in 2023, ended its sales, the Bogeumjari Loan was relaunched at the end of January last year with adjusted support requirements.

Until September last year, monthly sales remained at around 300 billion won and did not attract much attention. However, demand began to surge sharply in the second half of the year as financial authorities started managing the total volume of household loans. In October last year, new sales of Bogeumjari Loan reached 651.5 billion won, nearly doubling in just one month. Since then, the monthly increase has remained above 1 trillion won for seven consecutive months.

This year, Bogeumjari Loan has shown a similar trend to bank mortgage loans. Although there was a brief slowdown in March, the monthly new sales were 1.2191 trillion won in March, 1.2689 trillion won in April, and 1.3552 trillion won in May, marking a three-month consecutive increase. As housing transactions have increased, bank mortgage loans have also steadily risen since April. Bank mortgage loans grew to 6.7 trillion won last month, marking the largest increase in ten months.

Within the financial sector, there is an expectation that demand for Bogeumjari Loan will rise further in the second half of the year. This is because, while the government’s “June 27 Household Debt Management Measures” unusually reduced the loan limits for other policy loans such as Didimdol Loan and Bogeummok Loan, Bogeumjari Loan was excluded from these restrictions. However, financial authorities explain that Bogeumjari Loan does not account for a large enough share to drive overall household lending.

The fact that Bogeumjari Loan is also exempt from the “stress DSR (Debt Service Ratio)” regulation could further accelerate the concentration of demand. While bank mortgage loans are subject to the three-stage DSR regulation, which reduces loan limits, policy loans are not subject to DSR rules. In this case, bank mortgage lending could contract further, while demand may shift to policy loans, especially Bogeumjari Loan, which has maintained its loan limit. Contrary to the government’s intentions, there is a possibility of a “balloon effect,” where demand shifts rather than decreases.

However, Bogeumjari Loan is still subject to total volume regulation. The government has decided to reduce the annual supply plan for policy loans by 25%. Given that the target supply for policy finance products such as Bogeumjari Loan by the Korea Housing Finance Corporation is 23 trillion won this year, the supply is expected to be reduced to about 17 trillion won. A financial industry official said, “Although it has not yet been decided exactly how the total volume will be managed, it is possible that sales could be suspended once the supply limit is reached.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)