Survey of 186 Chicken, Coffee, and Burger Franchise Stores

48.8% of Sales Generated Through Delivery Platforms

Platform Commission Fees Average 10.8% of Operating Costs

Seoul City to Develop 'Win-Win Index' for Structural Improvement

Nearly half of franchise store sales are generated through delivery platforms. In particular, for some stores, online platform commission fees account for as much as 20% of operating costs. When considering additional expenses such as packaging container costs, franchisees are left with virtually no profit.

On June 26, Seoul City analyzed the sales of 186 franchise stores specializing in chicken, coffee, and hamburgers, and found that 48.8% of sales were generated through delivery platforms, accounting for nearly half of total sales. While online platforms such as delivery apps have been praised for boosting small business sales and enhancing consumer convenience, they have also been criticized for high commission fees and an unfair cost burden structure, making them a double-edged sword.

Examining the sales structure of franchise stores, sales through 'delivery platforms' accounted for the largest share at 48.8%, followed by 'in-store' sales at 43.3% and 'mobile gift certificates' at 7.9%. When combining sales from delivery platforms and mobile gift certificates, the total exceeds half at 56.7%, highlighting franchisees' heavy reliance on online platforms.

On the other hand, as of October last year, sales through delivery platforms were dominated by Baemin1 (42.6%) and Coupang Eats (42.1%). Both platforms showed a significant increase compared to October 2023, when their shares were 31.7% and 26.2%, respectively.

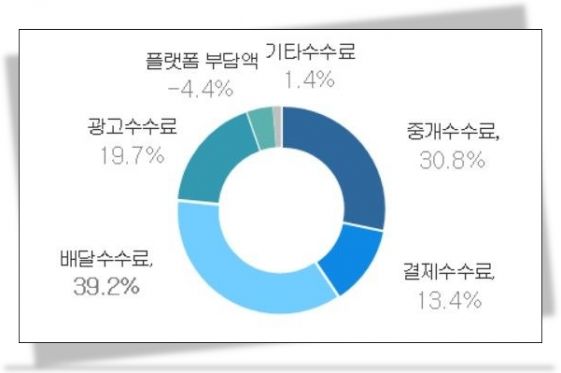

The increase in delivery platform sales has led directly to a heavier commission burden. As of October last year, commission fees accounted for 24.0% of delivery platform sales, up 6.9 percentage points from 17.1% in October 2023. Platform commission fees consist of delivery fees (39.2%), brokerage fees (30.8%), and advertising fees (19.7%). Recently, intensified competition for top exposure within delivery apps has driven up advertising costs, adding to the burden on franchise owners. Although the Fair Trade Commission and delivery platforms formed a win-win consultative body last November and reached an agreement to lower brokerage fees, the burden of delivery and advertising fees remains high.

Online platform commission fees also accounted for 10.8% of total operating costs. In the chicken sector, platform commission fees were 17.5%, exceeding labor costs at 15.2%. On average, material costs made up the largest portion of operating costs at 49.5%, followed by labor costs at 17.6% and platform commission fees at 10.8%. The average operating profit margin for franchise stores was 8.7%, with coffee at 9.5%, hamburgers at 9.4%, and chicken at 6.5%. The chicken sector, which faces the highest platform commission burden, recorded the lowest profit margin. Since this analysis excludes owner labor costs, the actual perceived profit may be even lower.

The average commission rate for mobile gift certificates, which have seen increased use for gifting, was 7.2%. Nearly half of franchise owners (42.5%) bear the entire commission fee themselves. At the end of last year, the mobile gift certificate consultative body (Fair Trade Commission, platform companies, and participating businesses) announced the introduction of a 'preferential commission system' for Kakao Gift. Under this system, if the franchisee's commission burden exceeds 3.0%, the excess above 3.0% is shared by Kakao and the franchise headquarters. However, this system only applies when the franchise headquarters and franchisee split the commission 50:50.

Seoul City stated that the preferential commission system cannot be effective when one out of two franchisees bears the full commission fee, emphasizing the urgent need for active discussions on commission sharing between franchise headquarters and franchisees. To address this, the city plans to develop a 'Delivery Platform Win-Win Index' in the second half of this year to monitor commission structures and transactions on delivery platforms. The 'Win-Win Index' will be composed of objective numerical data and franchisee feedback, and will use stage-specific indices where unfairness is a concern to encourage voluntary improvement by platforms.

Policies to ease the commission burden of mobile gift certificates will also be promoted. Incentives will be provided to franchise headquarters that split commissions 50:50 with franchisees, and measures to enhance the effectiveness of the preferential commission system will be discussed with the Fair Trade Commission. Kim Myungseon, Director of Fair Economy at Seoul City, said, "Online platforms such as delivery and mobile gift certificates help boost sales for small businesses, but also pose a structural problem of excessive commission burdens. We will establish fair and sustainable win-win policies based on data-driven surveys and actively support franchisees' management stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.