On June 30, Mirae Asset Securities announced that it has expanded the application of its self-developed robo-advisor service beyond individual and retirement pensions to include brokerage-type Individual Savings Accounts (ISAs), general stock accounts, and tax-free comprehensive savings accounts.

With this measure, more customers are expected to utilize AI-based asset management services across a broader range of everyday investment activities. Mirae Asset Securities emphasized that this expansion is significant not only because it adds new account types, but also because it greatly enhances the universality and accessibility of AI-driven asset management.

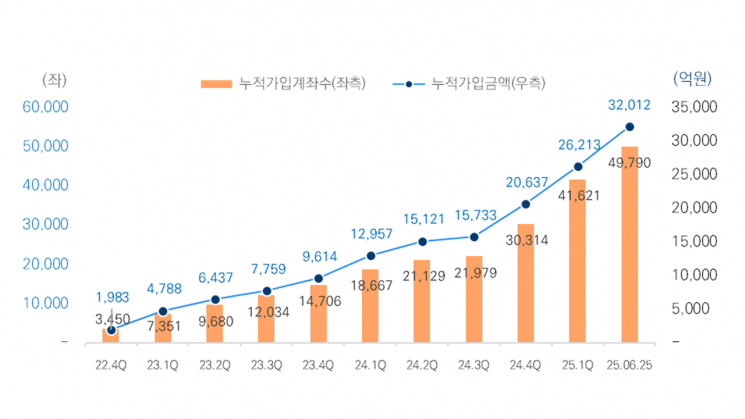

The robo-advisor is a non-face-to-face asset management service in which AI analyzes investors' risk profiles, market conditions, and account status in real time to propose optimal portfolios. Mirae Asset Securities first introduced the robo-advisor service to retirement pensions in September 2022, and expanded its application to individual pensions in November 2024. As a result, as of June 25, 2025, the number of subscribers has grown to approximately 50,000, with assets under management reaching 3.2 trillion KRW.

The Mirae Asset Securities robo-advisor service can be accessed through the company's mobile app (M-STOCK). There is no additional service fee for using the robo-advisor, aside from the management fees and commissions charged for individual investment products.

A representative from Mirae Asset Securities stated, "Any Mirae Asset Securities customer can receive highly personalized, AI-driven asset management services through the robo-advisor on M-STOCK," adding, "We will continue to enhance the service to better manage our customers' investment returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)