National Planning Committee Signals Easing of Regulations on Ancillary Businesses such as Advertising, Promotion, and Consulting

Fintech and Financial Sector Welcome the Move... Amendment of Credit Information Act Remains a Challenge

After the Lee Jaemyung administration announced its plan to establish a business model that combines private-sector data and public data, there is growing optimism across the industry that regulations restricting ancillary and concurrent business activities for MyData operators may be eased. In particular, not only fintech (finance + technology) companies engaged in the MyData business, but also traditional financial institutions such as banks, insurance companies, securities firms, and credit card companies, believe that if the Credit Information Act is amended to allow targeted financial product advertising, it will provide substantial support for improving profitability and expanding business portfolios. The industry expects that this government initiative will serve as a turning point to accelerate data-driven financial innovation.

Cho Seungrae, spokesperson for the National Planning Committee, is giving an explanation related to the ministry work report at the Government Sejong Convention Center on the 18th. Photo by Yonhap News

Cho Seungrae, spokesperson for the National Planning Committee, is giving an explanation related to the ministry work report at the Government Sejong Convention Center on the 18th. Photo by Yonhap News

According to political and financial industry sources on June 19, the National Planning Committee has indicated plans to push for revisions to relevant laws, including the Credit Information Act, to promote the sharing of private-sector data and the combination of private and public data. The Credit Information Act, its enforcement decree, and the Credit Information Business Supervision Regulations currently restrict the concurrent and ancillary business activities that the industry has long sought to expand, but the National Planning Committee has now stated its intention to ease these restrictions.

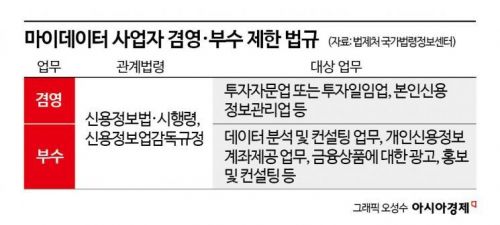

According to the Ministry of Government Legislation, concurrent business activities include investment advisory services, discretionary investment services, and personal credit information management services. Ancillary business activities include data analysis and consulting, personal credit information account provision, and advertising, promotion, and consulting for financial products. Financial companies engaged in the MyData business are subject to restrictions on both concurrent and ancillary business activities. This applies not only to banks in the first-tier financial sector, but also to insurance, securities, and card companies in the second-tier sector, as well as most fintech companies such as Toss, Naver Financial, Kakao Pay, and Banksalad.

The Financial Services Commission announced the previous day that 27 MyData operators would launch MyData 2.0 services, but the concurrent and ancillary business activities have not yet been permitted. MyData 2.0 improves consumer convenience by allowing users to view all their assets at once by selecting only the type of financial institution?such as banks, insurance, or securities?without having to specify each product individually, and by simplifying the consent process. However, in order to further expand the scope of MyData business in the financial sector, legal amendments are necessary.

In particular, when it comes to ancillary business activities, the fintech sector has consistently requested that regulations be relaxed to allow more flexible management compared to other sectors. Previously, during a meeting on March 12 between Lee Jongo, Deputy Governor of the Financial Supervisory Service, and CEOs of 10 fintech companies, the CEOs officially requested the easing of regulations on concurrent and ancillary business activities for MyData, but Deputy Governor Lee only responded, "We will consider it."

Participants at the meeting included Deputy Governor Lee Jongo, Park Sangjin (CEO of Naver Pay), Shin Wonguen (CEO of Kakao Pay), Lee Seunggeon (CEO of Viva Republica/Toss), Jeong Chanmook (CEO of Coupang Pay), Park Junseok (CEO of NHN KCP), Lim Hanuk (then CEO-designate and now CEO of Toss Payments), Kim Gwangcheol (CEO of Nice Payments), Moon Byeongrae (CEO of Payup), Kim Hyeongu (CEO of Travel Wallet), and Kim Taehun (CEO of Banksalad). One CEO who attended the meeting said, "Since then, we have not received any feedback from the Financial Supervisory Service regarding the regulations on concurrent and ancillary business activities."

The fintech industry believes that if the National Planning Committee's efforts to amend the Credit Information Act become reality, MyData operators will be able to utilize public data in their business operations, similar to used car platforms, thereby increasing business flexibility. Although there have been controversies over violations of personal information protection laws, used car trading platform operators such as Encar, HeyDealer, and Mr. Pick (operator of the 'Chutcha' platform) have provided vehicle information to consumers using public and private data supplied by the Ministry of Land, Infrastructure and Transport, Korea Transportation Safety Authority, financial institutions, insurance companies, and automakers.

A fintech industry official said, "It is still uncertain whether this will be fully legislated, so we are cautious, but this is positive news for MyData operators, especially smaller firms that need access to abundant data." The official added, "However, in order to foster the MyData application industry like the used car platform sector, the National Assembly must relax the regulations on concurrent and ancillary business activities for the sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.