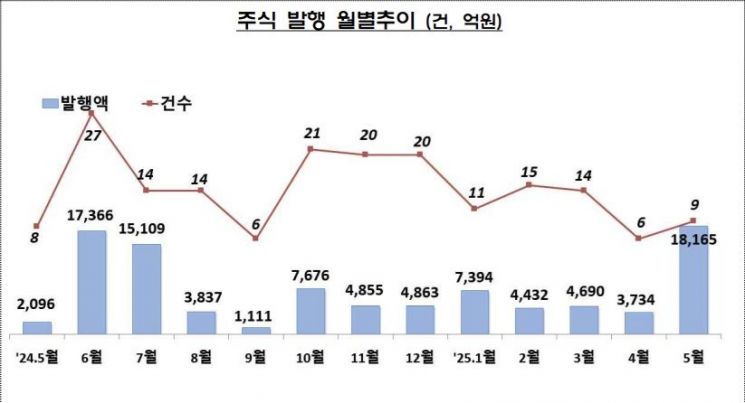

Stocks Issued: 1.8 Trillion Won, Up 387% from Previous Month

Corporate Bonds Issued: 19 Trillion Won, Down 36% from Previous Month

In May of this year, the total amount of funds raised by companies through the issuance of stocks and corporate bonds decreased by more than 30% compared to the previous month. Stock issuance saw a significant increase due to Samsung SDI's large-scale paid-in capital increase. However, corporate bond issuance declined, which is attributed to a base effect following the surge in preemptive issuances in April caused by uncertainty over U.S. tariffs.

According to the "Direct Financing Performance of Companies in May 2025" released by the Financial Supervisory Service on the 30th, the total amount raised by companies through the issuance of stocks and corporate bonds in May 2025 was 21.323 trillion won. This represents a decrease of 30.8% (9.4789 trillion won) compared to the previous month’s 30.8019 trillion won.

The amount raised through stock issuance was 1.8165 trillion won, a sharp increase of 386.5% from the previous month's 373.4 billion won. Paid-in capital increases totaled 1.6771 trillion won, up 493.6%. This surge was driven by Samsung SDI’s paid-in capital increase of 1.6549 trillion won for the acquisition of another company. There were a total of six initial public offerings (IPOs), raising 139.4 billion won, an increase of 45.8 billion won (53.4%) from the previous month.

In contrast, corporate bond issuance amounted to 19.5065 trillion won, a steep decline of 35.9% from the previous month's 30.4285 trillion won. Issuance of ordinary corporate bonds was only 2.15 trillion won, a decrease of 75.8%. This is analyzed as a base effect, as demand for preemptive funding surged in April due to U.S. tariff risks.

Among the uses of corporate bond funds, the proportion for refinancing increased to 89.8%, up from 86.9% the previous month. In contrast, the proportion for operating funds decreased to 5.6%, down from 12.6%. The share of corporate bonds rated AA or higher rose from 70.8% to 72.1%, while the share of BBB-rated bonds increased from 1.1% to 8.8%. However, the proportion of A-rated bond issuances fell from 28.0% to 19.1%.

By type, financial bond issuance comprised 213 cases totaling 15.1344 trillion won, a decrease of 4.8318 trillion won (24.2%) from the previous month’s 269 cases and 19.9662 trillion won. By category, financial holding company bonds totaled 7 cases and 1.08 trillion won, up 130 billion won (13.7%) from the previous month. Bank bonds totaled 29 cases and 4.7644 trillion won, a decrease of 3.0208 trillion won (38.8%). Other financial bonds accounted for 177 cases and 9.29 trillion won, down 1.941 trillion won (17.3%).

The issuance of asset-backed securities (ABS) was 41 cases and 2.2221 trillion won, an increase of 642.8 billion won (40.7%) from the previous month’s 1.5793 trillion won. Among these, primary collateralized bond obligations (P-CBOs) for supporting small and medium-sized enterprises totaled 12 cases and 992.1 billion won, a sharp increase of 654.1 billion won (193.5%) compared to the previous month’s 6 cases and 338 billion won.

By type of asset holder, financial companies issued 2.1111 trillion won, an increase of 1.2898 trillion won (157.0%) from the previous month. General companies issued only 111 billion won, a decrease of 647 billion won (85.4%).

The total issuance of commercial paper (CP) and short-term bonds in May was 130.9998 trillion won, down 6.2% (8.6687 trillion won) from the previous month. CP issuance was 43.7818 trillion won, and short-term bonds were 87.218 trillion won, representing decreases of 4.8% and 6.9%, respectively, compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.