Deposit Protection Limit to Double to 100 Million Won in September

Funds Expected to Shift to Second-Tier Financial Institutions Such as Mutual Finance Institutions and Savings Banks

Proactive Cleanup of Non-Performing Assets Needed as Asset Quality in Second-Tier Sector Deteriorates

Starting in September, the deposit protection limit will increase from 50 million won to 100 million won, raising the likelihood that funds in the market will move to second-tier financial institutions, which tend to offer relatively higher interest rates. However, there are growing concerns over the ongoing deterioration of the asset quality in the second-tier financial sector, including savings banks and mutual finance institutions, highlighting the need for more proactive risk management.

According to financial authorities on June 23, the deposit protection limit will be raised from the current 50 million won to 100 million won starting September 1. From September, the deposit protection limit of mutual finance institutions?where individual central associations provide deposit insurance?will also rise to 100 million won, in addition to banks and savings banks covered by the Korea Deposit Insurance Corporation.

The market expects that the higher deposit protection limit will trigger a "money move"?a shift of funds?toward second-tier financial institutions such as mutual finance institutions and savings banks, which offer higher interest rates than first-tier banks. Even before the new system takes effect, deposits at major mutual finance institutions such as Saemaeul Geumgo, Nonghyup, and Sinheup have been increasing. According to the Bank of Korea, as of the end of April, the outstanding balance of deposits at mutual finance institutions stood at 921 trillion won, up by more than 14 trillion won compared to the end of January. This suggests that, as deposit interest rates decline due to the base rate cut, funds are moving to mutual finance institutions that are offering high-interest special deposit products.

However, the government is concerned that the increase in the deposit protection limit could lead to an overheated competition among second-tier financial institutions to offer high-interest special deposit products. In response, the Financial Services Commission convened the "1st Mutual Finance Policy Council" last month to review the readiness of mutual finance institutions for the higher deposit protection limit. Financial authorities believe that the increase in the deposit protection limit could result in a significant inflow of deposits into second-tier financial institutions such as mutual finance institutions. Therefore, they have begun monitoring to ensure that these institutions do not engage in excessive competition for deposits in response to the higher protection limit. At the meeting, Kwon Daeyoung, Secretary General of the Financial Services Commission, stated, "Excessive competition for deposits creates another risk by distorting interest rates and undermining asset quality," and emphasized, "What matters more than outward growth is sound fund management and restoring trust."

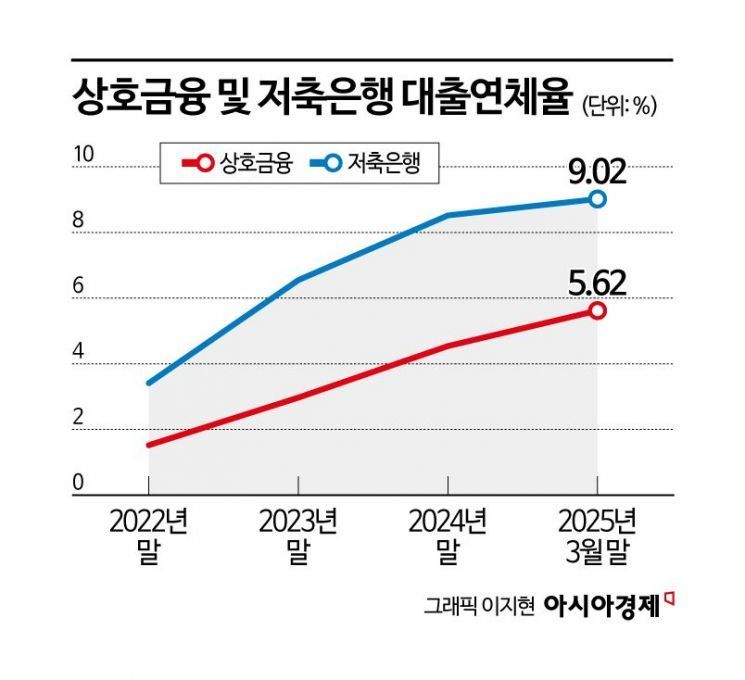

The government's preemptive measures are also prompted by the worsening asset quality of second-tier financial institutions. According to the financial sector, the delinquency rate on loans in the second-tier financial sector has surged since 2022. In particular, the delinquency rate at savings banks soared from 3.41% at the end of 2022 to over 9% as of the end of March this year. During the same period, the delinquency rate at mutual finance institutions jumped from 1.52% to 5.62%. This is because ongoing economic stagnation has intensified the deterioration of real estate project financing (PF) loans, and the number of low-income and low-credit borrowers unable to repay their loans has increased.

If asset quality problems become more serious and the higher deposit protection limit leads to rapid fund movement and increased volatility, there is a risk that the deterioration could worsen further. In response, financial authorities are encouraging mutual finance institutions and savings banks to actively clean up their non-performing assets and plan to strengthen supervision and oversight. In the second half of the year, mutual finance institutions and savings banks are expected to step up their efforts to dispose of non-performing loans (NPLs), including establishing dedicated NPL resolution subsidiaries at the central association level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.