Kakao Pay General Insurance Enters the Long-term Health Insurance Market

Hana General Insurance Shifts Focus to Face-to-face Sales

Carrot General Insurance to Be Merged into Hanwha General Insurance

Digital insurance companies, which have been struggling with chronic losses, are now making sweeping efforts to overhaul their business models. They are striving to improve their performance by moving away from short-term, small-amount products, introducing long-term insurance, and strengthening face-to-face sales.

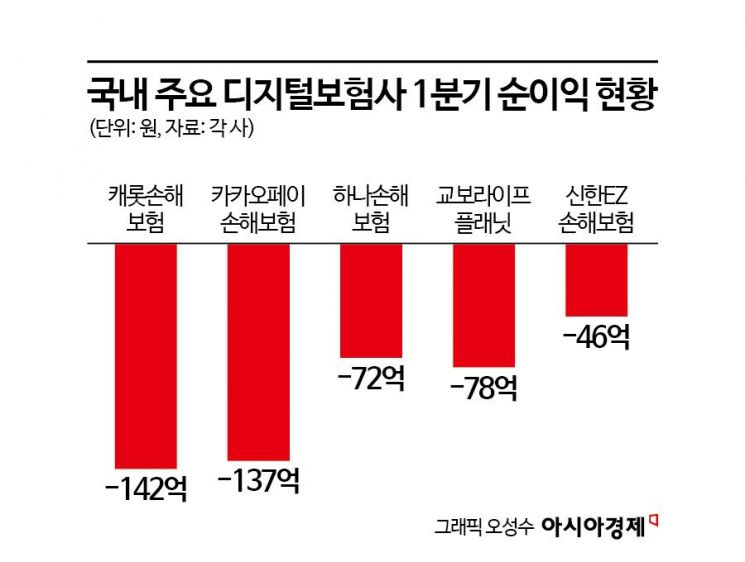

According to the financial industry on June 25, the net loss for the first quarter of this year among the five major domestic digital insurance companies (Carrot General Insurance, Kakao Pay General Insurance, Hana General Insurance, Kyobo Lifeplanet, and Shinhan EZ General Insurance) was 47.5 billion KRW. This represents a widening of losses compared to the same period last year, when the loss was 34.5 billion KRW. Except for Hana General Insurance, none of these companies have recorded an annual profit so far. Even the 17 billion KRW profit recorded by Hana General Insurance in 2021 was due to gains from the sale of its office building, highlighting that deficits among digital insurance companies are not a recent development.

Digital insurance companies are firms that sell and operate insurance exclusively online, without insurance planners or branches. Legally, they are referred to as direct marketing insurance companies, and must recruit more than 90% of their total insurance contracts and premiums via phone, mail, or the internet. Although many financial companies have established digital insurance subsidiaries amid the fintech (finance + technology) boom, they have yet to achieve meaningful results. This is because, due to the nature of the insurance business, there are limits to what can be achieved through non-face-to-face sales alone.

Kakao Pay General Insurance has recently sought change by entering the long-term health insurance market. This strategy is interpreted as a move to compete directly with major players, moving away from the short-term, small-amount niche market it had previously focused on. As part of this initiative, on June 16, Kakao Pay General Insurance launched five basic coverage plans centered on diagnosis benefits for major critical illnesses such as cancer, cerebrovascular disease, and ischemic heart disease, along with eight customized package riders. The company aims to appeal to both younger and senior demographics by leveraging the convenience of signing up via KakaoTalk, the nation's most popular messenger app.

Kyobo Lifeplanet, the only digital insurance company in the life insurance sector, is also shifting its focus from savings-type insurance and mini or short-term policies with premiums around 10,000 KRW to long-term protection-type insurance. This year, for the first time in the 12 years since its establishment in 2013, the company has undergone a comprehensive rebranding, updating its logo and various design elements to appeal to the MZ generation (Millennials + Generation Z). Interest among younger customers in Kyobo Lifeplanet’s main long-term insurance products?Kyobo Lifeplanet Term Insurance and Kyobo Lifeplanet Customized Comprehensive Health Insurance?has reportedly grown. Last year, 10% of Kyobo Lifeplanet’s protection-type insurance policyholders were in their 20s, double the proportion compared to the past.

Shinhan EZ General Insurance is increasing customer touchpoints through collaborations with other financial institutions. On June 20, Shinhan EZ General Insurance launched a dedicated menu called "Insurance is Shinhan EZ" within the Jeju Bank mobile application "JBANK," introducing 12 digital insurance products. On June 10, the company formed a strategic business alliance with Toss Insurance, a corporate insurance agency (GA). As a result, the digital financial fraud protection product developed by Shinhan EZ General Insurance has been added to the "Toss Insurance Recommended Insurance" section of the Toss app. Shinhan EZ General Insurance also plans to strengthen synergy among its affiliates by launching services on Shinhan Financial Group's super app "SuperSOL" in August. Unlike direct marketing insurance companies, Shinhan EZ General Insurance holds a comprehensive insurance license, allowing for face-to-face sales. Although there has not yet been a clear move in this direction, the company is currently strengthening its long-term insurance portfolio, raising the possibility that it may soon pursue face-to-face sales.

Hana General Insurance also holds a comprehensive insurance license. Having recognized the limitations of non-face-to-face sales, Hana General Insurance shifted its business strategy at the end of last year to focus on long-term insurance and GA-centered face-to-face sales. The company expanded its GA sales organization from 7 business divisions and 17 branches in 2023 to 9 business divisions and 35 branches this year.

Carrot General Insurance, which launched as Korea’s first digital general insurance company in 2019, is set to be absorbed and merged into Hanwha General Insurance. However, the "Carrot" brand, which is familiar to younger customers through products such as "Per-mile Auto Insurance," will be retained. Hanwha General Insurance is currently considering how to utilize the Carrot brand within its cyber marketing (CM) channel. Hanwha General Insurance plans to accept creditor objections until July 4, and submit a merger approval application to the Financial Services Commission on July 7. The merger is expected to be completed by September 10.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.