Operating Profit Margin of Externally Audited Companies Reaches 6.0% in Q1

Driven by Machinery, Electrical/Electronics, Automobiles, Transportation Equipment, and Information and Communications

Sales Growth Rate at 2.4%... Down from Previous Quarter

Slower Memory Semiconductor Export Growth and Impact of Low-Priced Chinese Primary Metal Products

In the first quarter of this year, domestic companies experienced a slowdown in growth, but their profitability improved. Increased sales of high value-added semiconductors and ships, along with strong performance from game companies with high operating margins, contributed to the improvement in profitability.

A liquefied natural gas (LNG) carrier ship, fully occupying the yard dock at Hanwha Ocean Okpo Shipyard in Geoje, Gyeongnam, is brightly lit as construction work continues. Recently, the United States has been focusing on South Korea as a strategic partner to rebuild its outdated shipbuilding industry. According to the shipbuilding industry revitalization policy strongly promoted by the Trump administration, the U.S. is expected to order up to 448 vessels, including merchant ships, liquefied natural gas (LNG) carriers, and naval warships, by 2037. Photo by Kang Jinhyung

A liquefied natural gas (LNG) carrier ship, fully occupying the yard dock at Hanwha Ocean Okpo Shipyard in Geoje, Gyeongnam, is brightly lit as construction work continues. Recently, the United States has been focusing on South Korea as a strategic partner to rebuild its outdated shipbuilding industry. According to the shipbuilding industry revitalization policy strongly promoted by the Trump administration, the U.S. is expected to order up to 448 vessels, including merchant ships, liquefied natural gas (LNG) carriers, and naval warships, by 2037. Photo by Kang Jinhyung

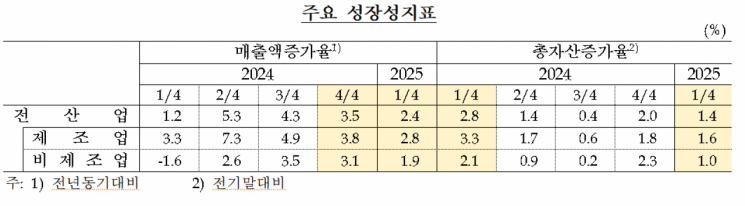

According to the "Corporate Management Analysis for the First Quarter of 2025" released by the Bank of Korea on the 20th, the year-on-year sales growth rate, a key indicator of growth for domestic companies subject to external audit, was 2.4% in the first quarter of this year, down from 3.5% in the previous quarter. This estimate is based on a sample survey of 3,940 companies out of 23,137 corporate entities subject to the "Act on External Audit of Stock Companies, etc." as of the end of 2023 (excluding industries unsuitable for the survey).

By industry, the sales growth rate for manufacturing fell from 3.8% in the fourth quarter of last year to 2.8% in the first quarter of this year. The machinery and electrical/electronics sector declined from 8.0% to 5.9%, and the primary metals sector dropped from 1.4% to -0.6%, both contributing to the overall decrease in manufacturing sales growth. Jung Youngho, head of the Corporate Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, explained, "In the machinery and electrical/electronics sector, export growth slowed, especially for memory semiconductors, and there was also a base effect due to the high sales growth rate (13.8%) in the same period last year. For primary metals, exports decreased due to competition from low-priced Chinese products."

In the non-manufacturing sector, the sales growth rate fell from 3.1% in the fourth quarter of last year to 1.9% in the first quarter of this year, mainly due to the transportation and construction industries. In transportation (13.5% to 5.6%), the slowdown was attributed to a decline in maritime freight indices, while in construction (-5.2% to -8.7%), the decrease was due to a drop in domestic housing construction performance and the completion of major large-scale projects.

By company size, both large enterprises and small and medium-sized enterprises (SMEs) saw declines. Large enterprises fell from 3.3% to 2.6%, and SMEs dropped from 4.8% to 1.4%.

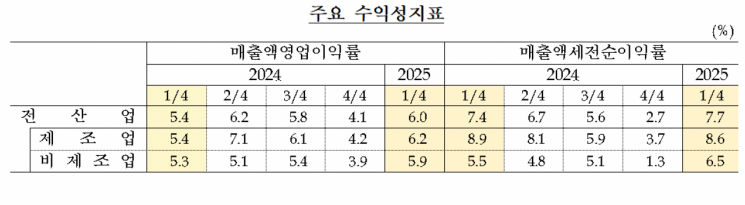

On the other hand, the operating profit margin, which measures profitability, rose to 6.0% in the first quarter of this year, up from 5.4% in the same period last year. Both manufacturing and non-manufacturing sectors saw increases: manufacturing (5.4% to 6.2%) was driven by machinery, electrical/electronics, automobiles, and transportation equipment, while non-manufacturing (5.3% to 5.9%) was led by information and communications.

Jung explained, "In the machinery and electrical/electronics sector, the share of high value-added products such as high bandwidth memory (HBM) 3E and DDR5 increased, raising the operating margin from 5.6% to 6.9%. For transportation equipment, the margin jumped from 6.0% to 7.0% due to higher new ship prices and increased sales of high value-added vessels such as liquefied natural gas (LNG) carriers." In the information and communications sector, the operating margin rose from 7.7% to 10.0% thanks to strong sales from game companies with high operating margins.

By company size, both large enterprises (5.7% to 6.4%) and SMEs (3.8% to 4.1%) saw increases.

Meanwhile, stability indicators improved. Both the debt ratio and dependence on borrowings decreased compared to the previous quarter. The debt ratio fell from 91.2% in the fourth quarter of last year to 89.9% in the first quarter of this year, and dependence on borrowings also edged down from 25.1% to 25.0%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)