Average Daily Increase Reaches 289 Billion Won, the Largest Since Last August

Total Household Loan Growth in June Could Approach 6 to 7 Trillion Won Across All Financial Institutions

It has been found that household loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) increased by approximately 5 trillion won in June. This surge is attributed to a spike in last-minute borrowing demand ahead of the implementation of the third phase of the Debt Service Ratio (DSR) regulations, as well as the delayed impact of the temporary suspension of the Land Transaction Permit System (Togeje). Although financial authorities have recently taken measures to curb the trend, household loan growth is expected to continue through July and August, especially as real estate prices in the Seoul metropolitan area have soared before and after the presidential election.

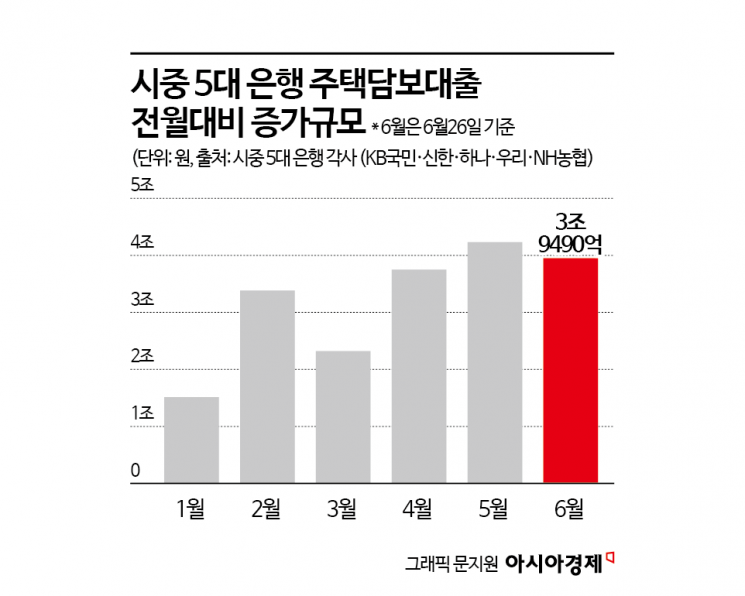

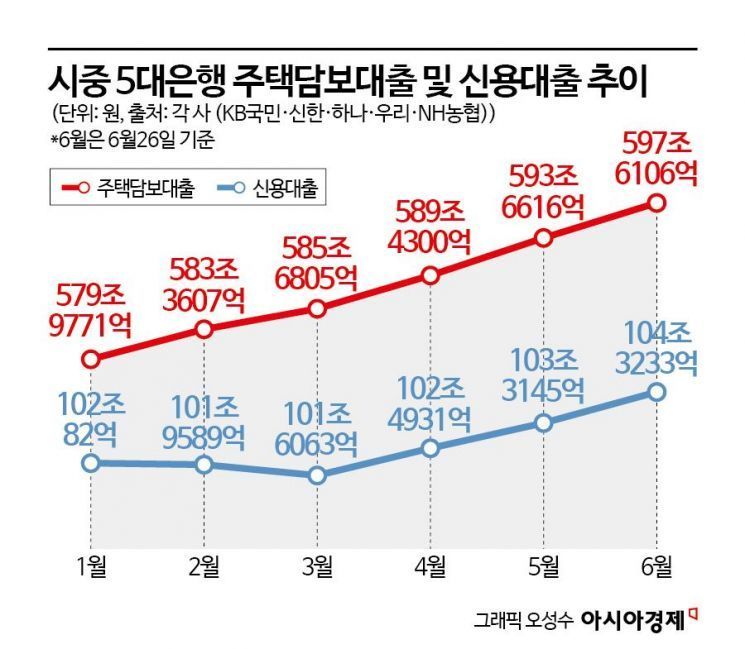

According to the financial sector on June 30, as of June 26, the outstanding household loans at the five major banks stood at 752.9948 trillion won. This represents an increase of 4.9136 trillion won from the previous month's 748.0812 trillion won, marking the fifth consecutive month of growth. On a business day basis, this is an average daily increase of about 289 billion won, the highest since August last year when the daily average reached 310 billion won. If this trend continues, the increase is expected to surpass 5 trillion won by the end of June. When including all financial institutions beyond the five major banks, some predict that the total increase in household loans this month could well exceed 6 trillion won.

The main driver behind the rise in household loans was mortgage loans. Mortgage loans reached 597.6106 trillion won, up 3.949 trillion won from the previous month. Credit loans also increased by 1.0088 trillion won during the same period, bringing the total to 104.3233 trillion won. The average daily increase in credit loans was 38.8 billion won, about 1.5 times higher than the previous month's 26.5 billion won. Industry insiders believe that the increase in credit loans was influenced not only by the so-called 'Yeongkkeul' (maxing out all available resources) demand but also by the bullish stock market.

The implementation of the third phase of the DSR in July is seen as a key factor behind the roughly 5 trillion won increase in household loans at the five major banks in June. Starting July 1, the third phase of the DSR will apply a stress rate of 1.50 percentage points in the Seoul metropolitan area. For example, the maximum mortgage loan limit for a salaried worker with an annual income of 100 million won will decrease by about 20 to 30 million won compared to the previous limit. Additionally, the impact of the temporary suspension of the Land Transaction Permit System, which led to a brief surge in home transactions in February and March, appears to have continued to affect household loan balances through this month.

As last-minute borrowing demand surged, financial authorities and banks scrambled to respond, including suspending mortgage loan applications through loan brokers. Hana Bank has set new limits on new business handled by each loan brokerage firm since June 26. Nonghyup Bank and Shinhan Bank have also suspended mortgage loan applications through brokers until July, as their limits have already been exhausted. SC First Bank, which saw a significant increase in household loans, shortened the maximum mortgage loan term from 50 years to 30 years, while Nonghyup Bank has tightened preferential interest rate conditions and strengthened household loan management.

Although the government announced a set of strong measures to reinforce household debt management on June 27, most expect the growth in household loans to continue at least through August. This is because loans that have already been applied for and approved are executed with a time lag of one to three months, and a considerable number of home transactions finalized this month to avoid the third phase of the DSR will be included in future loan figures.

An industry official from one of the banks stated, "The increase in household loans in June appears to be due to the delayed impact of the temporary suspension of the Land Transaction Permit System in March, as well as a rush of last-minute borrowing ahead of the implementation of the third phase of the DSR. The recent boom in the real estate market is also expected to continue affecting household loan balances through August and September."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.