K-batteries Gain Ground in North America with "De-China" Policy

European Market Share Halved in Four Years Due to Chinese Competition

The fortunes of K-batteries are diverging on the global stage. In the United States, their market share has surged, buoyed by an anti-China stance, while in Europe, their position has rapidly weakened due to aggressive low-price competition from Chinese companies. As the polarization of battery ecosystems by region intensifies, diversifying supply chains and strengthening technological competitiveness have emerged as key factors for a turnaround in K-batteries.

According to an analysis by Samil PwC Management Research Institute on July 1, the market share of Korean battery companies in North America, which stood at 26.7% in 2021, rose to 54% in the first quarter of this year.

The relative success of Korean companies in North America is underpinned by a "de-China" policy. Following the Inflation Reduction Act (IRA), the Trump administration further strengthened restrictions on the entry of Chinese-made batteries and materials into North America through measures such as the "One Big Beautiful Bill (OBBB)."

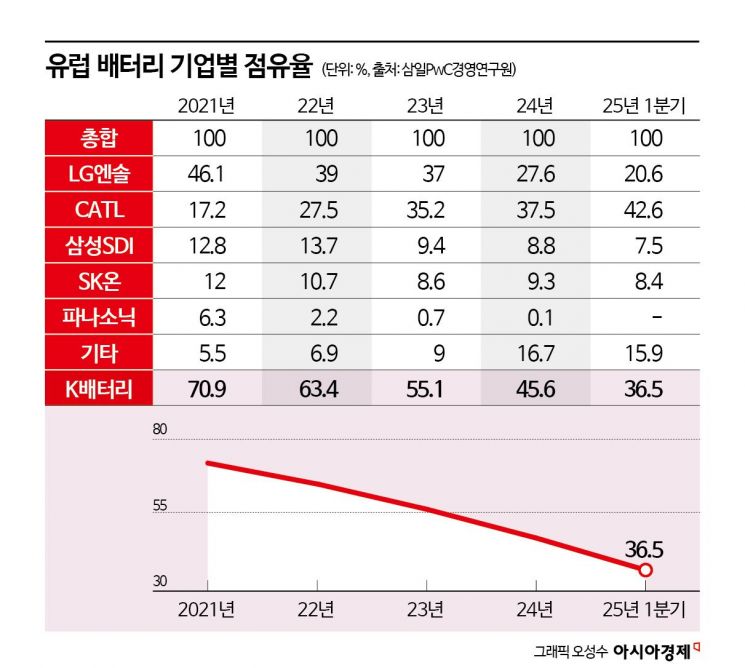

In contrast, in Europe, market share, which reached 70.9% in 2021, has steadily declined, dropping to 36.5% in the first quarter of this year?effectively halving. By company, LG Energy Solution, which was the top player in the European battery market in 2021 with a 46.1% share, ceded its position to China's Contemporary Amperex Technology (CATL) starting last year. Both Samsung SDI and SK On have also seen their European market shares fall to single digits since 2023, struggling to regain momentum.

This is largely because European automakers consider China a major export market and show a clear preference for low-cost Chinese batteries to reduce costs.

Nevertheless, the European market remains a crucial battleground that Korean companies cannot afford to abandon. As European countries accelerate the adoption of electric vehicles and the expansion of renewable energy in line with carbon neutrality goals, battery demand is rising rapidly. In particular, the energy storage system (ESS) market is showing marked growth. According to the European Association for Storage of Energy, new battery installation capacity in Europe reached about 5 gigawatts (GW) in 2022, and cumulative installed capacity is projected to reach 57 GW by 2030.

The industry is seeking a turnaround based on technological strength and supply chain strategies. LG Energy Solution recently signed contracts with Mercedes-Benz for 46-series products and with Renault for lithium iron phosphate (LFP) batteries, making inroads into the European market. Samsung SDI has also signed a supply contract for ESS-dedicated batteries with Tesvolt, Europe's largest commercial ESS manufacturer, pursuing a profitability-focused strategic response.

Kim Seungcheol, Senior Research Fellow at Samil PwC Management Research Institute, stated, "Chinese batteries are rapidly capturing the European market with price competitiveness," but added, "Europe also regards secondary batteries as a strategic asset and is wary of unilateral dependence on the Chinese supply chain." He advised, "Especially as the expansion of renewable energy is expected to drive a surge in ESS demand, Korean companies should seize this as an opportunity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)