Iranian Parliament Votes to Blockade in Response to U.S. Airstrike

Concerns Over Simultaneous Surge in Product Costs and Freight Rates in Refining Industry

Experts Warn Oil Prices Could Reach $100 if Crisis Prolongs... Countermeasures Under Review

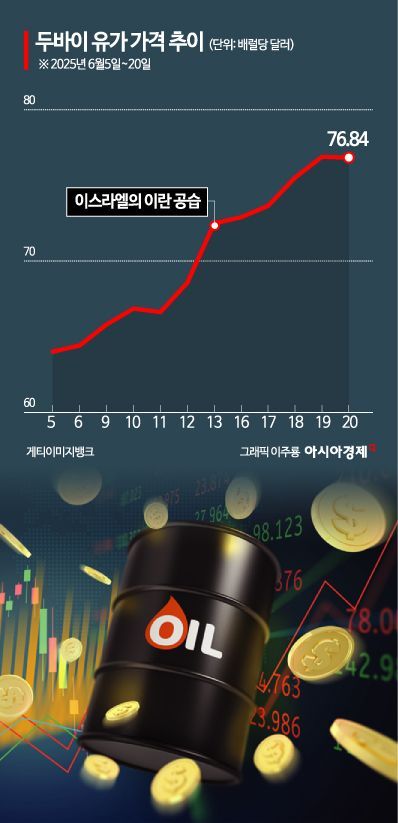

As the Iranian parliament has decided to blockade the Strait of Hormuz in response to a U.S. mainland airstrike, concerns are mounting within the domestic industry that a complex crisis originating from the Middle East may soon become a reality. The refining, shipping, and home appliance industries, as well as the aviation and automotive sectors, are closely monitoring the potential shocks from a surge in oil prices and supply chain disruptions. Analysts point out that logistics costs, transportation delays, and increased product costs are likely to act in combination. There are also grim forecasts that international oil prices could surpass $100 per barrel.

As of the morning of the 23rd, according to the global ship tracking service MarineTraffic, a large number of vessels seeking to load crude oil and liquefied natural gas (LNG) were found to be densely concentrated around the Strait of Hormuz. The Strait of Hormuz is a strategic chokepoint through which about 35% of the world's seaborne crude oil and about 33% of global LNG consumption pass. South Korea also relies on the Middle East for about 67% of its total crude oil imports, with most of it coming in through the Strait of Hormuz.

The refining industry is reacting sensitively to the possibility of a blockade of crude oil import routes. An industry official said, "There have been no disruptions to tanker operations yet, but as market uncertainty grows, transaction prices are fluctuating sharply," adding, "If a blockade becomes a reality, both product costs and shipping rates could surge simultaneously." Refiners are currently reviewing diversification strategies for supply sources, such as increasing imports of U.S. crude oil.

The shipping industry is also on high alert. If the Strait of Hormuz is blockaded, both container ships and bulk carriers will need to secure alternative routes, making transportation delays and higher freight rates unavoidable. As seen during last year's Red Sea crisis, detouring via the Cape of Good Hope in Africa would significantly increase logistics costs. Last year, the Shanghai Containerized Freight Index (SCFI) soared by 149% year-on-year due to the impact of Red Sea risks. While bulk carriers are not on fixed schedules and can avoid the area, there are concerns that detouring could lead to delays and a shortage of available ships, resulting in higher freight rates.

The shipping industry is struggling to come up with countermeasures. An HMM official stated, "To prepare for a blockade of the strait, we will flexibly review options such as unloading at alternative ports followed by overland transportation."

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns over rising oil prices, drivers were refueling at Mannam Square in Seocho-gu, Seoul. Photo by Kang Jinhyung

On the 23rd, as the United States struck Iran's nuclear facilities, escalating tensions in the Middle East and raising concerns over rising oil prices, drivers were refueling at Mannam Square in Seocho-gu, Seoul. Photo by Kang Jinhyung

If ocean freight rates rise, the burden on domestic export companies will increase. Samsung Electronics, LG Electronics, and others, which have a significant share of exports to the Middle East and Europe, are closely monitoring the current situation. An industry official said, "There are no visible countermeasures yet, but internal discussions have begun," adding, "As with the Red Sea crisis, it may be possible to resolve the situation by utilizing alternative routes."

Hyundai Motor stated that it has no factories in Iran and that its export volume to the country is minimal, so the direct impact is limited. However, since the United States is one of its largest markets, the company is closely monitoring the situation in case military tensions between the U.S. and Iran escalate. The aviation industry is also not directly affected by the Middle East crisis. Korean Air suspended its Tel Aviv route after the Red Sea crisis and is currently only operating its Dubai route. A company official said, "We are monitoring the situation with a focus on oil price volatility."

Experts warn that if the situation is prolonged, international oil prices could break through $100 per barrel. A sharp increase in oil prices could lead to higher electricity and fuel costs, which in turn could simultaneously trigger inflation and exchange rate instability.

The future course of this crisis is expected to depend on the extent of Iran's additional retaliation, the oil production strategies of the Organization of the Petroleum Exporting Countries (OPEC), and the response of the U.S. State Department. Sung Ilkwang, a professor at the Sogang University Euromena Institute, said, "There has never been a precedent where Iran was directly attacked on its mainland by the United States," adding, "This time, the possibility of an actual blockade is high." He further noted, "We are entering a phase where the Ministry of Trade, Industry and Energy may have to activate its crisis response manual."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)