Daiso's Annual Sales Near 4 Trillion Won... A Flood of New Entrants

Japan's Daiso Launches 'Threeppy', China's Daiso Introduces 'Yoyoso'

"Success Uncertain Without Differentiation Strategies"

The Korean low-cost retail market is emerging as a new battleground for Japanese and Chinese companies. Amid economic downturn and high inflation, the number of consumers seeking value for money is rising, and the success of Asung Daiso, whose annual sales have approached 4 trillion won, has sparked these companies' entry into the market. However, industry experts caution that it will be difficult for newcomers to gain a foothold through price competition alone, as domestic distribution giants have already secured a strong presence in the market.

According to the Korean Intellectual Property Office's intellectual property information search service on the 23rd, Daiso Industries, the Japanese parent company of Daiso, registered the trademark 'THREEPPY' in Korea on April 15. THREEPPY is a '300-yen shop' (about 2,820 won) launched by Daiso Japan in 2018, targeting women in their 20s to 40s as a lifestyle goods brand. Unlike Daiso Japan, which gained mass appeal as a '100-yen shop,' THREEPPY mainly sells miscellaneous goods such as interior accessories, stationery, and cosmetics.

Daiso Japan previously attempted to register the 'DAISO' trademark in Korea in 2019, but was rejected due to a conflict with the existing operator, Asung Daiso. This time, by changing the brand name, Daiso Japan is making an indirect entry into the Korean market for the first time in six years.

Chinese retail brands are also entering the market. YOYOSO, often referred to as the 'Chinese Daiso,' is preparing to launch in Korea. It currently operates more than 3,000 offline stores in over 50 countries worldwide. It is targeting the market with household goods, cosmetics, and private brand (PB) products.

MINISO, which previously withdrew from Korea, has returned. After its initial entry in 2016, MINISO opened about 30 stores but exited the market in 2021 amid controversy over allegedly copying Daiso. Since last year, MINISO has opened stores in three locations?Daehak-ro, Hongdae, and Gangnam Station?focusing on character intellectual property (IP).

Seeking Growth Opportunities for Domestic Brands... Daiso's Popularity Proves Success Potential

These companies are turning to the Korean market due to stagnant domestic consumption and worsening export environments in their home countries. In Japan, domestic demand has shrunk due to an aging population and stagnant real wages. In China, the US-China conflict has restricted exports to the United States, prompting companies to view Korea as a strategic market.

An industry insider explained, "The Korean consumer market has strong online purchasing power and a high level of digital adaptability, making it the optimal test bed for brands. The success of Daiso has served as a kind of 'entry signal' for foreign brands."

The domestic lifestyle goods market currently lacks a clear leader. The leading platform, 10x10, saw its sales drop from 32.4 billion won in 2023 to 16.8 billion won last year and is now in a state of capital erosion. Seizing this opportunity, 29CM, a subsidiary of Musinsa, opened its offline store '29HomeSeongsu' on the 20th, expanding into the lifestyle platform sector. Daiso Japan's renewed attempt to enter the Korean market with the 'THREEPPY' brand is also seen as a strategy aimed at capturing this market.

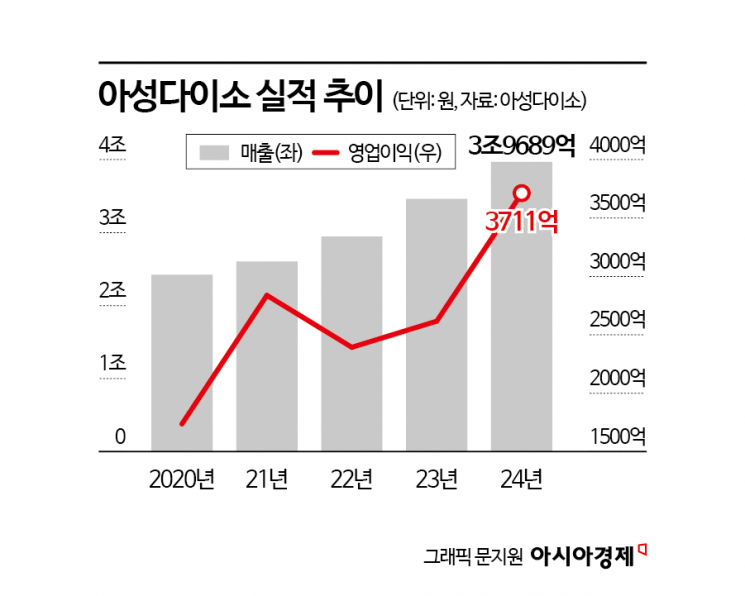

However, the market consensus is that Japanese and Chinese retail brands will find it difficult to surpass established players like Daiso. Asung Daiso, with over 1,500 stores nationwide, is a 'super low-cost retail powerhouse.' It maintains its ultra-low price strategy through economies of scale and holds advantages in both brand recognition and accessibility. Last year, Asung Daiso posted record results with sales of 3.9689 trillion won and operating profit of 371.1 billion won. Compared to the previous year, sales grew by 14.7% and operating profit by 41.8%. Both price and accessibility represent formidable barriers for competitors to overcome.

Lee Youngae, a professor of consumer studies at Incheon National University, pointed out, "While price is important in the low-cost retail market, the key is ultimately 'store accessibility,' which is the point of contact with consumers. Foreign companies will find it difficult to match price competitiveness without logistics infrastructure or manufacturing lines."

Chinese companies are also ramping up their offensive in online retail. C-commerce (Chinese e-commerce) firms such as AliExpress and Temu are aggressively targeting the Korean market with massive marketing expenditures. In fact, over the past two years, their monthly active users (MAU) have surpassed those of established players such as 11st and Gmarket. JD.com, often called the 'Chinese Coupang,' also established logistics centers in Incheon and Icheon in April.

Lee Eunhee, a professor at Inha University, observed, "Korean consumers are increasingly prioritizing practicality over political factors, making it difficult for anti-Japanese or anti-Chinese sentiment to serve as an entry barrier as it did in the past." However, she emphasized, "Korea is a market where it is difficult to compete on price alone. As there have been cases like Don Quijote withdrawing from the market, product quality and building consumer trust will be key to success."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)