5% Price Increase for White Cardboard in Southeast Asia

10% Hike in Thermal Paper Prices Across All Overseas Markets

Global Surge in Ocean Freight and Energy Costs

Hansol Paper, the top company in the domestic industry, is set to raise export prices across its main product lines, white cardboard and thermal paper. This measure comes in response to the recent sharp increases in global ocean freight rates and energy costs. Both within and outside the industry, there are growing expectations that this price adjustment could have an impact on the overall domestic market as well.

Thick stacks of white cardboard paper are piled up in the automated warehouse of Hansol Paper Daejeon Plant.

Thick stacks of white cardboard paper are piled up in the automated warehouse of Hansol Paper Daejeon Plant.

According to industry sources on June 27, Hansol Paper recently decided to increase the selling price of white cardboard in Southeast Asia by 5%. White cardboard is a thick, white-coated paper known for its strength and durability, commonly used as packaging material for food, cosmetics, and electronic products. The increased price will be applied to new orders starting August 1.

The price of POS thermal paper sold to all overseas clients will also be raised by 10%. POS thermal paper is a specially coated paper that reacts to heat to display text or images, and is used for paper receipts, movie tickets, and delivery invoices. The price increase will apply to shipments dispatched from July 28. A Hansol Paper representative stated, "Detailed plans regarding the price increase will be individually communicated to each client."

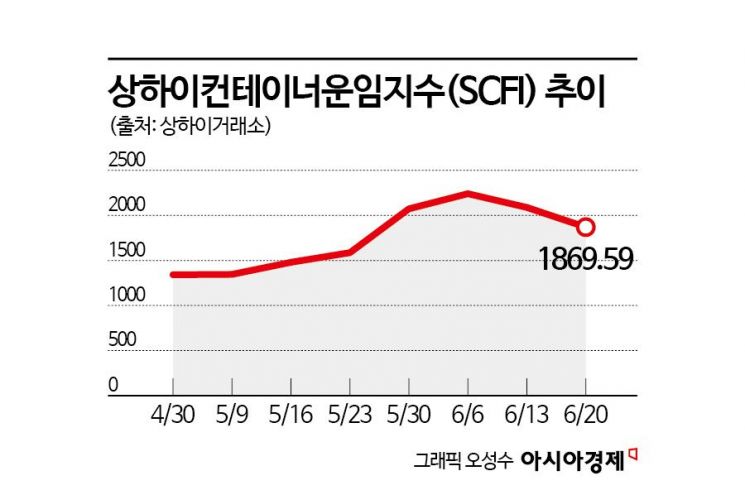

The main reasons for the price increase are the recent surges in global ocean freight rates and energy costs. Uncertainties stemming from tariff risks originating in the United States, as well as the closure of the Strait of Hormuz triggered by the Iran-Israel conflict, are both driving up prices in the transportation and energy markets. The Shanghai Containerized Freight Index (SCFI), which reflects spot rates on 15 routes in the Shanghai export container shipping market, soared to 2,240.35 on June 6 after the U.S. decided in May to sharply reduce tariffs on Chinese products from 145% to 30% (with a 90-day grace period). During this period, global exporters rushed to ship large volumes, causing prices to spike.

There are also predictions that this price increase could affect the entire domestic paper market. In 2021, when paper demand rebounded sharply after COVID-19 and ocean freight rates rose, major domestic paper companies such as Hansol Paper and Moorim Paper simultaneously raised printing paper prices. Given that increases in supply chain costs have repeatedly led to price hikes for key product lines at major domestic paper companies, there is a possibility that other companies, such as Moorim Paper, may also raise their export prices this time. If the export price increases lead to supply and demand imbalances for specific paper types both domestically and internationally, this could result in a temporary rise in unit prices.

An industry official explained, "If the overall supply chain burden intensifies, other domestic paper companies may also follow suit and raise their prices. As export unit prices climb, a distribution structure focused more on exports than on domestic sales may form, which could affect domestic supply volumes and temporarily impact domestic market prices as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)